BlackRock’s Bitcoin ETF simply noticed its largest outflow in two months as costs dipped. Regardless of this, institutional curiosity in crypto is powerful.

BlackRock’s iShares Bitcoin Belief (IBIT), probably the most intently watched Bitcoin ETFs, simply recorded its largest outflow in two months.

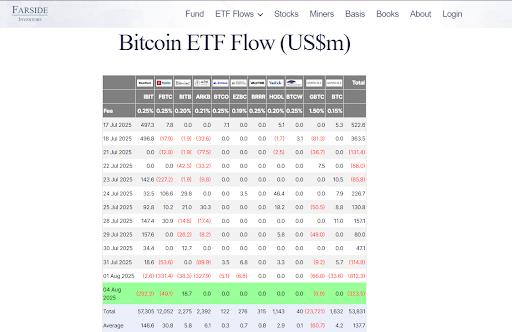

The $IBIT skilled $292.5 million in withdrawals on Monday, simply as Bitcoin costs fell over the weekend, solely to stage a minor restoration by the beginning of the week.

The outflow stands as a break in what had been a robust streak for BlackRock’s fund and different spot Bitcoin ETFs. It additionally exhibits that the market traction could be slowing down after a very bullish July.

Bitcoin ETFs Outflows Observe Worth Dip

The sudden outflow from BlackRock’s BTC fund got here after an enormous decline within the value of Bitcoin. Over the weekend, Bitcoin slid 8.5% and fell from its July 14 all-time excessive to a low of $112,300, earlier than bouncing again to $115,000 on Monday.

This value motion appeared to shake investor confidence quickly. BlackRock’s IBIT noticed a $292.5 million outflow, which was the biggest since Might, amid a smaller outflow on Friday that ended a 37-day streak of inflows.

It wasn’t simply BlackRock feeling the warmth. Constancy’s Sensible Origin Bitcoin Fund (FBTC) reported a $40 million outflow, and the Grayscale Bitcoin Belief (GBTC) shed $10 million. Apparently, solely Bitwise’s Bitcoin ETF (BITB) noticed inflows, pulling in $18.7 million.

July Was Nonetheless a Huge Month for BlackRock

Even with the current dip, July was an enormous win for BlackRock. The iShares Bitcoin Belief recorded $5.2 billion in internet inflows throughout the month, which accounted for 9% of its whole inflows since launching final 12 months.

The fund has now raked in additional than 700,000 BTC, which exhibits how a lot institutional capital has poured into the asset. This huge holding signifies that, regardless of short-term fluctuations, confidence within the long-term worth of Bitcoin continues to be strong amongst large traders.

Digital Property Are Outpacing Trad-fi Options

The current ETF outflows don’t present a wider downturn in digital asset curiosity. In actual fact, digital property are at present the fastest-growing phase within the options market.

In line with information shared by Bloomberg’s ETF analyst Eric Balchunas, digital property and hedge funds are pulling forward. Alternatively, fundraising in non-public fairness and personal credit score slows down.

JPMorgan’s Nikolaos Panigirtzoglou additionally confirmed this pattern. He famous that traders are more and more turning to digital property for publicity to different markets. By late July, the phase had already attracted $60 billion in capital and was on observe to rival final 12 months’s report of $85 billion.

JUST IN: 🇺🇸 Donald Trump says “we’re embracing the longer term with crypto and leaving the gradual and outdated large banks behind.”

— Bitcoin Journal (@BitcoinMagazine) September 12, 2024

Spot Bitcoin ETFs Are Lowering Market Volatility

Some of the promising indicators for institutional traders is the lowered volatility of Bitcoin because the launch of spot ETFs.

The 90-day rolling volatility for BlackRock’s IBIT has now dropped under 40 for the primary time. For context, when these ETFs first launched, volatility was above 60.

Which means that Bitcoin is experiencing fewer wild value swings and a extra secure funding atmosphere. As Balchunas famous, the market has moved away from “vomit-inducing drawdowns.” That is making BTC much more engaging to bigger traders and establishments.

This lowered volatility could possibly be the important thing to Bitcoin’s adoption over the subsequent few years.

Because the asset turns into extra secure, the case for utilizing it as a purposeful foreign money somewhat than only a speculative one grows stronger.