There’s a variety of chatter round Ethereum value; will it break $4,000, or is one other collapse brewing? The bears appear to be successful this spherical. During the last 7 days, the ETH value has shed greater than 8.6% and at the moment trades round $3,533, nonetheless 27.1% off its all-time excessive.

However beneath the floor, the info paints a unique image: one the place the good cash could have already set the entice. Three clear alerts and a bullish sample recommend Ethereum’s latest breakdowns is likely to be nothing greater than an orchestrated bear entice.

Whale and Retail Focus Flip Bullish

The primary sign comes from Ethereum’s on-chain focus metrics. During the last 30 days, whale holdings have risen by 1.82%, whereas retail wallets (small holders) have elevated publicity by 1.87%. Generally, whale strikes find yourself outweighing investor and retail actions as a result of sheer dimension of buying and selling.

And this time, it appears that evidently retail is following the ETH whales, presumably leaving buyers or mid-size of us in a entice of kinds.

Apparently, mid-size investor wallets have offloaded, doubtlessly hinting at redistribution towards the extremes; whales and retail, two teams recognized for having very totally different motives, however each appear assured right here.

Including weight to this view is IntoTheBlock’s Bull vs Bear deal with chart, which doesn’t use typical sentiment metrics. As a substitute, it tracks pockets habits: bulls are those who have purchased over 1% of each day traded quantity, whereas bears have offered no less than 1%.

During the last 7 days, bulls outnumber bears by 7: a slim edge, however sufficient to recommend conviction is leaning towards accumulation, not distribution.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Lengthy/Quick Account Ratio Reveals Merchants Leaning Bullish

Regardless of the sideways motion and frequent dips, merchants haven’t flipped bearish but. Based on Binance’s long-short account ratio, Ethereum’s metric at the moment stands at 1.91, that means there are almost twice as many lengthy accounts as quick ones.

It’s vital to notice: this isn’t the identical because the lengthy/quick place quantity ratio. The account ratio measures the variety of person accounts holding lengthy vs. quick positions, not simply commerce dimension.

This information, taken over the previous 24 hours, means that extra merchants count on upside continuation, at the same time as the worth chops round close to key resistance. Traditionally, related ratios have held simply earlier than main directional strikes.

Bullish Triangle Nonetheless Intact After Testing Key Ethereum Worth Assist

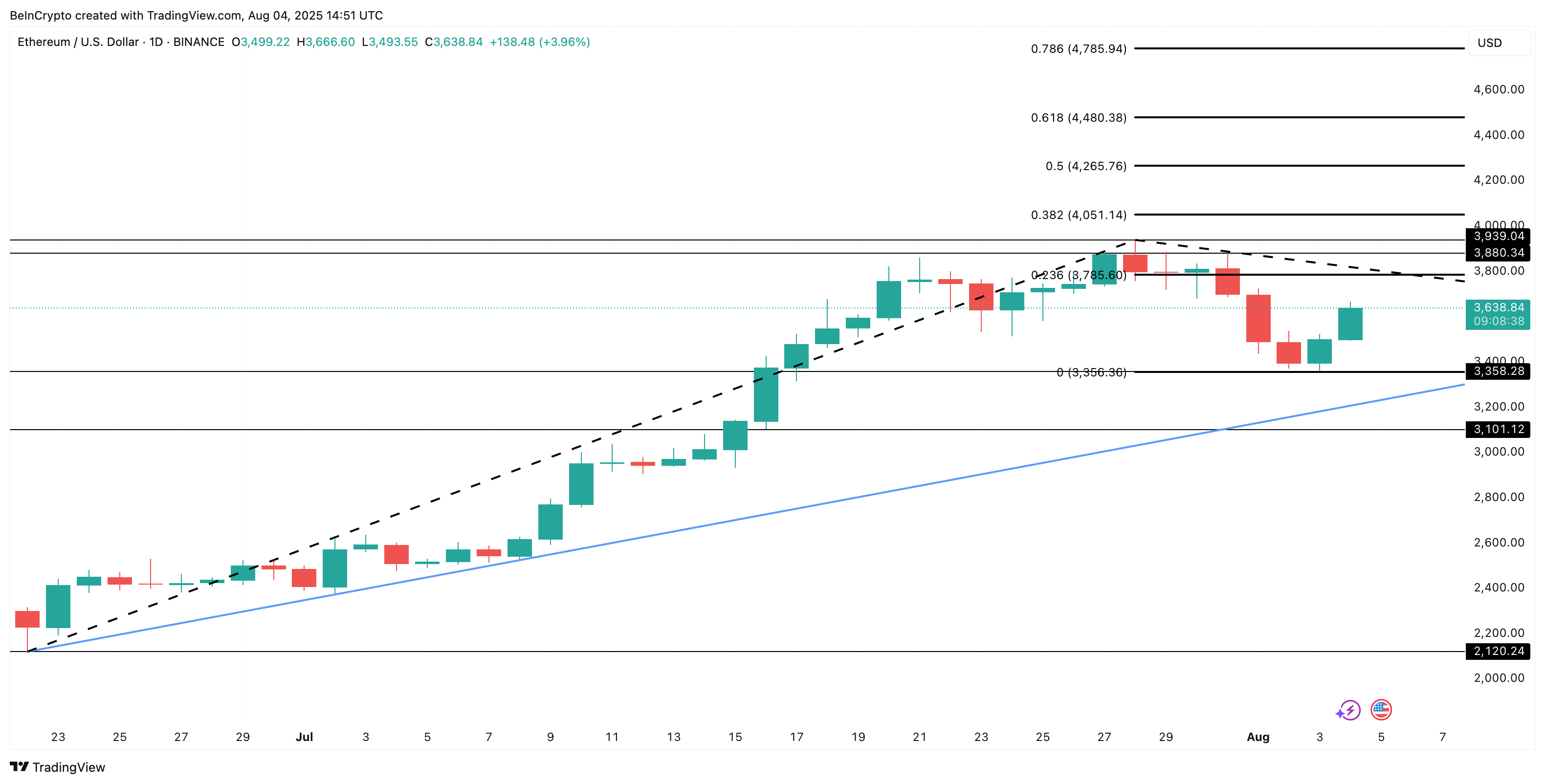

Probably the most visually telling a part of the Ethereum value construction is its bullish (ascending) triangle sample on the each day chart. After an explosive transfer from the $2,120 low to $3,939, Ethereum entered a decent consolidation vary. The 0.236 Fibonacci pattern extension stage, or the $3,785 value stage, tried providing help however was rapidly damaged.

An extended crimson candle adopted, similar to the timeframe when ETH quick positions took middle stage. Even ETH promoting intensified publish the drop, with merchants supposedly assuming that even the $3,356 help can be damaged. And guess what, that help line was examined briefly.

The road was examined yesterday, aligning with the Sensible Dealer opening a brief place. However then, the worth rebounded, and would have already liquidated the dealer. One bear trapped!

It gained’t be improper to imagine that many related quick positions have been opened.

Nonetheless, if the each day candle closes above $3,785, ETH value would possibly simply have the legs to check $3,939 after which $4,051, with the transfer to the latter qualifying as a clear breakout.

However then, if the important thing help of $3,356 is in the end damaged, the bullish speculation will get invalidated

The publish Did Ethereum Simply Lure the Bears? 3 Alerts Counsel It Would possibly Have appeared first on BeInCrypto.