Whereas the remainder of the crypto market searches for cash pushing all-time highs, the Pi Coin (PI) value has been busy doing the other, notching contemporary lows, one after one other. The PI token is down 1.2% up to now 24 hours, and almost 25% over the past month. The newest all-time low? Simply yesterday.

Nevertheless, some technical indicators now point out that the PI value could also be approaching a short-term reversal. One explicit divergence on the chart, paired with weakening promote stress and rising sentiment, might be the turning level.

Bears Dropping Their Edge as Bull-Bear Energy Shifts

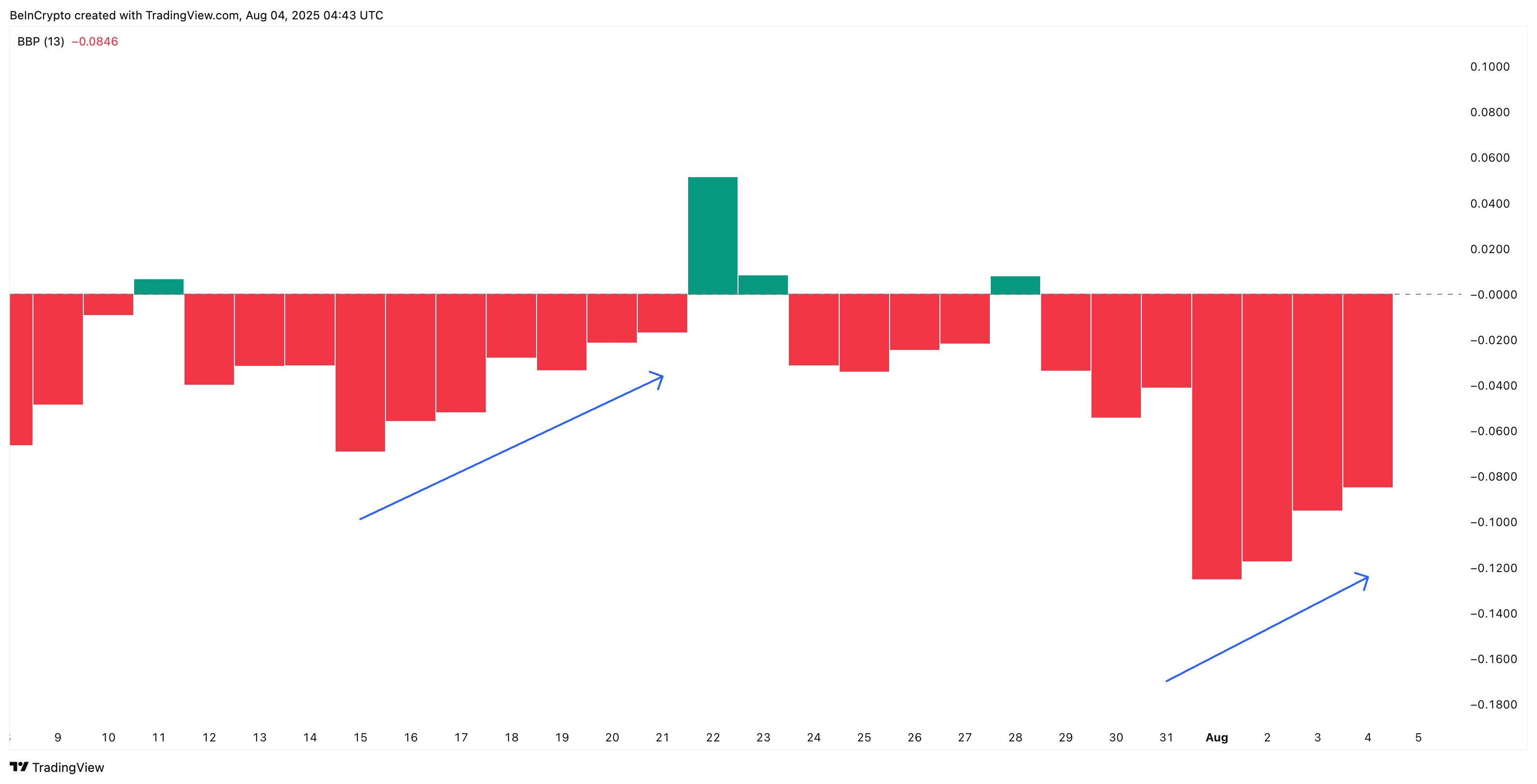

Sellers have had agency management over PI’s development for weeks. That’s why the Bull-Bear Energy (BBP) indicator is essential proper now. When bearish power begins fading after an prolonged downtrend, it might usually sign that sellers are operating out of steam.

That’s what the chart is starting to indicate. BBP has been rising since August 1, shifting from a deeply unfavourable zone to a much less aggressive print, much like what occurred between July 15 and 21. Again then, the fading bearish momentum preceded a transfer from $0.45 to $0.52.

The Bull-Bear Energy indicator tracks the distinction between the best value and a short-term transferring common to indicate whether or not bulls or bears are at present in management.

