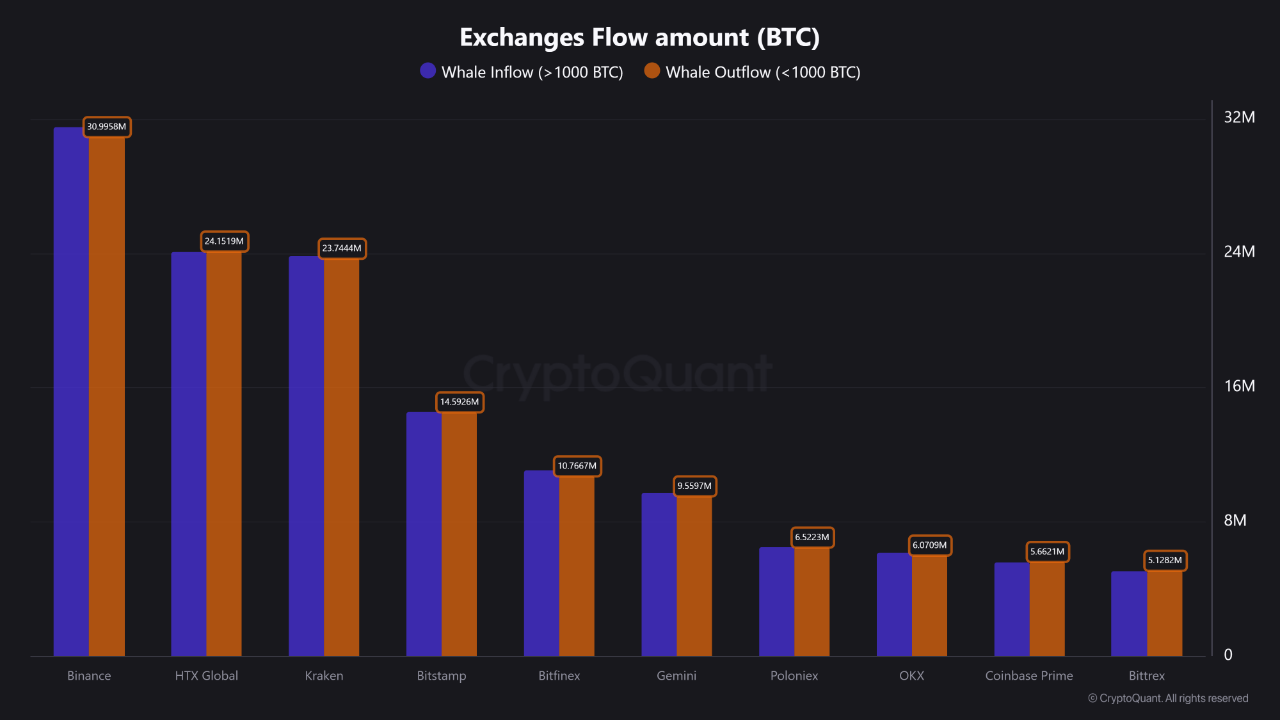

New on-chain knowledge from CryptoQuant has revealed that Binance is the dominant hub for large-scale Bitcoin exercise, far surpassing all different exchanges on the subject of whale-level transactions.

Analyzing pockets flows of 1,000 BTC or extra, the report highlights that whereas a number of platforms see notable quantity, Binance stands alone as the first change for high-frequency institutional exercise.

Whale flows crown Binance the king of crypto liquidity

In keeping with the report, Binance leads the business in whole whale-sized Bitcoin flows, registering over 30 million BTC in each inflows and outflows. However quantity alone doesn’t inform the complete story. What units Binance aside is its sheer variety of giant transactions—a metric that indicators ongoing, constant use by deep-pocketed gamers.

Whereas different platforms like HTX International and Kraken additionally noticed important whale volumes, their transaction counts pale as compared. Binance recorded an astonishing 56 million+ whale transactions, dwarfing HTX’s ~16 million, and indicating that Binance is probably the most trusted and actively used platform for executing high-impact trades.

Why this issues for the market

The dominance of whale exercise on Binance interprets to distinctive liquidity, which in flip permits tight bid-ask spreads and dependable execution for big orders with minimal slippage. For institutional gamers and high-net-worth merchants, this atmosphere is essential.

Extra broadly, the information positions Binance’s order books as key indicators of institutional sentiment. When main actions happen within the crypto market, it’s more and more doubtless that the preliminary ripple began at Binance.

CryptoQuant’s evaluation makes it clear: Binance isn’t simply the place Bitcoin whales swim—it’s the place they reside. The platform’s unmatched transaction frequency and quantity from top-tier merchants reinforce its standing because the go-to venue for market-shaping choices.