Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

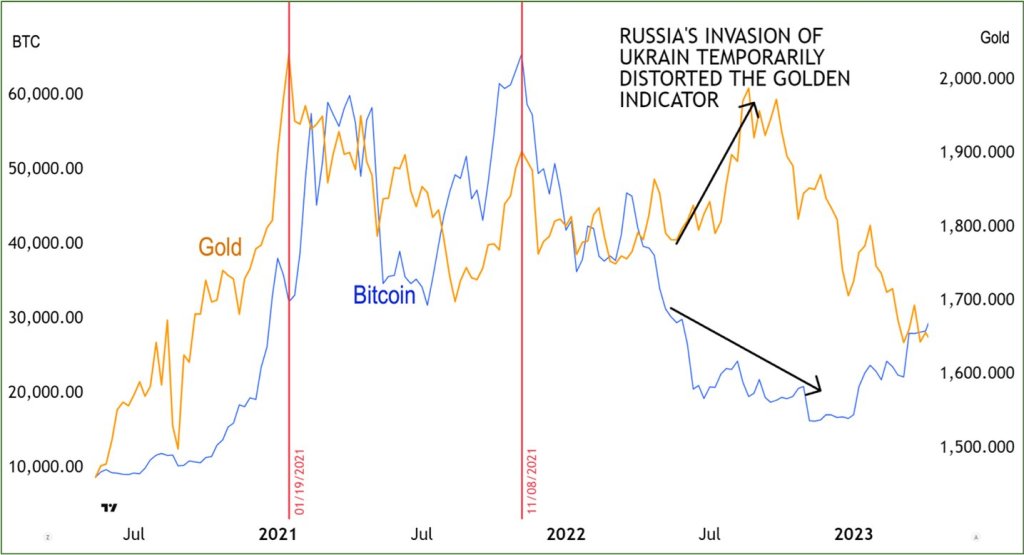

A thread posted late on 4 August 2025 by Weiss Crypto analyst Juan Villaverde has ignited debate a couple of hardly ever mentioned harbinger of Bitcoin value cycles. In a thread on X, the quantitative researcher argued that an “ignored asset class”—one he says virtually no-one screens in a crypto context—persistently pivots months earlier than Bitcoin does, providing what he calls “a sneak peek at main turning factors.” Villaverde’s proprietary back-testing suggests the lag is roughly six months, sufficient lead time, he claims, to anticipate the apex of the present bull market in late November.

How Gold’s Trendlines Map The Bitcoin Value

“Many are conscious that Bitcoin tends to observe world liquidity—with a roughly twelve-week lag,” Weiss Crypto wrote, setting the stage for the reveal. “However Juan Villaverde has quietly tracked a special early indicator… one that may sign the place BTC is headed six months prematurely.” In a follow-up publish he teased, “That little-known indicator? [ … ]. Seems, its value motion usually leads Bitcoin by a number of months—offering a sneak peek at main turning factors.”

Associated Studying

Villaverde’s thesis rests on an information sequence stretching again to the appearance of recent crypto markets. He factors to the trough of December 2018, which, in his reconstruction, was foreshadowed by a major low within the thriller market some weeks earlier. “After analysing years of information, Juan noticed a constant sample,” Weiss Crypto said, quoting the analyst to the impact that “main lows [there] are likely to precede main lows in Bitcoin.”

The identical lead-lag cadence, Villaverde notes, flashed purple in November 2021 when Bitcoin printed its all-time excessive even because the benchmark asset he tracks refused to interrupt greater—an omen that presaged the 2022 bear market.

The mannequin will not be with out blemishes. Weiss Crypto acknowledged “one exception lately—through the Russia–Ukraine invasion—the place the Bitcoin relationship briefly inverted on account of macro chaos.” But Villaverde maintains the anomaly reinforces moderately than weakens his conviction: exogenous geopolitical shocks can distort correlations, however as soon as the shock dissipates the historic rhythm reasserts itself.

Associated Studying

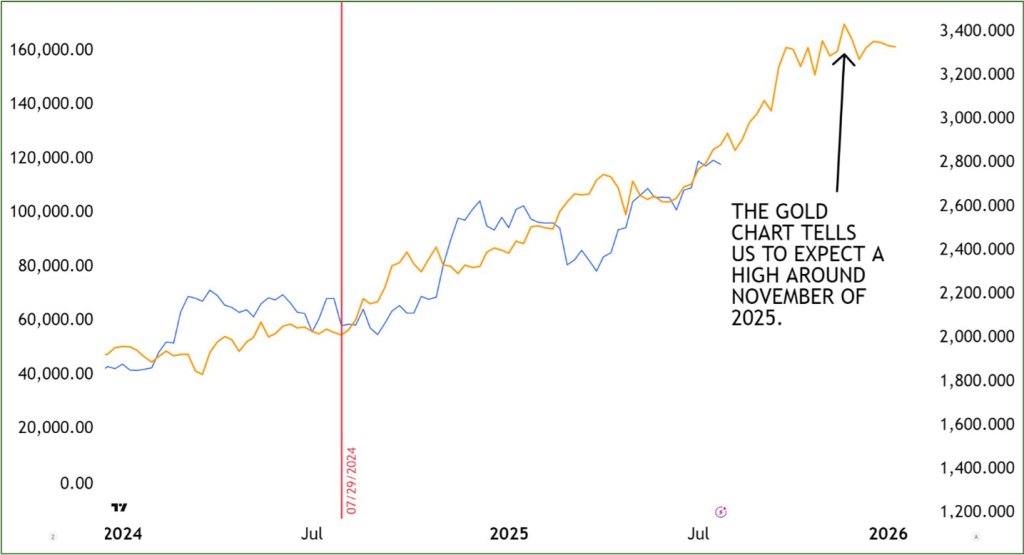

The place does that go away the market in mid-2025? “In keeping with Juan’s evaluation,” the agency wrote, “the indicator is pointing to a significant excessive in Bitcoin round late November 2025. That aligns completely along with his Crypto Timing Mannequin.” Villaverde cautions that the sign is dynamic, not deterministic. If the benchmark asset he watches “rallies above its April excessive,” it will suggest “Bitcoin may march greater into 2026.” Conversely, any decisive breakdown would “be an early warning that crypto’s bull market could also be nearing its finish after November.”

Villaverde insists the connection he has recognized is strong as a result of it focuses on magnitude moderately than path alone. “It’s not solely the turns that matter,” he mentioned in a direct message to this outlet, “however the amplitude of these turns.” By quantifying each, he argues, the sign captures investor psychology biking from worry to greed and again once more.

At press time, BTC traded at $114,522.

Featured picture created with DALL.E, chart from TradingView.com