Welcome to the Asia Pacific Morning Temporary—your important digest of in a single day crypto developments shaping regional markets and international sentiment. This Monday’s version is dropped at you by Paul Kim. Seize a inexperienced tea and watch this area.

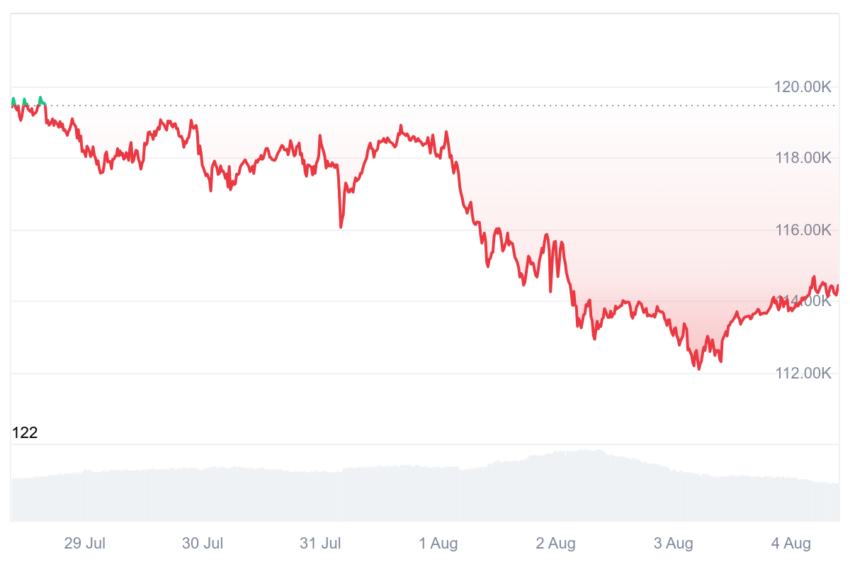

The crypto market in August is off to a difficult begin. Final week, Bitcoin costs sharply fell, breaking under the $117,000–$120,000 vary established since July 11. Bitcoin dropped almost 4% over the week, with some altcoins plunging over 15%.

First by Powell, Second by NFP

Final week’s decline unfolded in two essential phases. One trigger was the remarks of Federal Reserve Chair Jerome Powell following the July Federal Open Market Committee (FOMC) assembly held on Wednesday. The market had been extremely anticipating a charge reduce in September after the pause in July, however Powell poured chilly water on these expectations.

Powell acknowledged that the potential of a September charge reduce remains to be unsure. Whereas acknowledging indicators of a possible recession, he defined that it’s affordable to maintain charges regular because the inflationary results of tariffs are but to be confirmed.

He additionally emphasised that the labor market stays stable and close to stability, urging the main focus to shift from employment to inflation dangers.

Apparently, there was robust inner opposition throughout the Fed to this view. Fed Governor Christopher Waller identified that non-public sector employment development has slowed considerably. Regardless of surface-level well being, information revisions reveal weak point, prompting requires preemptive charge cuts.

For now, Powell’s perspective aligns with the bulk throughout the Fed, and the market has to mood its expectations for a September charge reduce. Bitcoin costs fell to $115,800.

The nonfarm payroll (NFP) information was launched on August 1, ensuing within the second decline. The July NFP estimate amongst Wall Avenue analysts was round 110,000, however the precise determine got here in at 73,000. This contradicts Powell’s optimistic outlook and signifies a major deterioration within the US labor market.

Extra regarding was the foremost downward revision of Could and June information by 258,000 jobs. The initially robust June NFP determine of 147,000 was largely a statistical phantasm. The US Bureau of Labor Statistics revised June’s determine to 14,000 and Could’s to 19,000—the bottom in 5 years.

The official unemployment charge matched expectations at 4.2%, however the broader U-6 unemployment charge hit 7.9%, the very best because the COVID-19 disaster. The variety of long-term unemployed and people looking for work for over 27 weeks additionally worsened. These indicators of a pointy financial downturn and labor market weak point triggered a plunge within the US inventory market. Bitcoin additionally retreated to round $112,000 on that day.

Macro Downturn Drags Company Shopping for and ETFs, Which As soon as Led the Rise

All through the week, main macroeconomic traits appeared to pull the crypto business alongside. The inflows into spot-listed ETFs that had pushed Bitcoin and Ethereum costs throughout July diminished considerably after July 30. On August 1, spot ETFs recorded their greatest single-day outflow since February this 12 months.

Ethereum-buying corporations, which have been main drivers behind Ethereum’s worth rise, additionally faltered. The week began positively: Sharplink Gaming confidently introduced a further $296 million Ethereum buy and staking, whereas Bitmine, led by CEO Tom Lee, claimed Ethereum’s intrinsic worth is $60,000.

Customary Chartered Financial institution forecasted that corporations shopping for Ethereum would maintain about 10% of the entire provide, noting a strategic accumulation that has surpassed $10 billion—a 50-fold improve in simply 4 months.

Nonetheless, these corporations have been powerless in opposition to the worth crash later within the week. Ethereum fell 7.2%, with high Ethereum-holding corporations Sharplink Gaming (-30.80%) and Bitmine (-23.16%) shares additionally plummeting.

Given this case, bearish sentiment naturally unfold. Crypto influencer Arthur Hayes, founding father of BitMEX, made bearish predictions for main cryptocurrencies. He predicted Bitcoin may fall to $100,000 and Ethereum to $3,000. Hayes cited upcoming US tariff laws and sluggish international credit score enlargement as key elements.

Over the weekend, on-chain information caught consideration with a regarding Ethereum metric. The Ethereum holder accumulation ratio dropped to 27.57%—the bottom in two months. This means traders are not aggressively growing their ETH holdings.

US Inventory Market Is the Key

The nice and cozy momentum from July disappeared out of the blue amid this sharp decline. What lies forward for crypto costs this week? The important thing shall be whether or not the US inventory market can rebound from the shock of the NFP information revision.

The US Employment Statistics Bureau has a historical past of revising annual nonfarm payroll information by over 800,000 jobs final 12 months, revealing that these jobs by no means really existed regardless of prior stories for the earlier 12 months. Nonetheless, even that revelation didn’t set off vital inventory market volatility.

The steep drop final Friday was partly because of the current US inventory market hitting new highs easily; the weakening employment figures offered an opportune set off for correction. If the US inventory market recovers with out additional corrections, the crypto market is prone to bounce again as nicely.

Nonetheless, if additional corrections proceed, Powell’s feedback denying a September charge reduce regardless of robust US employment will turn out to be essential. CME Group’s FedWatch instrument already forecasts three charge cuts throughout the 12 months.

No main macroeconomic points are anticipated this week, however US employment stays a important focus. The Convention Board will launch its Employment Traits Index on Monday, and this information may considerably affect US inventory markets.

We want our readers profitable investments this week as nicely.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.