Coinbase Layer-2 community, Base chain, skilled an outage on Tuesday, briefly halting block manufacturing.

Whereas the state of affairs was resolved shortly after, it rekindled issues over sequencer centralization.

Base Chain Non permanent Outage: Every thing Customers Have to Know

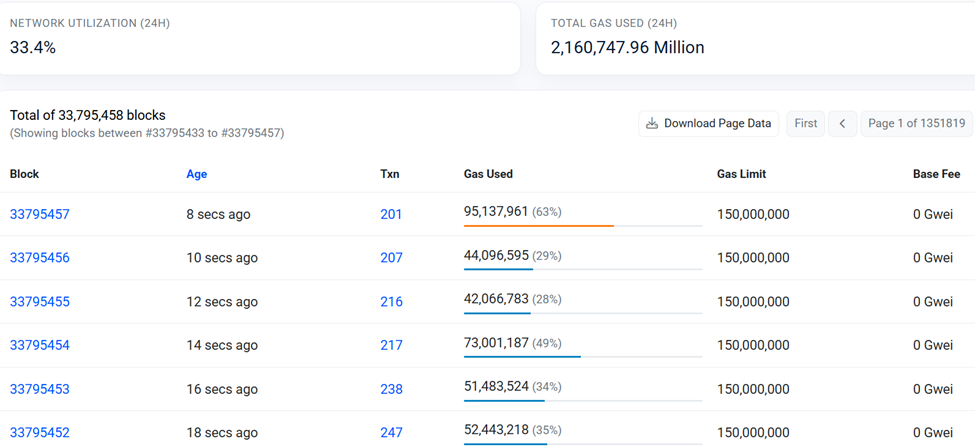

Base chain suffered an outage on Tuesday, inflicting a short lived halt in block manufacturing. Knowledge on Basescan, the Base chain explorer, exhibits that the Base community didn’t produce a block for 20 minutes.

Notably, the chain halt was solely localized to dam manufacturing, with all different providers working usually.

When Base blockchain halts block manufacturing, it doesn’t file new transactions, inflicting delays. As of this publication, neither Base nor its creator, Jesse Pollak, had addressed the incident to elucidate what occurred.

Experiences attribute the incident to an anomaly within the Base community, however it’s crucial to notice that this incident ends almost two years of uninterrupted operation. Some customers likened it to Solana, which has skilled a number of outages over time.

“Base went down for 23 minutes and never a peep. If it have been Solana, you’d by no means hear the top of it,” one consumer remarked.

In the meantime, the incident validates the issues about centralized sequencers. Base’s reliance on a single sequencer run by the Coinbase alternate creates a single level of failure.

Based mostly on this outlook, Base chain’s latest outage raises questions concerning the decentralization claims of such networks.

Sequencers Underneath Scrutiny After Base Outage Sparks Centralization Debate

Consideration has turned to a crucial however typically neglected part of Layer-2 (L2) blockchains, the sequencer.

The sequencer is liable for ordering, verifying, and batching transactions earlier than anchoring them to Ethereum. It acts because the “air visitors controller” for roll-up networks like Base, Arbitrum, and Optimism.

Whereas these techniques supply sooner and cheaper transactions, critics warn that right now’s sequencers are centralized, usually run by the community’s founding firm.

This setup introduces potential single factors of failure, censorship dangers, and vulnerabilities to regulatory strain.

Coinbase, as an illustration, runs Base’s sequencer, which analysts estimate may generate $30 million in annual income.

“BASE has been sending all sequencer charges to Coinbase since launch. We don’t know in the event that they bought, however we do know they didn’t deploy these funds on Base or maintain them on-chain. The shortage of transparency makes it honest to imagine they bought. Not very Ethereum-aligned of them,” wrote DeFi researcher Santisa in a latest submit.

Coinbase’s Q2 2025 earnings didn’t explicitly state Base’s transaction quantity. Nevertheless, the report famous a 55% rise in Base transaction quantity quarter-over-quarter. Different transaction income, together with Base, was $34 million, down 35% from Q2, attributed to decrease sequencer charge income.

“Why quick interop issues for rollup–it’s merely a should, with the intention to keep aggressive in opposition to alternate rollups like Base. – Coinbase <> Base is extraordinarily quick as a result of there’s no exterior belief, since Coinbase trusts its personal sequencer. – Coinbase units pessimistic delays for all different rollups aside from Base, with the notable exception being the Avalanche C-Chain (which is comparatively decentralized),” wrote Wei Dai, one other DeFi researcher.

It factors to important Base platform potential, which may make Coinbase an excellent larger powerhouse within the DeFi house.

Regardless of ongoing discussions about decentralizing sequencers, most main roll-ups have but to implement such adjustments.

Because the demand for roll-up options grows, the strain is mounting for Ethereum’s layer 2 networks to align with the blockchain ethos of trustless and distributed infrastructure.

The submit Base Chain Outage Renews Issues Over Coinbase’s Centralized Sequencer Mannequin appeared first on BeInCrypto.