Bitcoin is up 2% previously 24 hours, taking its market cap again above $2.3 trillion. Spot buying and selling volumes have additionally hit $56 billion – suggesting merchants’ danger urge for food is returning after Tuesday’s dip.

One analyst is monitoring an enormous “megaphone” sample on Bitcoin’s worth chart, and it’s pointing towards a wild upside goal: $260,000. If the sample performs out, we may see Bitcoin attain this goal earlier than the tip of the yr.

A transfer like that wouldn’t simply be a win for BTC – it might energize the entire Bitcoin ecosystem. That’s why sensible cash is already initiatives constructed on Bitcoin, particularly new ones just like the Layer-2 answer, Bitcoin Hyper.

What the Bullish Megaphone Sample Means for Bitcoin

The dialog kicked off when analyst Mister Crypto, with over 140,000 followers on X, identified the megaphone sample. He didn’t mince phrases, calling the chart “good” and signaling there’s a “large pump incoming.”

So, what’s the large take care of this sample? A bullish megaphone exhibits up when volatility is rising, with two trendlines fanning out as patrons and sellers battle for management. Throughout the sample, worth makes greater highs, then decrease lows.

However the important thing half right here is the breakout. Bitcoin already appears to have smashed by the highest resistance line of the megaphone on its every day chart. And proper now, we’re on the most crucial half: the retest.

Value is hovering simply above the higher trendline of the sample. If it bounces right here, confirming it as a brand new flooring, that $260,000 goal by 2026 all of the sudden appears very achievable. If Bitcoin does rally to $260,000, it might signify a 125% leap from in the present day’s worth.

A number of Market-Vast Catalysts Might Gas Bitcoin’s Subsequent Rally

But there’s extra to Bitcoin’s bullishness than simply this megaphone setup. The entire crypto market has some severe tailwinds proper now that might make circumstances ripe for a BTC rally.

For one, new cash is getting simpler entry to crypto. Beginning this month, UK retail buyers can lastly purchase crypto ETNs, which is a large deal. In the meantime, US regulators are clearing the best way for high-profile banks to supply crypto providers.

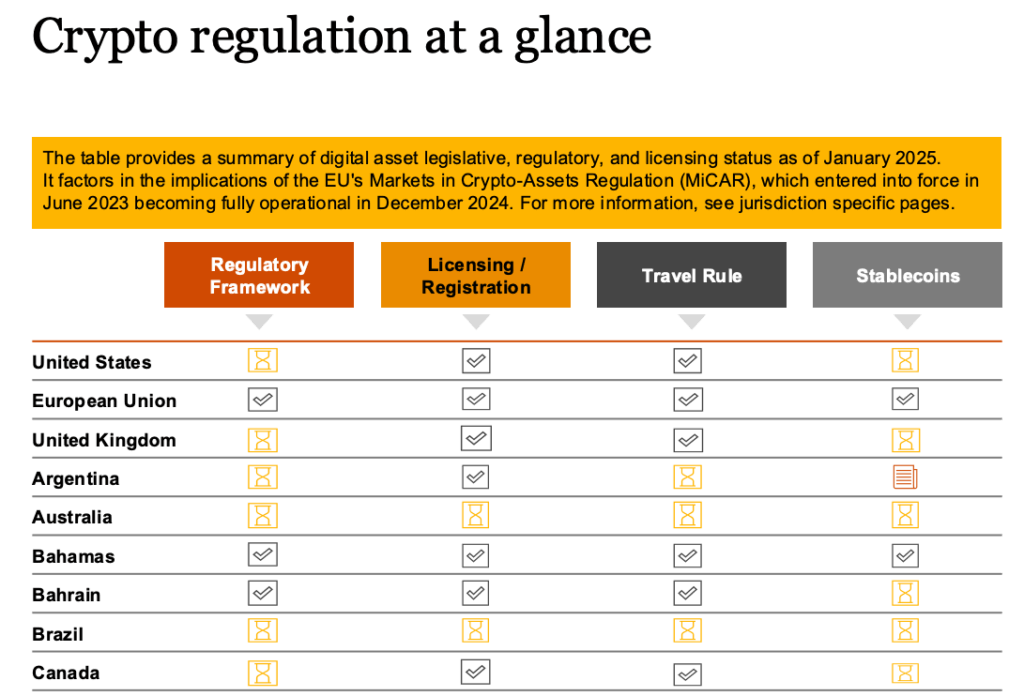

However crucial change is simply higher, clearer guidelines throughout the board. The US is taking a friendlier stance towards digital property, and main hubs just like the EU, UK, and Singapore are all rolling out stablecoin frameworks by the tip of the yr.

This readability eliminates the guesswork for giant establishments. They’ve been ready for this, and it’s the type of factor that might unlock main funding – which might doubtless enhance Bitcoin demand (and the coin’s worth).

How Bitcoin-Linked Initiatives Like Bitcoin Hyper Might Profit If BTC Rallies

When Bitcoin takes off, initiatives constructed on prime of it typically get a lift. That places the highlight on new Layer-2s like Bitcoin Hyper. The challenge is designed to sort out Bitcoin’s oldest issues head-on: the community congestion, excessive charges, and its incapability to deal with sensible contracts.

What makes Bitcoin Hyper completely different is its engine. It’s the primary to mix the Solana Digital Machine – bringing uncooked processing velocity – with the safety of ZK-rollups. This implies transactions are bundled and processed extremely quick off-chain, however are then anchored to the primary Bitcoin blockchain for final safety.

It’s the most effective of each worlds: Solana’s efficiency with Bitcoin’s trusted finality. The objective is to allow you to make use of your Bitcoin for DeFi, gaming, RWAs, meme cash, or NFTs, thereby making it a productive asset moderately than simply sitting in your crypto pockets. That’s why the consultants at 99Bitcoins assume it’s the “finest crypto to purchase” proper now.

This setup may unlock an enormous portion of Bitcoin’s multi-trillion-dollar market cap for the Web3 financial system. And merchants are pumped. Bitcoin Hyper’s presale has already raised over $7.4 million as buyers are drawn in by the potential purposes and excessive HYPER staking rewards of 145%.

If the Layer-2 narrative for Bitcoin will get as huge because it did for Ethereum – the place prime networks like Arbitrum hit multi-billion-dollar valuations – Bitcoin Hyper is in an amazing place. That makes it one of the thrilling infrastructure performs proper now.