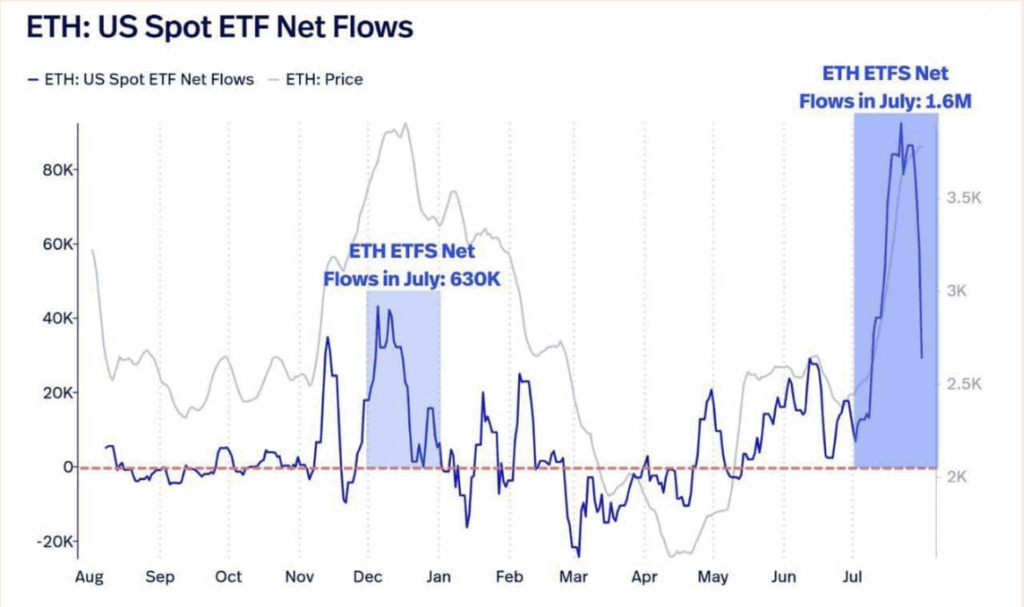

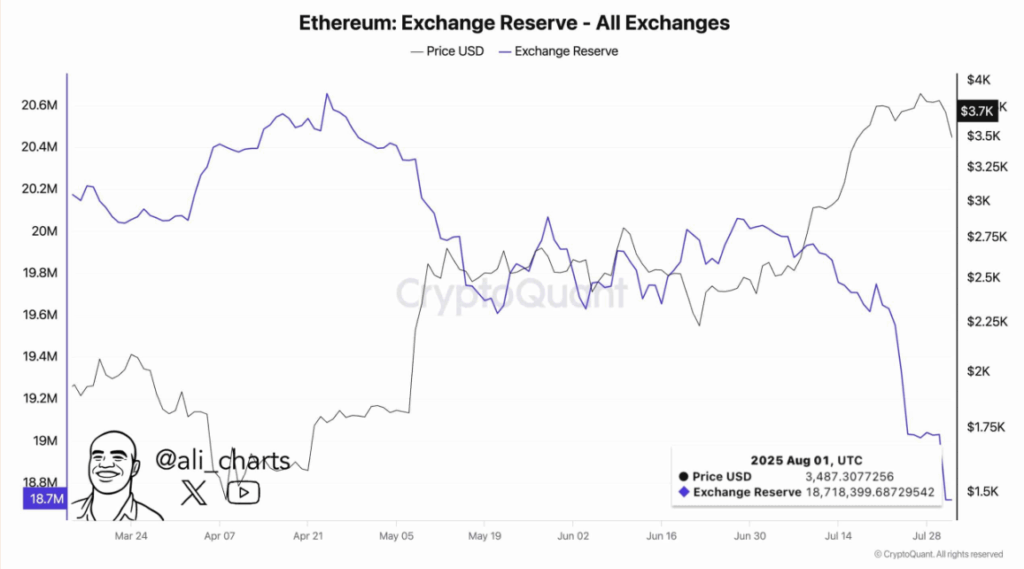

- Ethereum spiked 60% in July, fueled by 1.6M ETF inflows and 1M ETH withdrawals from exchanges—suggesting robust long-term conviction.

- Whale exercise and regular futures metrics point out the market is coiled for a transfer, with no heavy bias in both route.

- Regardless of cooling momentum, ETH is holding key ranges, and consolidation might flip right into a bullish breakout if sentiment turns.

Ethereum had one heck of a July—ripping almost 60% increased in one in all its greatest month-to-month strikes in a very long time. It wasn’t simply hype both. The surge got here as spot ETH ETFs noticed historic inflows, and greater than one million ETH vanished off exchanges in simply two weeks. Yeah, that’s a giant deal.

What’s much more telling? It’s not simply random pumps. This appears like good cash taking management. Retail of us grabbed earnings whereas whales and long-term holders quietly scooped up luggage. And now? ETH is sitting tight, prefer it’s ready for the following massive push.

Huge Strikes, Huge Cash, and… Huge Withdrawals?

Let’s break it down. Ethereum’s July explosion noticed it soar into the highest tier of crypto by market cap once more. ETF web inflows hit 1.6 million ETH. That’s no small potatoes. In the meantime, over 1 million ETH left centralized exchanges—gone. That’s normally an indication that individuals aren’t planning to promote anytime quickly.

On the identical time, the variety of massive transactions (we’re speaking $1M+) spiked. Whales are circling, and so they’re not enjoying round. This sort of exercise normally means they’re seeing construction—one thing value parking severe capital in.

Futures Market Trying… Suspiciously Calm?

Whereas ETH’s value motion cooled off a bit, the derivatives information nonetheless appears robust. Open curiosity in ETH futures has been regular at round $22.4 billion, with the funding fee chilling close to 0.0049. Which means the market isn’t overly bullish or bearish—simply kinda ready.

It’s a kind of setups the place one thing’s brewing, however nobody’s pulled the set off simply but. Sensible merchants know: when every little thing’s calm and balanced like this, the following transfer could be big. Up or down? That’s the million-dollar query.

Momentum’s Fading… or Simply Recharging?

ETH has been hovering above $3,450, holding its floor for now. The RSI’s at 52.41, sitting impartial—not overbought, not oversold. And whereas the MACD reveals a slight bearish crossover, the histogram’s crimson bars are shrinking. Mainly, sellers are slowing down, however consumers haven’t jumped again in but.

This consolidation zone? Might be a springboard. If sentiment stays respectable and whales preserve stacking, we is likely to be taking a look at a breakout loading. However for now, ETH’s enjoying it cool, ready on a cue—possibly one other ETF announcement or some macro shift.