Bitcoin is getting into a vital section after shedding the essential $115,000 help stage, with promoting stress mounting throughout key timeframes. The bullish momentum that beforehand fueled upside strikes has pale, and worth motion now indicators rising market weak spot. As investor sentiment shifts from cautious optimism to concern, fears of a deeper correction under $110,000 are gaining traction amongst analysts.

Associated Studying

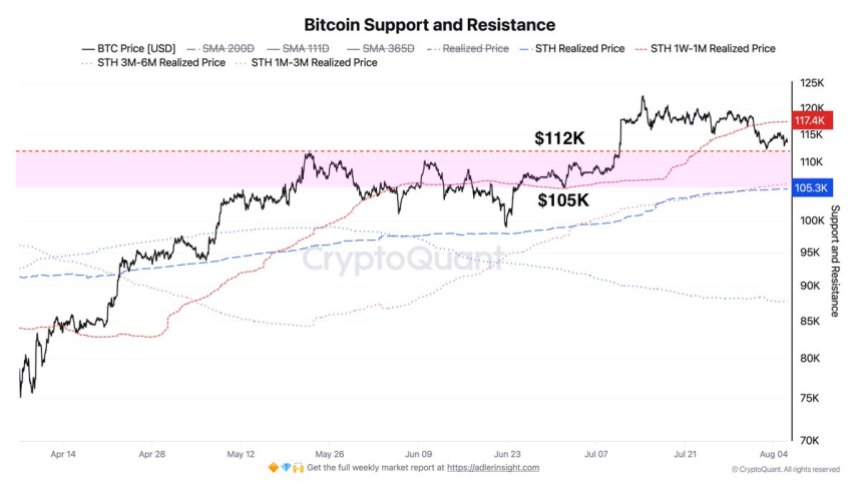

In line with CryptoQuant analyst Axel Adler, Bitcoin has established a short-term resistance stage at $112,000—a constructive signal that the market is making an attempt to stabilize. Nevertheless, Adler warns that the $112K–$105K zone stays structurally fragile, performing as a buffer that separates present worth ranges from extra aggressive draw back danger. If sellers push BTC under $105K, it might set off a cascade of lengthy liquidations and shake out short-term holders.

With macroeconomic uncertainty and declining ETF flows weighing on sentiment, Bitcoin’s path ahead relies on the way it reacts inside this vary. A restoration above $112K would sign resilience, whereas a breakdown might open the door to a broader market correction.

Quick-Time period Holder Danger Grows As Bitcoin Fails To Reclaim Momentum

In line with Adler, the present construction of the Bitcoin market reveals rising vulnerability, notably amongst short-term holders (STHs). Adler factors out that the 1-week to 1-month STH Realized Worth sits at $117,000, which means this complete cohort is now underwater. These traders, who are likely to react emotionally to short-term volatility, will be the first to panic-sell if any adverse catalysts emerge—probably triggering a cascade of sell-offs throughout the broader market.

Adler additional highlights the $105,000 stage as a vital help zone, based mostly on the aggregated STH Realized Worth. If Bitcoin drops into this vary, the stress to carry will intensify, however it might additionally act as a robust technical and psychological stage that might gradual and even reverse the downtrend.

“The market stays weak,” Adler reaffirmed, sustaining his bearish stance from the day prior. He emphasised that retail traders are failing to push the worth increased, and the shortage of sustained demand provides to the rising structural weak spot out there.

Compounding the stress is latest weak US jobs information, which has sparked contemporary hypothesis about potential rate of interest cuts from the Federal Reserve. Whereas this may very well be bullish for danger property in the long term, the present uncertainty is including stress to already fragile market sentiment.

Associated Studying

Bitcoin Makes an attempt Restoration Amid Resistance Cluster

The 4-hour chart for Bitcoin (BTC) reveals a key battle enjoying out under the $116K resistance zone. After briefly dipping under $113K earlier this week, BTC has rebounded and is now buying and selling round $115,478, approaching the 100 and 200 transferring averages—presently performing as overhead resistance at $116,596 and $115,799, respectively.

The worth can be making an attempt to interrupt again above the horizontal support-turned-resistance at $115,724, a stage that held throughout July’s consolidation vary. This cluster of resistance—fashioned by the SMAs and horizontal stage—poses a major short-term hurdle. A clear breakout above this zone with robust quantity might sign renewed bullish momentum and open the trail towards retesting the $122K vary excessive.

Associated Studying

Nevertheless, quantity stays comparatively low in comparison with the July breakout, and the failed makes an attempt to reclaim increased ranges recommend consumers are cautious. Until BTC can reclaim and consolidate above $116K, the rejection danger stays excessive, probably pushing the worth again into the decrease $112K–$113K help band.

Featured picture from Dall-E, chart from TradingView