Retail buyers are piling into the inventory market, deploying trillions of {dollars} in capital.

Information from the Nasdaq reveals that particular person buyers snapped up $3.4 trillion value of shares within the first six months of 2025 amid market volatility triggered by geopolitical tensions and Trump’s commerce conflict, experiences MarketWatch.

In the meantime, the investor cohort additionally offered $3.2 trillion in shares over the identical time interval, pushing whole buying and selling exercise between January and June to a record-setting $6.6 trillion.

Citing knowledge from VandaTrack, the Monetary Instances experiences that retail buyers stepped in to purchase the dip, scooping up $155 billion value of US shares and exchange-traded funds this 12 months – whilst markets witnessed a pointy correction in April.

However whereas retail buyers are busy gobbling up shares, well-liked macro analyst Adam Kobeissi says that firm insiders have been exploiting inventory market rips to unload their holdings.

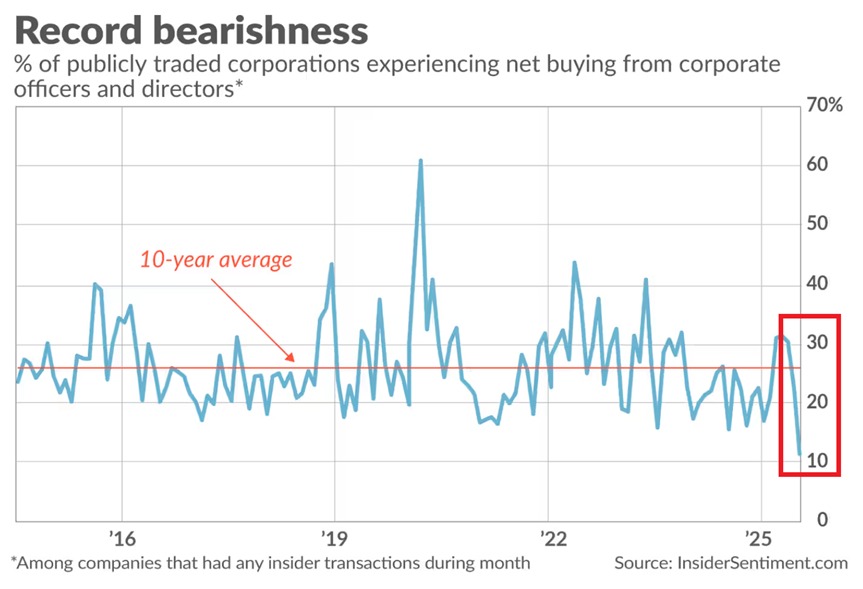

The founder and editor-in-chief of The Kobeissi Letter tells his 948,800 followers on the social media platform X that insiders are exhibiting excessive bearishness towards the inventory market based mostly on knowledge from InsiderSentiment.com, a agency that tracks internet insider shopping for and promoting exercise throughout US equities and sectors.

“Insiders have not often been this bearish earlier than:

Solely 11.1% of corporations with insider exercise are seeing extra shopping for than promoting by company officers and administrators, the bottom share on document. Over the past decade, this determine has by no means fallen beneath 15%.

This implies insiders have been internet sellers in nearly 90% of corporations with latest transactions. Insiders have been both impartial or destructive in 10 of the 11 S&P 500 sectors, with utilities being the one sector to indicate optimistic sentiment.

Promoting was additionally broad-based throughout firm sizes, from small to large-cap shares. An attention-grabbing divergence.”

In the meantime, InsiderSentiment says company insiders and executives usually beat the market by shopping for their agency’s shares earlier than costs spike and promoting earlier than costs plunge.

“They obtain a return that’s triple the market return (on common, on a one-month horizon).”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney