Key takeaways

Ethereum’s Open Curiosity has hit a file $8.7B on Binance, an indication of rising leveraged bets with out overheating. ETH now could also be on monitor for a breakout towards $5K.

Ethereum [ETH] could also be on the verge of a breakout. Open curiosity on Binance has soared to an all-time excessive of $8.7 billion — almost 3.5 instances its peak in the course of the 2021 bull run — exhibiting heightened dealer anticipation.

With Funding Charges nonetheless hovering close to impartial and historic August patterns favoring sturdy post-halving rallies, market analysts consider ETH could possibly be setting the stage for a speculative run towards the $5K mark.

Leverage builds alongside warning

Supply: CryptoQuant

Ethereum’s Open curiosity on Binance has exploded to an all-time excessive of $8.7 billion, shattering its earlier bull market peak of round $2.5 billion in 2021.

This large 3.5x improve exhibits an intense buildup of leveraged positions, but with out the extremes typically seen in overheated markets.

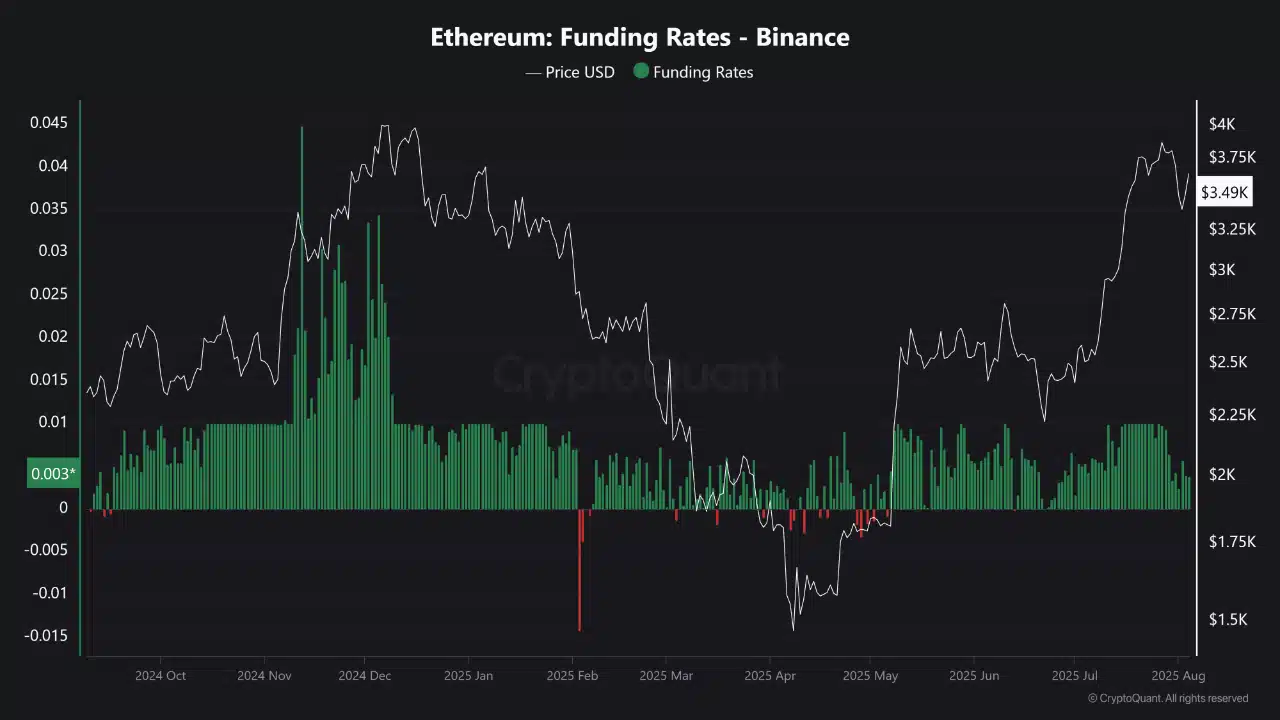

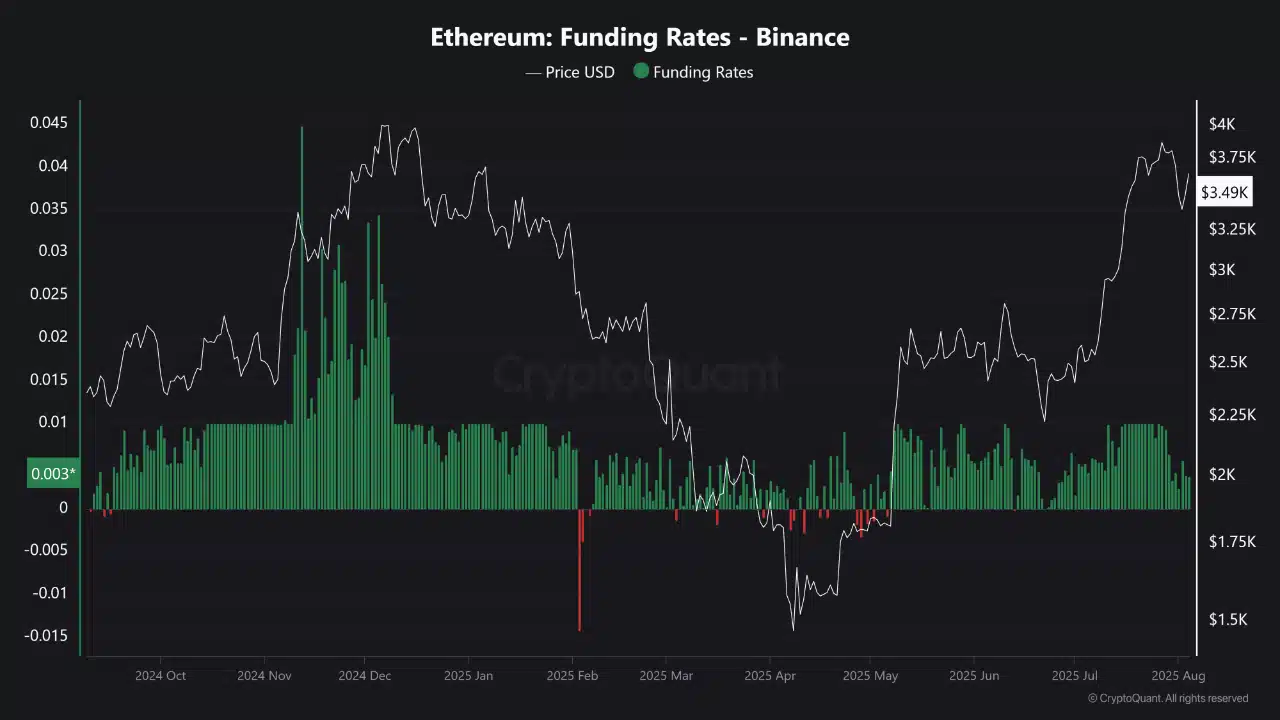

Supply: CryptoQuant

What’s hanging is the disconnect between rising OI and flat Funding Charges. Present knowledge exhibits that funding stays impartial, indicating that merchants aren’t aggressively positioned lengthy or brief.

This equilibrium implies there’s nonetheless vital headroom for value motion with out pressured liquidations or overcrowded bias.

Publish-halving patterns level to nice potential

August has all the time been a strong month for crypto, particularly in post-halving years.

Whereas Bitcoin often takes the highlight, Ethereum tends to outperform throughout these cycles, because of its beta-like responsiveness to Bitcoin’s power.

Supply: X

In keeping with analyst Alek Carter, ETH has averaged a staggering 64.2% achieve in August throughout previous post-halving years.

If this sample repeats, it may catapult ETH towards the extremely anticipated $5,000 mark within the coming weeks.

Minor dip, with momentum intact

Ethereum’s newest day by day chart confirmed a slight pullback to $3,632, making a 2.38% drop. Nonetheless, technical indicators have proven this isn’t a breakdown.

The RSI was nonetheless above impartial at 57.61 at press time, an indication of continued power with out being overbought.

In the meantime, the MACD confirmed convergence however not a bearish crossover but, indicating the latest dip could possibly be a wholesome pause in a broader uptrend.

As volatility resets and momentum consolidates, ETH could also be getting ready for a larger transfer, particularly if macro and on-chain traits stay supportive.