XRP value is beneath strain as whales offload $1.9B in tokens. Analysts are warning of a 30% crash if the $2.65 assist fails to carry.

The value of XRP has been beneath intense strain these days, particularly because the assist stage at $2.65 faces a number of threats. This stage is now the one factor that stands between XRP’s continued restoration and a significant correction.

Briefly, analysts are warning of a attainable 30% drop if it fails.

The altcoin has already fallen almost 19% from its July 18 excessive of $3.65, and its latest bounce is probably not sufficient to maintain the uptrend alive.

XRP Value Below Stress at Key $2.65 Help

The $2.65 stage isn’t only a random quantity. It is among the most necessary markers for the value of XRP. Over the previous couple of months, this barrier has acted as resistance earlier than lastly flipping into assist in July.

Since then, XRP has examined this stage once more a number of instances.

$XRP replace

$2.80s was first space of curiosity and that has been sliced by way of

I’m looking ahead to a bounce to return in from right here right down to $2.65 (the place quarterly VWAP sits)

Something under that and the chart could be very broken. Both manner not what we wished to see for any likelihood of a… pic.twitter.com/Fe4my7ApYs

— Dom (@traderview2) August 2, 2025

In accordance with analyst Dom, $2.65 is consistent with the quarterly Quantity-Weighted Common Value (VWAP). For context, it is a essential indicator that merchants use to gauge whether or not an asset is buying and selling above or under its honest worth.

In essence, if XRP stays above this value, bulls nonetheless have an opportunity to push larger. But when it breaks under, the whole rally from Q2 could possibly be in danger, and a drop towards $2 will develop into very probably.

Whale Exercise Exhibits Weak spot

One other disturbing consider XRP’s battle is its whale distribution.

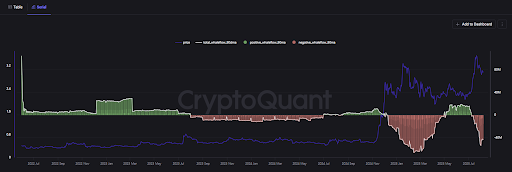

Since July 9, XRP whales have offloaded greater than 640 million XRP tokens, value over $1.9 billion at present costs, in keeping with CryptoQuant.

These aren’t remoted trades both. The 90-day shifting common of whale netflows is presently deeply destructive. This development confirms that there was a constant sample of promoting over a number of weeks.

That is the second time prior to now yr that whales have offered closely throughout a rally. Beforehand, they dumped XRP between November and January as the value rose from $1.65 to $3.27. This time, they’ve offered throughout the climb from $2.28 to $3.54.

Whereas not all whale outflows are confirmations of promoting, the sample is obvious and massive buyers are exiting.

Technical Indicators Again up the Bearish Outlook.

On the weekly chart, XRP’s value has shaped larger highs. Nonetheless, the Relative Energy Index (RSI) has accomplished the alternative. It has shaped decrease highs since January, confirming a bearish divergence, which is a basic sign that momentum is fading.

Quantity has additionally dropped throughout the newest push to new highs, which is one other signal that patrons could also be dropping energy. When value rises whereas quantity falls, it usually reveals an exhausted development.

If XRP can’t maintain $2.65, the following assist ranges are the 20-week EMA close to $2.55 and the 50-week EMA round $2.06. Each may act as security nets, however solely quickly.

A break under the 50-week EMA would mark a full pump retrace, bringing XRP again to the place its rally started.