- Hyperliquid is exhibiting early indicators of a development reversal after a 28% drop, with bullish patterns forming on the 4-hour chart.

- On-chain alerts like trade outflows and liquidation strain counsel rising bullish sentiment and accumulation.

- A breakout above $39 may set off a brief squeeze and push HYPE as much as $42.60, however blended alerts from Supertrend trace at some warning.

After taking a nasty 28% dip from its all-time excessive final month, Hyperliquid (HYPE) may lastly be turning the nook. A contemporary wave of bullish power is creeping into the charts — and whereas buying and selling quantity’s nonetheless kinda mushy, some people are already calling this a reversal.

Value Wiggles & Market Temper

As of now, HYPE is buying and selling at $38.48, up round 1.85% within the final 24 hours. Not precisely fireworks, however hey — inexperienced is inexperienced. What’s extra attention-grabbing is that buying and selling quantity’s down 45%, which could sound dangerous, but additionally often means… individuals are ready for one thing.

After which there’s this: one crypto analyst on X (previously Twitter) identified that HYPE simply flashed a TD Sequential purchase sign on the 12-hour chart. When you’re into patterns and tea leaves, that’s usually a kind of indicators bulls take note of.

Charts Are Speaking: Will It Break?

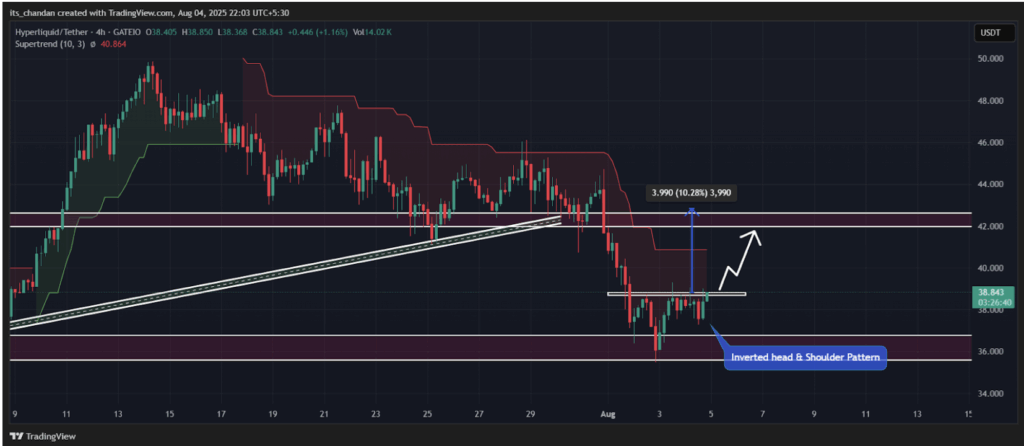

Zoom into the 4-hour chart and also you’ll discover one thing fairly textbook — an inverted head-and-shoulders sample. That often screams reversal. The neckline of that setup sits proper round $39 — if HYPE can shut above that on the 4H candle, we could possibly be taking a look at a soar to about $42.60 (a neat 10% transfer).

Key help to control? Round $35.70 — that’s the place this bullish motion appears to be rooting itself.

Now, just a little wrinkle: the Supertrend indicator is flashing crimson on the 4-hour timeframe (which often means promote strain), however on the hourly chart? It’s flipped inexperienced. So yeah, blended alerts. This factor may be attempting to show the tide… or simply pulling a short-term bounce inside an extended downtrend. Time’ll inform.

On-Chain Knowledge: Bulls Sneaking In?

Behind the scenes, issues look… attention-grabbing. In response to Coinglass, exchanges noticed $502K value of HYPE circulation outover the previous 24 hours. That’s often an indication people are pulling tokens off exchanges to carry — a basic accumulation transfer.

Add to that: the liquidation map exhibits massive strain round $36.85 and $39.10. On the higher band, there’s $2.29M in brief positions on the sting of liquidation. If the value pushes above $39 and liquidates these shorts? Might gasoline a mini rally actual quick.

Longs are a bit heavy too — sitting at $7.33 million, which implies leverage is piling up. So yeah, it’s trying bullish… however don’t sleep on the volatility.