Social media rumors of a Japanese XRP ETF have taken the crypto group by storm after a brand new report from SBI Holdings. Citing regulatory progress, the agency sketched out theoretical plans for brand new crypto ETFs.

Nonetheless, the agency isn’t going to make an official transfer till the authorized scenario improves. Nonetheless, SBI Holdings has a well-documented historical past of curiosity in XRP. If anybody’s going to guide the ETF race in Japan, it’s an incredible candidate.

New XRP ETF Rumors

One subject that persistently attracts consideration in crypto is the XRP ETF. This product started buying and selling in Brazil in April and went stay in Canada in June, however US regulators preserve dragging their ft.

Due to latest developments, social media rumors counsel that Japan would be the subsequent nation to launch this product.

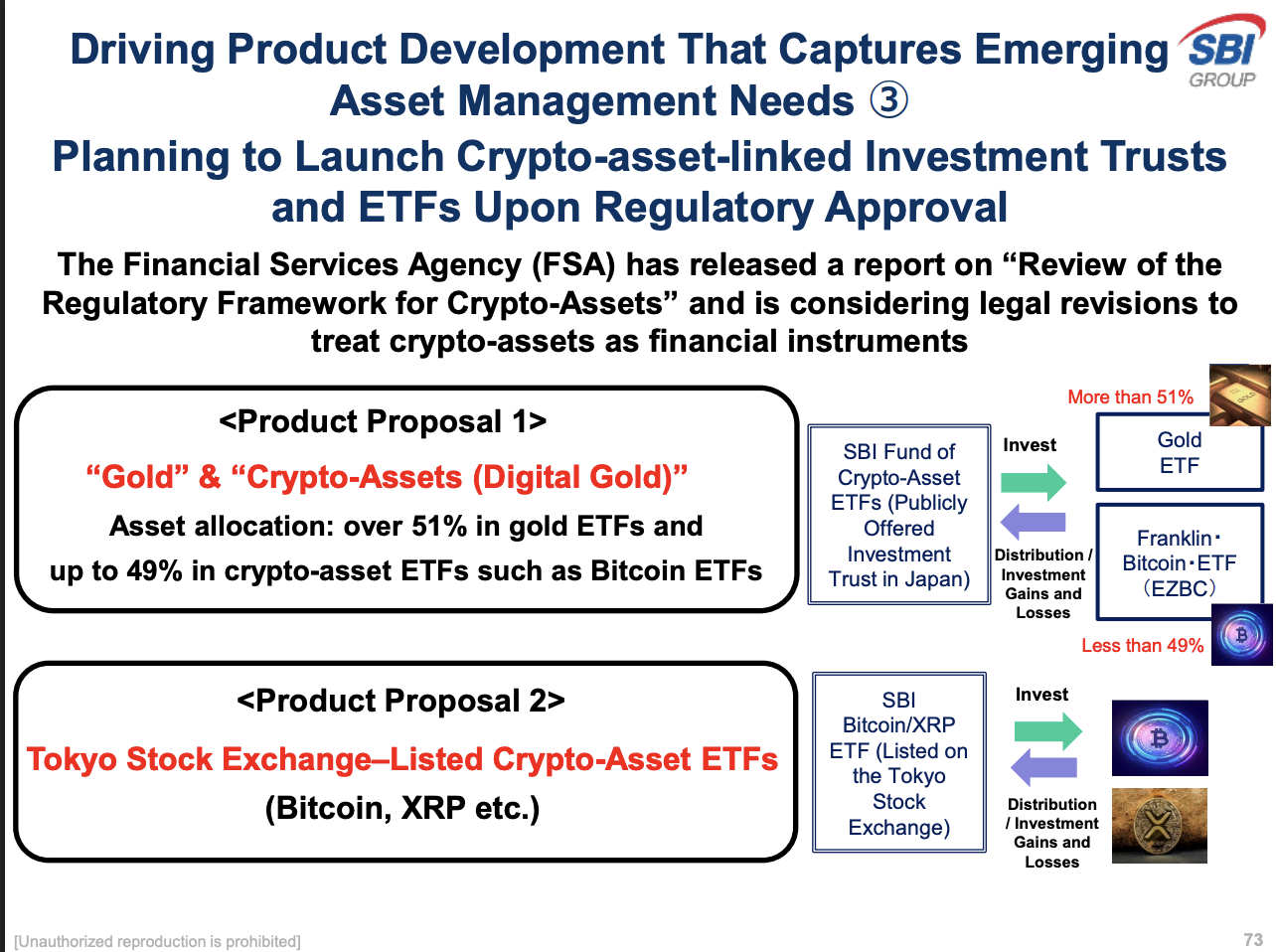

So, why is that this? SBI Holdings, a Japanese monetary conglomerate, lately posted its Q2 2025 Monetary Outcomes. Amongst many matters, it referenced potential regulatory developments within the nation, which may allow the agency to create new token-based ETFs.

One among its ETF proposals targeted on oblique crypto publicity, whereas the opposite included XRP:

Is the Hype Credible?

There’s definitely a bullish case for why SBI may set up an XRP ETF.

For one factor, the agency has a longtime historical past with Ripple, because it’s at the moment one of many largest customers of XRP on Ripple’s International Funds Community. Furthermore, it even permits clients to amass XRP utilizing bank card factors.

Nonetheless, social media rumors implied or erroneously claimed that SBI’s XRP ETF utility was already in progress. Sadly, that’s an exaggeration.

No less than Japan is definitely getting critical about crypto regulation; considered one of its high monetary regulators lately started working a Working Group on Web3 coverage. This sign inspired SBI to organize these hypothetical merchandise.

Nonetheless, SBI received’t make a transfer till it will get extra readability from the authorities. Moreover, this marketed product isn’t really an XRP ETF. It’d be a basket product, combining XRP with a number of different main tokens.

The US, as a matter of truth, already authorised such a product, though it faces a number of setbacks earlier than market entry.

Nonetheless, SBI has a particular historical past of partnership with Ripple and curiosity in XRP. If anyone in Japan goes to launch an XRP ETF, they’re a powerful candidate.

For now, nevertheless, it’ll have to attend for regulatory approval, identical to XRP followers in most jurisdictions worldwide.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.