- Stellar has dropped over 21% since July 19 however is exhibiting short-term indicators of a possible rebound as bulls defend the $0.42 assist zone.

- Spot demand and open curiosity are rising, whereas funding charges have flipped constructive, hinting at near-term bullish momentum.

- Retail exercise has cooled off, and there’s no main promoting strain — giving bulls some respiratory room to aim a breakout above resistance.

Stellar (XLM) hasn’t precisely had a clean experience recently. Since July 19, it’s dropped about 21.2%, which is lots steeper than what we’ve seen throughout the remainder of the crypto market. For some perspective, altcoins are down simply over 4%, and Bitcoin’s barely flinched at -2.9%. So yeah, Stellar’s been on a little bit of a wild experience.

However — and it’s a giant however — that form of volatility? It might probably create probabilities. Whereas the worth has taken successful, bulls aren’t precisely waving the white flag. In actual fact, they’re attempting to carry the road at $0.42, aiming to show it again into assist. If that occurs, it may clear a path towards $0.515 — a good little pump if the celebrities (no pun meant) align.

Brief-Time period Indicators Level to a Doable Flip

Proper now, the short-term knowledge truly seems… not dangerous. In keeping with Coinalyze, each the spot CVD and open curiosity have been ticking upward over the past 24 hours. Meaning merchants are stepping again in — there’s extra shopping for within the spot markets and a bit extra speculative vitality creeping in.

Plus, the funding price’s constructive, which provides one other tick to the bullish facet. Taken collectively, these alerts counsel that, not less than within the subsequent day or two, XLM would possibly attempt to claw its manner again up.

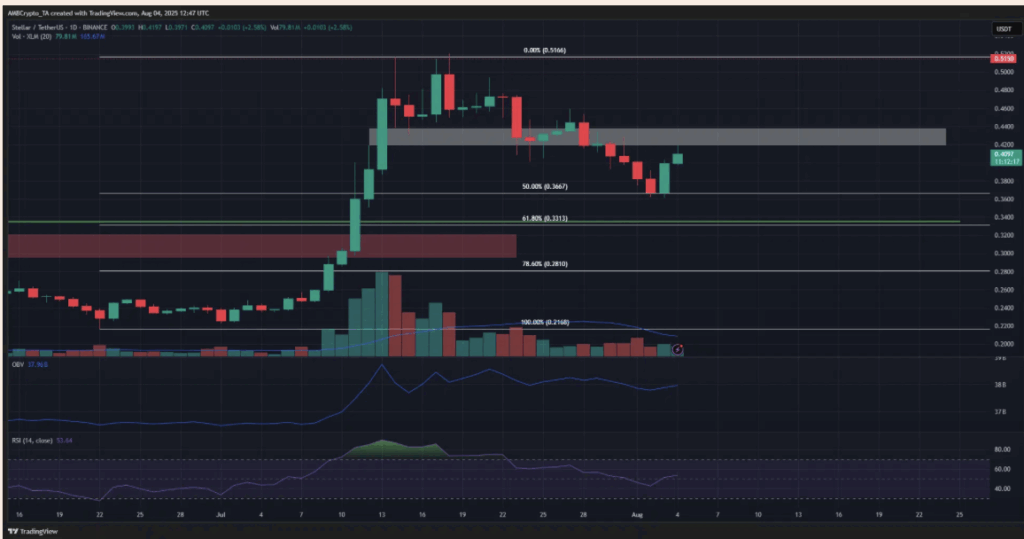

However Technically Talking… Nonetheless Some Hurdles

Zooming out a bit, the 1-day chart nonetheless leans bearish. Despite the fact that XLM bounced 12% off its $0.366 retracement degree, it’s actually simply retesting the outdated assist zone round $0.42–$0.44 — now appearing as resistance. That zone’s gotta flip earlier than we discuss actual momentum.

The RSI is impartial, the OBV goes sideways, and there’s no clear signal of power but. Mainly: hope’s not misplaced, however the bulls have some work to do in the event that they wanna flip the script.

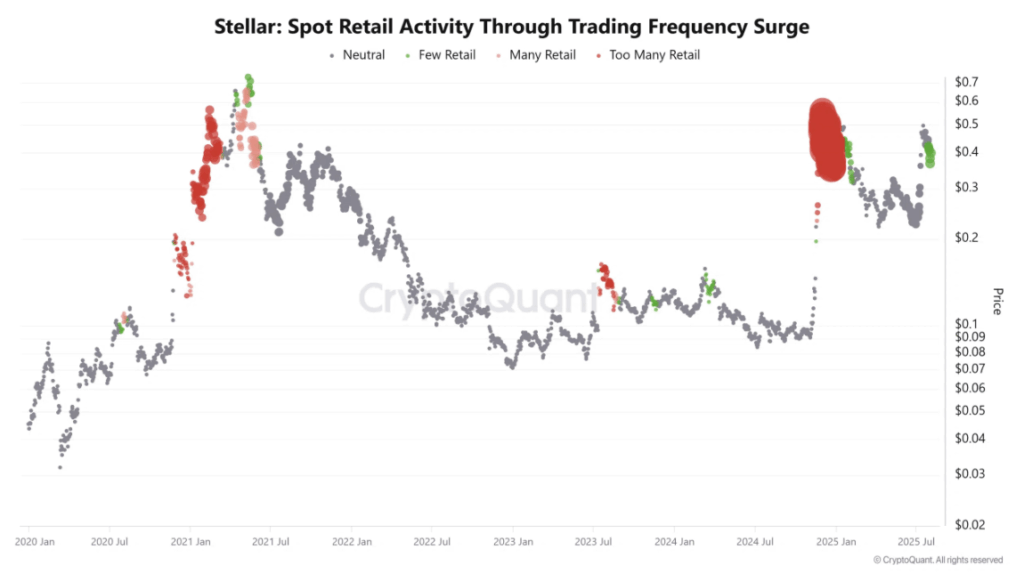

What’s the Crowd Doing?

Retail merchants? They’re kinda sitting this one out. CryptoQuant’s knowledge reveals spot retail exercise dropping off recently. And that’s not a horrible factor — generally when there’s an excessive amount of retail motion (assume big pink bubbles), the market overheats. So this little breather would possibly truly be wholesome.

In the meantime, the spot taker CVD is holding flat, which isn’t tremendous thrilling, nevertheless it does line up with the concept there’s no heavy promoting strain both. That’s key. Again in December 2024, Stellar acquired crushed by aggressive sell-offs. Proper now, although? That’s not taking place.

If bulls can maintain the strain on and push by that $0.42-$0.44 vary, we may lastly see some contemporary upside motion.