Current on-chain and derivatives market indicators recommend that Bitcoin’s sharp value declines could also be getting into a cooling-off part, significantly on Binance—the most important crypto alternate by quantity.

Key divergences between value motion and open curiosity knowledge are portray an image of fading bearish momentum.

Bullish Divergence Between Worth and Open Curiosity

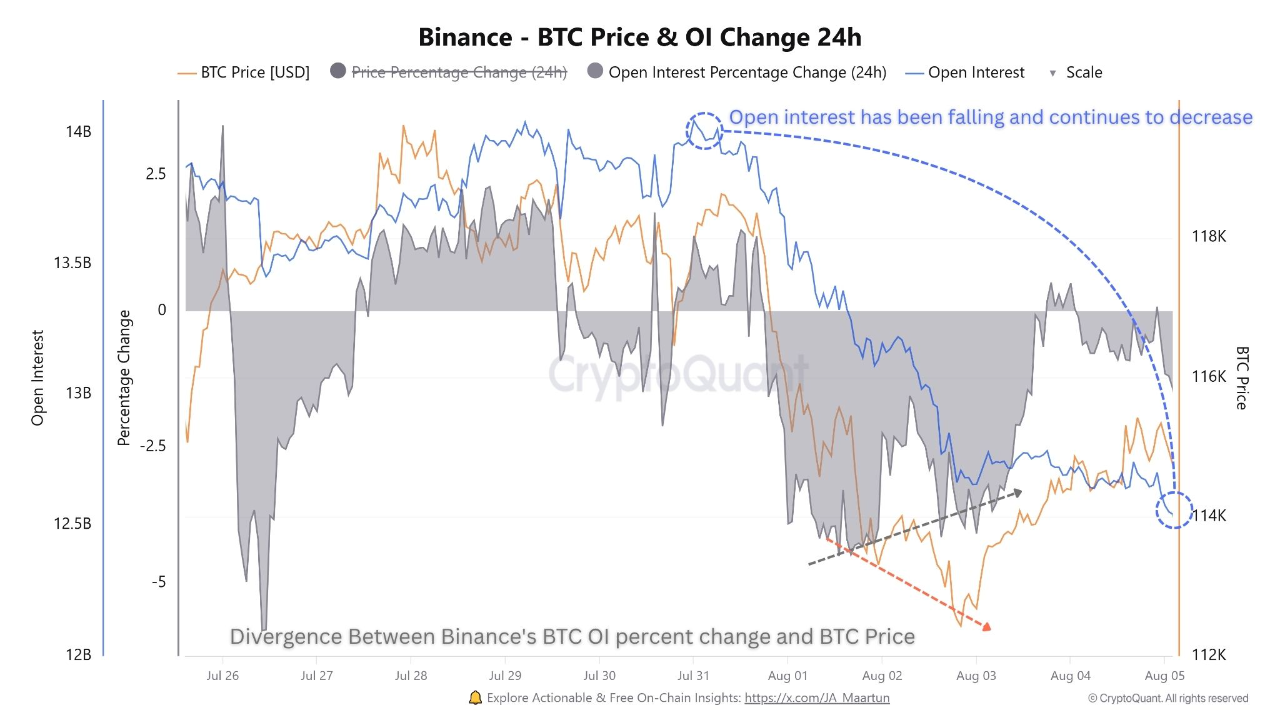

Bitcoin just lately dropped under $113,000, marking a decrease low on the value chart. Nevertheless, Binance’s 24-hour Open Curiosity proportion instructed a distinct story, forming a better low over the identical interval. This type of divergence—the place value falls however open curiosity decline slows—is commonly seen as a bullish sign.

In keeping with new report by CryptoQuant, such a sample sometimes factors to a part of capitulation the place merchants are closing positions, however with lowering urgency. On this case, it seems to have performed out in two distinct waves: the primary selloff occurred after BTC breached the $113K stage, triggering lengthy liquidations. A secondary wave pushed costs barely decrease to round $112,500, doubtless activating stop-losses or extra pressured closures.

The gradual unwinding of positions via these staggered liquidations usually units the stage for pattern exhaustion. When sellers run out of steam, market circumstances can shift, creating room for a reversal or a minimum of a consolidation.

Spot vs. Perpetual Worth Unfold Reveals Threat Aversion

One other revealing indicator is the rising hole between Binance’s spot and perpetual futures costs. At current, spot BTC is buying and selling under its perpetual counterpart, producing a unfavorable foundation—a situation not typical of bullish market environments.

This unfold is commonly pushed by a pointy decline in open curiosity and sustained lengthy place closures. In such instances, liquidity and demand within the derivatives market wane, pushing funding charges decrease and disincentivizing bullish publicity.

In more healthy, optimistic markets, perpetual contracts sometimes commerce at a premium to identify (a construction often called Contango). The present inverse setup indicators a risk-off perspective, the place merchants are hesitant to pay extra for future BTC publicity, opting as a substitute to scale back leverage and restrict draw back danger.

Conclusion

Collectively, the divergence between Bitcoin’s value and open curiosity, mixed with the unfavorable unfold in spot-perpetual pricing, recommend that the current promoting frenzy could also be nearing exhaustion. Whereas this doesn’t assure a right away rebound, it signifies that bearish momentum may very well be weakening—opening the door for stabilization or a possible shift in sentiment within the days forward.