Supporting that is social dominance, which measures how a lot of the crypto dialog is about PI. Between August 1 and three, PI’s social dominance fashioned a three-day streak of upper highs, similar to it did between July 15 and 23. That earlier stretch aligned with an area value backside and led to that surge to $0.52.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

The alignment of sentiment and weakening bearish power now provides weight to the concept the PI value could also be making ready for an additional leg up.

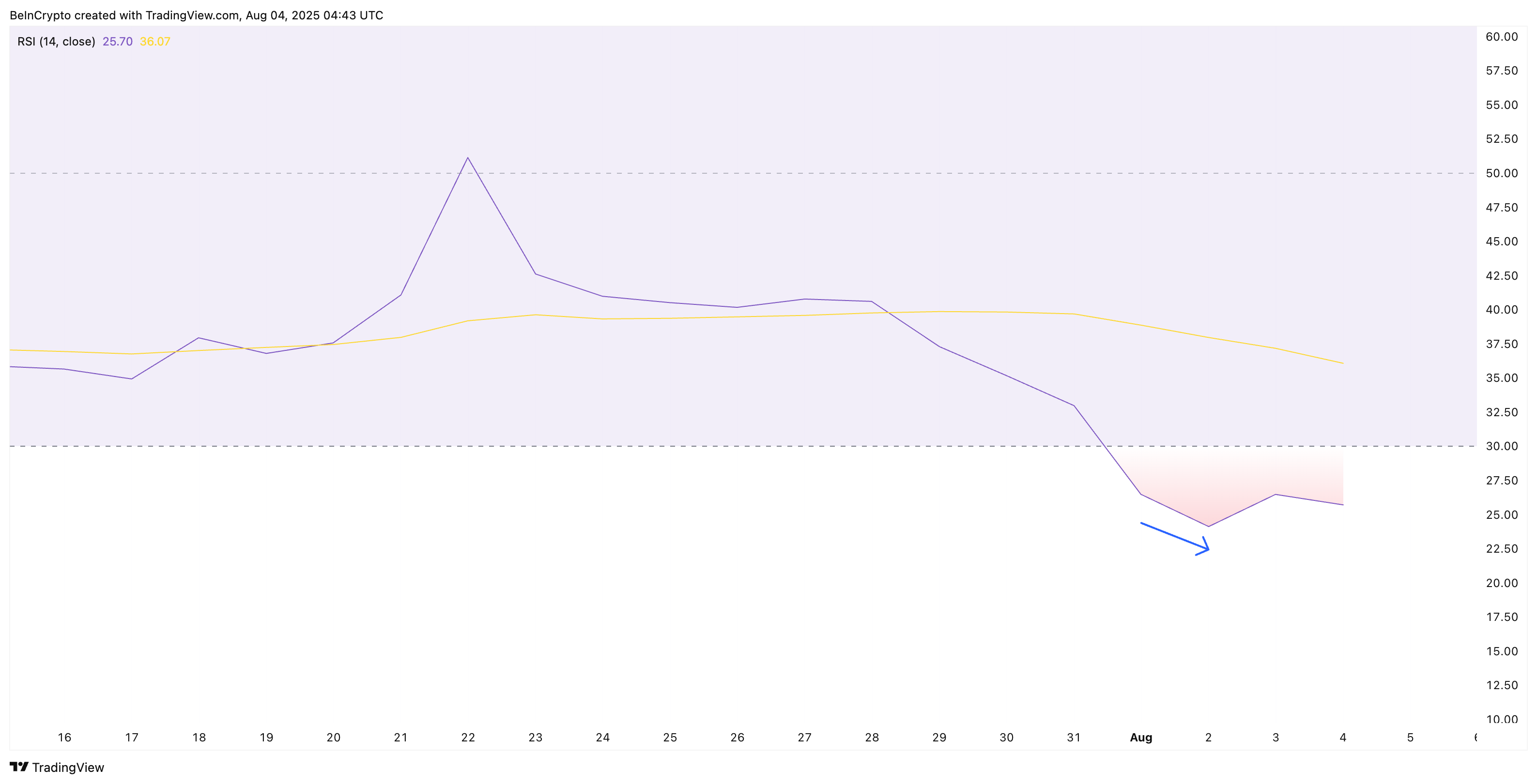

RSI Exhibits Bullish Divergence, However Pi Coin Value Must Reply

The Relative Energy Index (RSI) is at present at 23.37, indicating oversold territory. However past the quantity, the sample it’s forming issues extra.

PI’s value not too long ago made a better low, whereas the RSI made a decrease low. This setup is called a hidden bullish divergence, and it’s usually seen earlier than native bottoms.

At first look, a falling RSI might sound bearish. However when value doesn’t observe it decrease, that’s often an indication that draw back momentum is weakening, whilst sellers attempt to push. It exhibits that provide stress is failing to tug the worth additional, which could be a bottoming sign.

Nonetheless, this type of RSI divergence alone doesn’t verify a bounce, particularly when PI Coin’s value is declining. It’s extra like a delicate early signal.

