As Bitcoin faces renewed worth stress, issues are starting to floor—significantly amongst short-term holders (STH) now holding unrealized losses.

Nevertheless, in accordance to CryptoQuant analyst Darkfost, a more in-depth have a look at demand-side metrics reveals a way more resilient market beneath the floor.

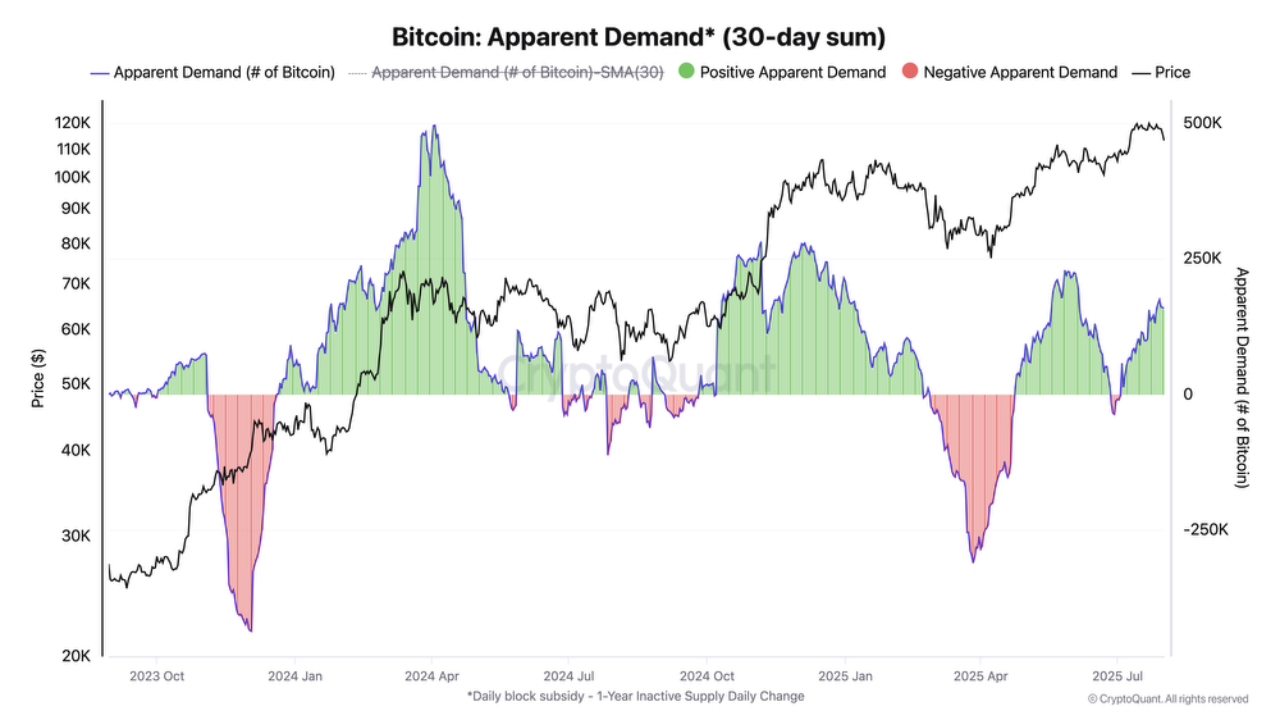

Optimistic Demand Nonetheless Evident in Accumulation Tendencies

One of many clearest indicators of energy lies in what’s known as “obvious demand.” This metric compares new BTC issuance to the quantity of Bitcoin that has remained untouched for over a 12 months. When the ratio turns unfavorable, it suggests demand is weakening; when it rises above zero, it signifies wholesome shopping for curiosity.

At present, this ratio stays firmly in constructive territory, with greater than 160,000 BTC accrued over the previous 30 days. This indicators that demand isn’t solely current—it’s rising.

Accumulator Wallets Present Rising Confidence

One other encouraging sign comes from accumulator addresses, that are wallets which have solely acquired BTC and by no means offered. These wallets are identified for robust conviction and long-term intent. Over the previous month, these addresses have added roughly 50,000 BTC, underscoring strong and sustained curiosity even amid market turbulence.

OTC Desks Reveal Provide Drain

From a broader, long-term perspective, the provision of BTC on over-the-counter (OTC) desks has declined sharply. Again in September 2021, OTC desks held round 550,000 BTC. That determine has now fallen to simply 145,000 BTC, reflecting diminished availability for giant off-exchange transactions and suggesting accumulating curiosity from institutional gamers.

Conclusion: Demand Outlook Stays Optimistic

Regardless of the latest worth correction, Darkfost sees no main warning indicators from demand indicators. Each short-term accumulation and long-term holding tendencies stay robust, implying that the present volatility isn’t pushed by a collapse in investor confidence. As an alternative, the information suggests a market nonetheless underpinned by regular and deliberate accumulation.