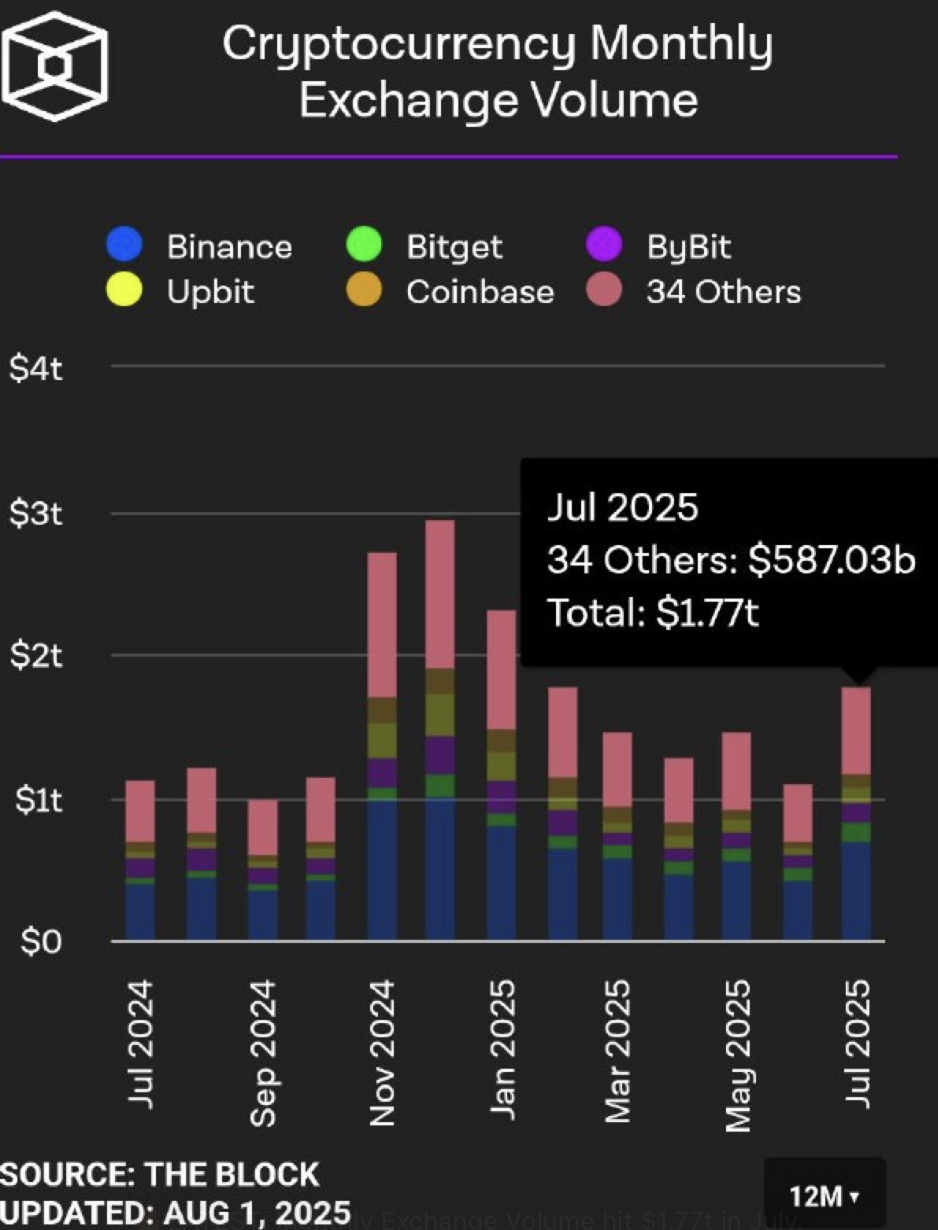

In July 2025, cryptocurrency change quantity surged to a complete of $1.77 trillion, marking one of many strongest months for buying and selling exercise for the reason that slowdown earlier within the 12 months.

In accordance with the newest information from The Block, the mixed quantity from the broader class of “34 Others” accounted for $587.03 billion of the whole, underlining a noticeable rise in exercise throughout smaller and rising exchanges. This displays a shift in market conduct, the place merchants are more and more turning to various platforms past the main names.

Whereas Binance continued to steer because the dominant participant, its share of the whole market remained steady reasonably than increasing. Different prime exchanges reminiscent of ByBit and Bitget maintained constant efficiency, contributing notable quantity all year long however not matching their late-2024 peaks. Coinbase and Upbit, although extra modest in measurement, confirmed dependable month-to-month quantity, reinforcing their roles as regular individuals available in the market.

The general chart exhibits that after reaching a near-$3 trillion excessive in November 2024, month-to-month change quantity declined into early 2025. Nonetheless, starting in Might, volumes started climbing once more, with July representing a major rebound. This means a renewed wave of buying and selling curiosity, probably pushed by a mixture of speculative rallies, altcoin rotation, or elevated institutional flows.

The continued power of the “34 Others” group is especially notable. Not solely did it contribute the one largest share amongst all classes in July, however it additionally indicators rising decentralization of liquidity throughout the change panorama. If this pattern holds, it could reshape how liquidity and worth discovery function within the subsequent part of the crypto market cycle.