For that, the worth wants to maneuver by the resistance.

RSI is a momentum oscillator that tracks the velocity and alter of value actions. Readings under 30 usually sign an oversold asset with potential for reversal.

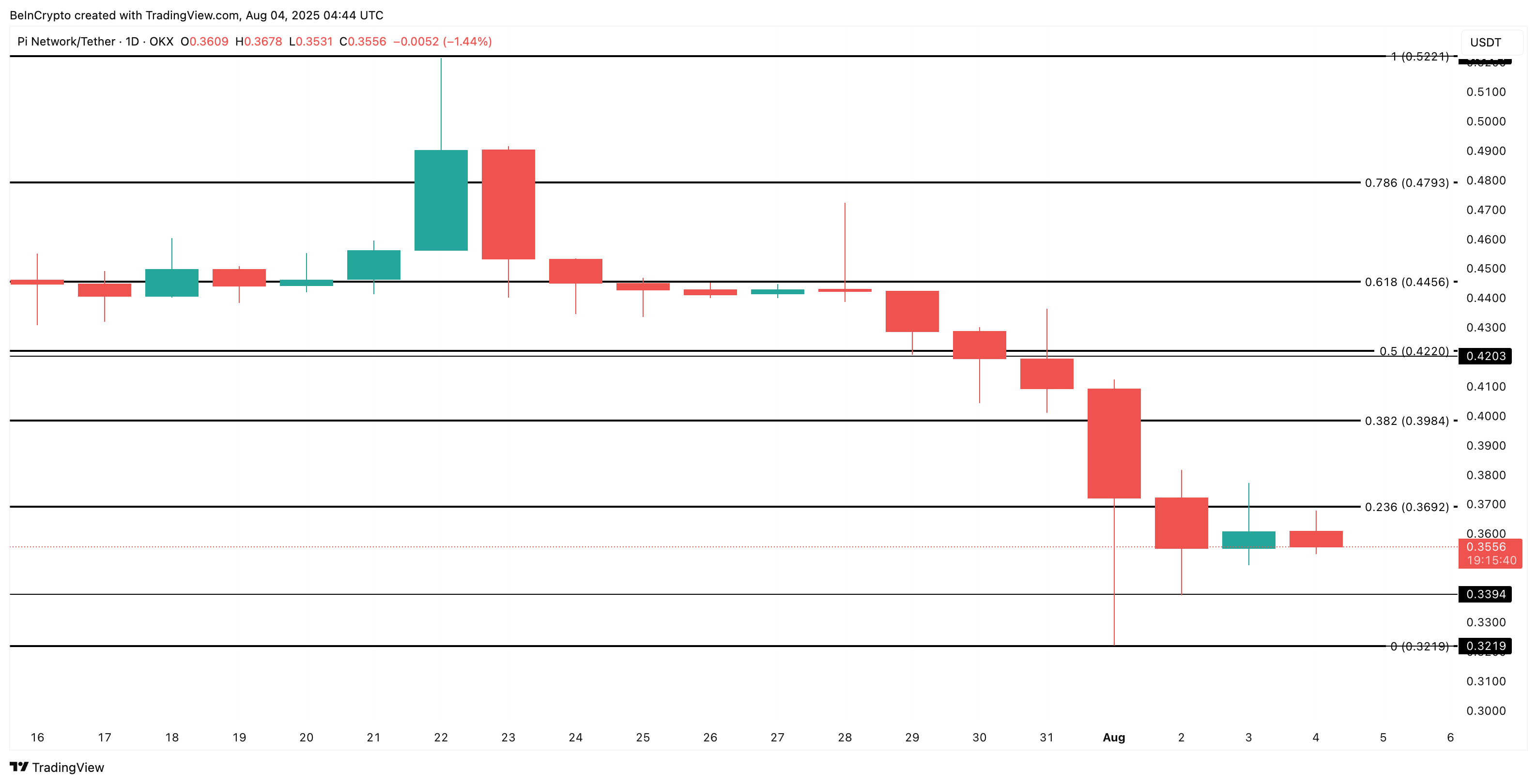

PI Value Should Clear $0.369 to Sign Breakout

The Pi Coin value is at present buying and selling round $0.35. Primarily based on the Fibonacci retracement drawn from the July 22 excessive ($0.52) to the July 31 low ($0.32), the subsequent main resistance lies at $0.36, adopted by $0.39, and $0.42.

A each day shut above $0.39 can be the primary signal that the bulls are again in management. But when PI breaks under $0.32, the bullish divergence setup can be invalidated, and the development might proceed decrease.

Till then, Pi Coin’s chart should look heavy, however for the primary time in weeks, there’s purpose to imagine its trajectory might shift. Nevertheless, this possible shift must be backed by an enchancment in RSI (probably a better excessive or a decrease excessive) and an extra dip in bearish stress.

The publish Lifetime of Pi Coin Might Get Simpler If One Key Divergence Performs Out appeared first on BeInCrypto.