Bitcoin has advanced from being the most important cryptocurrency to one of the crucial in-demand belongings within the world monetary markets throughout this bull cycle.

The variety of Bitcoin treasury companies has skyrocketed, and BlacRock’s IBIT has established itself because the fastest-growing exchange-traded fund by a large margin.

Bitcoin continues to validate its position as a dependable retailer of worth whereas providing arguably the strongest risk-adjusted upside potential over the approaching decade.

BTC-related beta cash are additionally exhibiting promise. A brand new Bitcoin layer-2 chain, Bitcoin Hyper (HYPER), goals to convey the efficiency, scalability and programmability of recent blockchains to BTC.

Its native token, HYPER, has raised practically $7 million in viral presale behind sturdy whale demand. A number of distinguished analysts have even backed it as the following 1000x crypto.

Why Bitcoin Might Outperform Shares And Gold Over The Subsequent Decade?

Bitcoin was the top-performing asset over the previous decade, outperforming all main inventory indices and commodities like Gold and Silver by a large margin. There’s a sturdy consensus amongst analysts that it’s going to replicate its outperformance over the following decade as nicely.

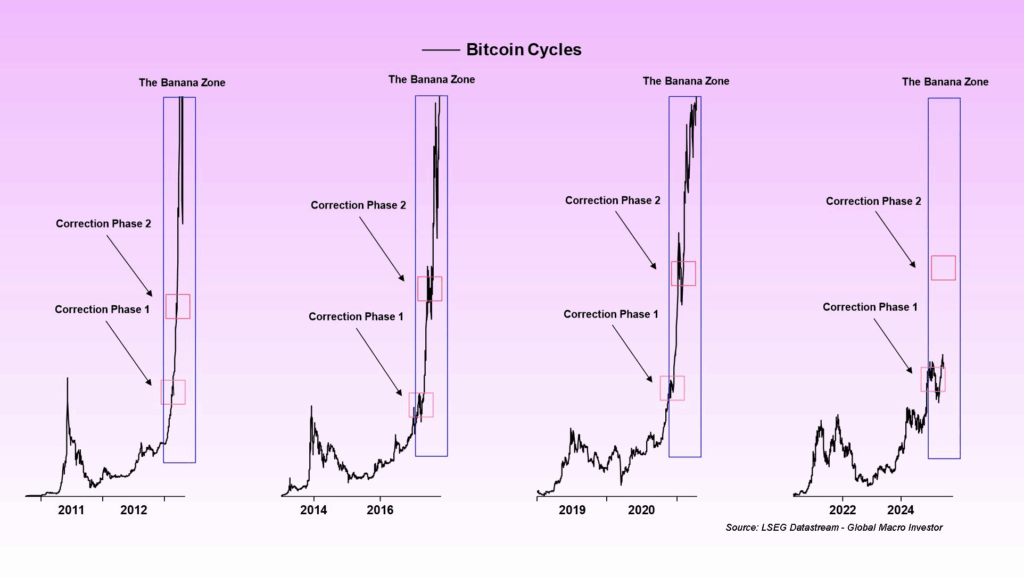

GMI’s Head of Macro Analysis Julian Bittel has provided a quite simple rationalization for BTC’s dominance. BTC carefully tracks world liquidity, as evident by its sturdy correlation with the International M2 cash provide.

With the worldwide drive participation plummeting as a result of ageing inhabitants and rising automation, main economies will proceed to wish stimulus to maintain the system afloat. This might require quantitative easing and cash printing, which might improve the worldwide liquidity and together with it, Bitcoin.

Furthermore, the cash printing will debase currencies just like the US Greenback, forcing traders to purchase debasement hedges like BTC.

Bittel claims that the $4 trillion crypto sector is anticipated to balloon to $100 trillion over the following decade as establishments, sovereign funds, and people rush to build up Bitcoin.

Bittel isn’t the one distinguished analyst extremely bullish on Bitcoin. Its long-term value targets by specialists fluctuate between $1 million and $13 million.

Legendary Wall Road traders and Fundstrat CEO declare that it wouldn’t take 5 years for the Bitcoin value to hit $500,000, highlighting its standing because the digital gold.

Why Bitcoin Hyper Might Be The Subsequent 1000x Crypto?

Bitcoin stays a wonderful long-term funding and will doubtlessly nonetheless have 10x upside over the following decade.

In the meantime, small-cap cryptos related to BTC provide a lot greater upside. As an illustration, the brand new BTC layer-2 coin, Bitcoin Hyper (HYPER), is being backed by many as probably the greatest low-cap gems to spend money on.

Lately, distinguished crypto publication CryptoDNES known as it the following 1000x crypto, as did a number of high influencers.

The sturdy demand for HYPER isn’t shocking. Layer-2 cash are considered as wonderful beta bets on their respective Layer-1s, and sometimes find yourself reaching multibillion-dollar valuations.

Furthermore, Bitcoin Hyper has impressed consumers with its fundamentals. Some like that as an alternative of re-inventing the wheel, its Layer-2 scaling answer makes use of the cutting-edge Solana Digital Machine, which may open the trail to DeFi, funds and meme adoption on Bitcoin.

Others are impressed with its community-centric tokenomics, audited sensible contracts and profitable staking rewards.

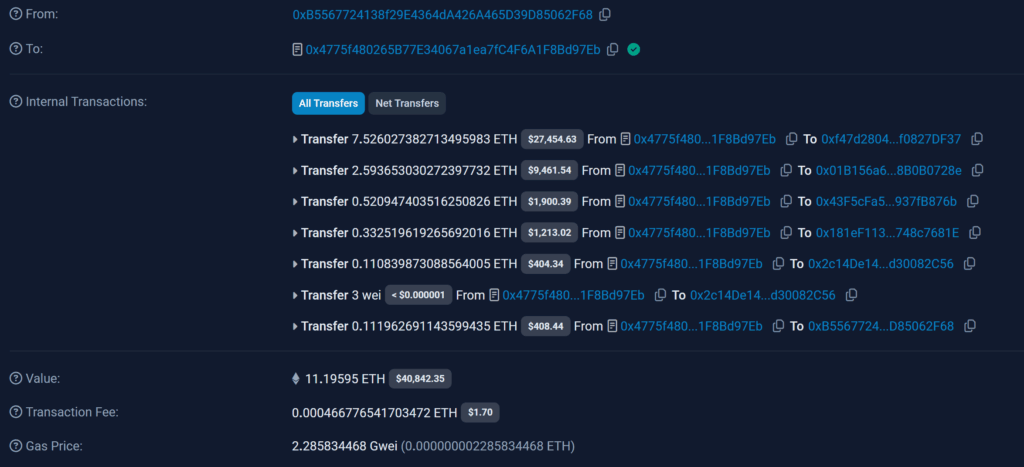

Unsurprisingly, whales have been early to acknowledge HYPER’s upside potential and are among the many first presale consumers. Simply final Saturday, a whale invested $60k value of HYPER in simply two transactions.

Behind such sturdy whale demand, the Bitcoin Hyper presale has raised practically $7 million in brief order, indicating sturdy group help and excessive upside potential.

Go to Bitcoin Hyper Presale

This text has been supplied by certainly one of our industrial companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind that our industrial companions might use affiliate packages to generate income by means of the hyperlinks on this article.