Michigan’s state pension fund has elevated its publicity to Bitcoin by a major buy of the ARK 21Shares Bitcoin ETF (ARKB). In keeping with a brand new SEC submitting, the fund held 300,000 shares of ARKB as of June 30, up from 100,000 shares reported on the finish of March.

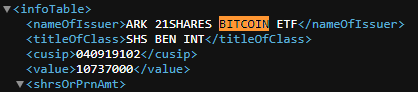

The place is valued at roughly $10.7 million, in comparison with roughly $4.1 million three months earlier. The rise comes as spot Bitcoin ETFs proceed to see inflows following their approval in January 2024.

The ARK 21Shares Bitcoin ETF is certainly one of a number of spot Bitcoin funds accredited by the SEC, permitting establishments to achieve publicity to Bitcoin with out straight holding the asset. These filings present a window into how public funds and institutional buyers are approaching Bitcoin throughout the framework of regulated monetary merchandise.

Michigan’s disclosure provides to a rising checklist of public establishments reporting Bitcoin associated investments by ETFs. Earlier this 12 months, the Wisconsin Funding Board reported positions in each the BlackRock and Grayscale Bitcoin ETFs. Comparable disclosures have been made by smaller establishments, however Michigan’s submitting is among the many bigger public pension entries.

As of at the moment, Bitcoin is buying and selling round $113,000 and is up roughly 21% year-to-date. The launch of spot ETFs has supplied establishments with a regulated solution to acquire publicity. Public filings like this one counsel that conventional buyers are starting to discover Bitcoin extra actively now that entry has grow to be extra standardized.