Bitcoin (BTC) has reclaimed the $116,000 psychological stage, inching nearer to its July peak.

The restoration follows stories that US President Donald Trump is making ready to signal a sweeping govt order permitting crypto and different various belongings into 401(okay) retirement accounts.

Trump’s Impending Government Order Pushes Bitcoin Close to $117,000

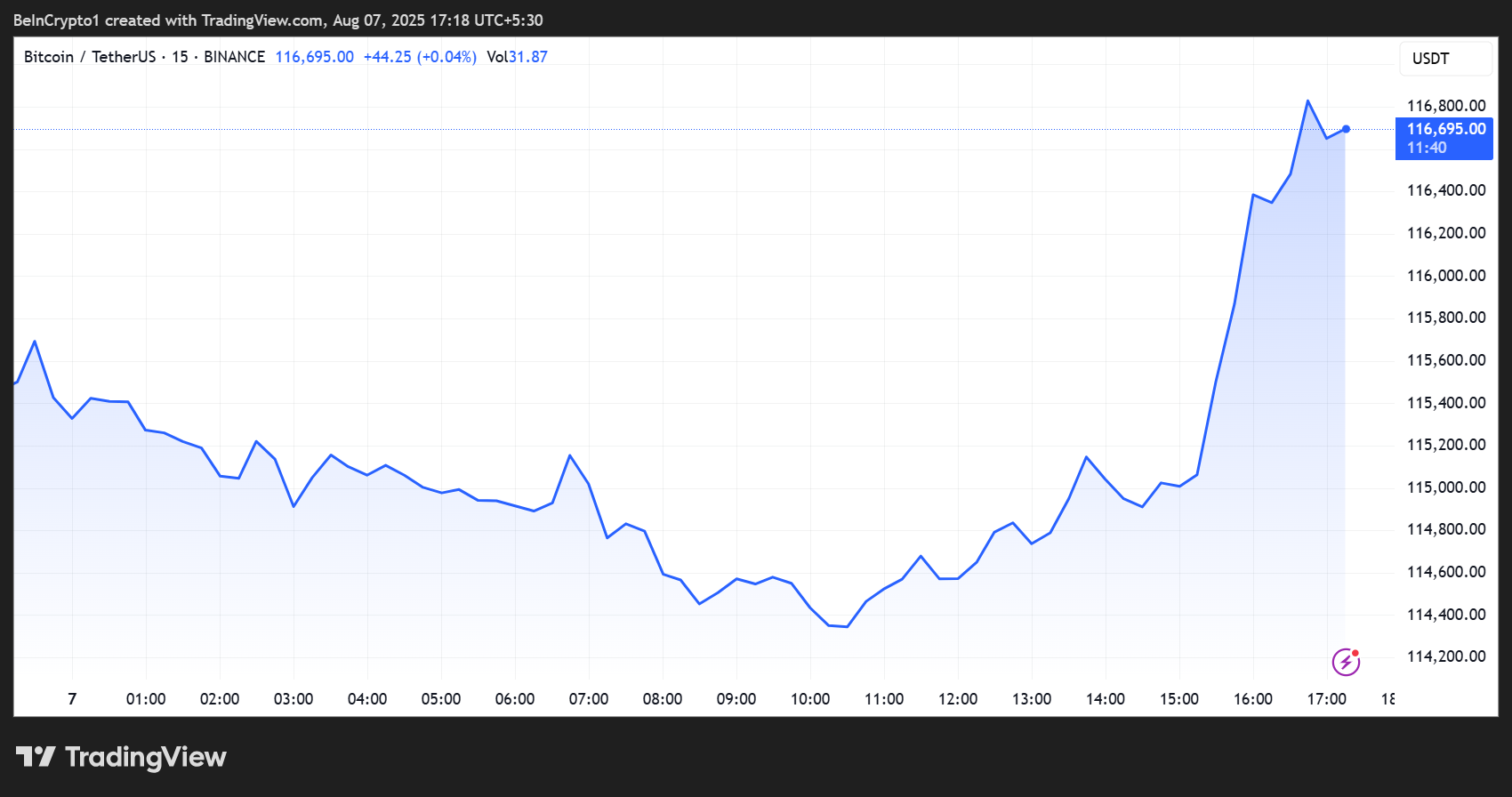

As of this writing, Bitcoin was buying and selling for $116,695, a big climb after opening the Thursday buying and selling session within the $114,000 vary.

The surge follows stories of an imminent govt order directing the Division of Labor to reassess steering beneath the Worker Retirement Revenue Safety Act of 1974 (ERISA).

Notably, the steering historically excluded various belongings like crypto, actual property, and personal fairness from most employee retirement plans.

Bloomberg stories that the order instructs the Labor Secretary to coordinate with the Treasury Division, the US SEC (Securities and Change Fee), and different regulators to discover rule modifications.

Amongst different causes, the purpose is to ease authorized hurdles for crypto inclusion in defined-contribution accounts.

“Insanely bullish for crypto!” mentioned crypto analyst Lark Davis on X.

Davis’ comment highlights the market’s response to what could also be a landmark shift in US retirement funding coverage. With practically $12.5 trillion held in 401(okay) accounts, the potential influx into Bitcoin and different digital belongings may very well be large.

Institutional buyers like pensions and endowments have lengthy tapped into non-public fairness and various markets. Nonetheless, the typical American saver has remained excluded till now.

This transfer mirrors Trump’s broader pro-crypto agenda in 2025. The possible order is predicted to repeal the Biden-era crypto warning for 401(okay)s.

However, permitting crypto into retirement accounts is not going to be with out challenges. Authorized consultants warning that 401(okay) plan directors might face lawsuits tied to volatility and excessive crypto or different illiquid asset charges.

Valuation difficulties, custody dangers, members’ restricted understanding, and steady modifications in regulatory oversight additionally stay a priority. Based mostly on this, fiduciary duties stay a core subject.

“At this early stage within the historical past of cryptocurrencies, the Division has severe issues concerning the prudence of a fiduciary’s choice to show a 401(okay) plan’s members to direct investments in cryptocurrencies, or different merchandise whose worth is tied to cryptocurrencies,” the division famous.

Bitcoin’s Position Expands in American Finance

Nonetheless, proponents argue that the trendy monetary system has developed. Public markets have shrunk significantly because the Nineteen Nineties, whereas non-public fairness has greater than doubled within the decade ending 2023.

As monetary innovation accelerates, Trump’s order could unlock new diversification choices for on a regular basis buyers. For crypto, the transfer might inject contemporary liquidity into the market, with this optimism already fueling Bitcoin’s restoration.

Past 401(okay) entry, Bitcoin is making quiet however vital progress in one other cornerstone of American finance, the housing market.

BeInCrypto reported a pilot initiative to supply Bitcoin-backed mortgages by a brand new American Housing Credit score facility.

This strategy permits crypto holders to make use of BTC as collateral to entry residence loans, probably bridging decentralized finance (DeFi) with conventional credit score markets.

Nonetheless, it’s not a clear sweep. Mortgage recognition of Bitcoin comes with regulatory strings connected, together with strict loan-to-value ratios, collateral liquidity checks, and heightened danger disclosures.

US regulators are additionally cautious of volatility and counterparty danger in crypto-collateralized residence lending, at the same time as they cautiously greenlight innovation.

The submit Bitcoin Nears $117,000 Forward of Trump’s Plan To Open 401(okay)s to Crypto appeared first on BeInCrypto.