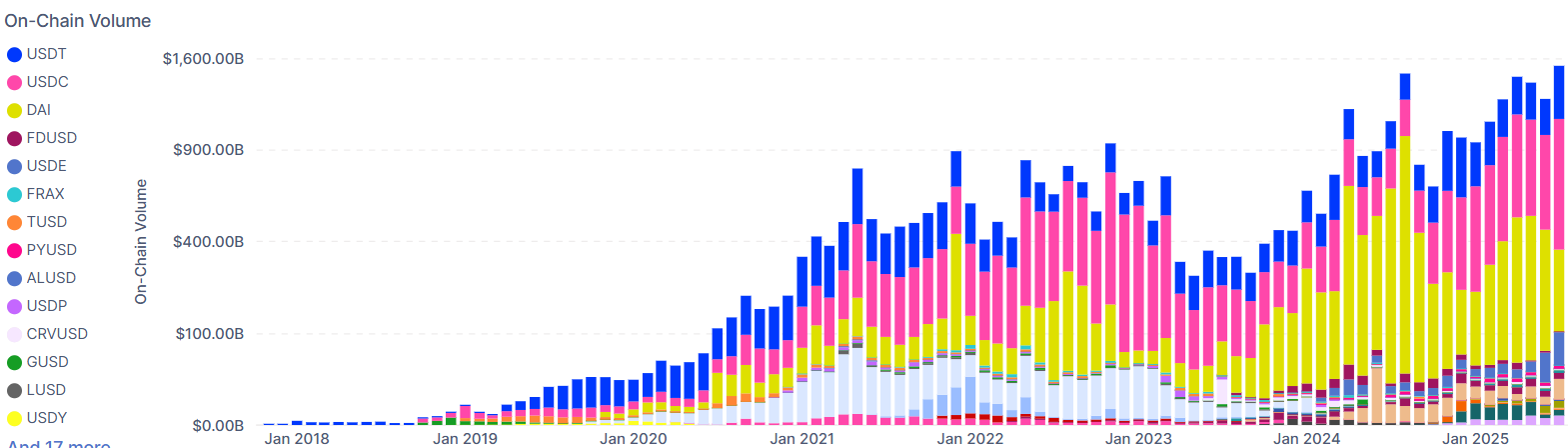

The stablecoin market has reached an unprecedented milestone, with month-to-month on-chain quantity surpassing $1.5 trillionfor the primary time in historical past, in response to new knowledge from blockchain analytics agency Sentora (previously IntoTheBlock).

Shared in a submit on August 5, the agency highlighted this record-breaking surge as a defining second for the digital asset sector—underscoring the increasing position of stablecoins in international crypto exercise.

The visible chart accompanying the replace confirmed an explosive rise in transaction quantity, led by USDT (Tether) and USDC (USD Coin), adopted by DAI, FDUSD, and rising stablecoins like PYUSD and GUSD.

USDT and USDC Dominate Exercise

As illustrated in Sentora’s quantity breakdown, USDT continues to guide, clearing over $1.6 trillion in cumulative on-chain transactions. USDC follows intently because the second-largest contributor, showcasing rising demand for each centralized and decentralized stablecoin choices.

Latest months additionally noticed noticeable will increase in utilization for stablecoins like FDUSD and DAI, indicating a broader diversification in person desire throughout ecosystems. Smaller gamers comparable to FRAX, TUSD, and PYUSD additionally registered modest however rising exercise, pointing to continued innovation and fragmentation throughout the area.

Driving Forces Behind the Surge

A number of macro and sector-specific elements seem like fueling this upswing:

- Regulatory readability in key markets just like the U.S. and Europe.

- The GENIUS Act, signed into legislation on July 19, established clear federal tips for stablecoins and digital asset-backed monetary merchandise. The laws consists of reserve necessities and Federal Reserve oversight, a framework prone to foster deeper institutional belief and long-term stability within the sector.

- Elevated adoption of stablecoins in cross-border funds, DeFi protocols, and remittance platforms.

The information additionally means that stablecoins are enjoying an even bigger position in enabling liquidity and settlement throughout Layer-1 blockchains, DeFi apps, and centralized exchanges.

The Rise of the “Stablecoin Summer time”

The historic quantity milestone has been dubbed a part of a broader pattern that Sentora refers to as #StablecoinSummer—a interval characterised by speedy capital inflows into stablecoin infrastructure and utilization. This comes as monetary establishments and fintech platforms more and more discover integrations with on-chain steady property.