Crypto costs have entered a section of heightened volatility since late July. The times of “up solely” seem like over, at the least for now, as bulls and bears battle it out at each key help and resistance degree.

Nevertheless, sensible cash traders and whales stay unfazed by the broader market uncertainty. To savvy merchants, the uneven value motion is much less a risk and extra a technique to capitalize on each upward and downward swings.

Knowledge from on-chain evaluation platforms reveal that whales are opening crypto futures trades, generally with 40 to 50x leverage – usually even 100x leverage – and tens of millions of {dollars} in margin. Many amongst them even have a powerful monitor file of navigating such volatility, with a beautiful all-time PnL to point out for it.

With the arrival of on-chain evaluation instruments, small-scale retail traders don’t want to remain on the sidelines attributable to a scarcity of market alpha. As a substitute, they will copy these whales and savvy merchants, with correct threat administration methods, and earn profitable returns as properly.

CoinFutures, a brand new in style beginner-friendly leverage buying and selling platform for crypto futures, additional ensures that new merchants don’t get slowed down by complicated interfaces, complicated buying and selling phrases, or prolonged onboarding processes.

As soon as customers see their favorite sensible cash dealer open a place, replicating it on CoinFutures is as straightforward as selecting a path, setting your leverage, and letting the markets do the remainder. Most significantly, customers may even transcend 100x leverage – as much as 1000x – to maximise their returns, offered they arrange correct threat administration instruments.

Copytrading Whales And Good Cash Merchants Utilizing On-Chain Knowledge

Because of the transparency of blockchains and several other cutting-edge on-chain information evaluation instruments, retail merchants don’t have to pay for ready-made copy buying and selling options.

Lookonchain’s X account is a gold mine in itself. It scours by way of hundreds of trades and posts probably the most notable ones, offering dependable alpha to retailers.

Take, as an illustration, its current submit on whale 0xCB92, highlighting how it’s a whale that may be trusted for copy buying and selling, contemplating it has precisely predicted Ethereum’s short-term value trajectory each time.

0xCB92 is presently bearish on Ethereum. It has opened a 15x brief place in ETH price over $213 million and presently holds an unrealized revenue of over $4.25 million.

Equally, Lookonchain posts about a number of the highest-risk, high-reward trades that whales place. On March tenth this 12 months, a smart-money dealer used 50x leverage to open a $53 million lengthy place in ETH, profiting over $2.1 million in lower than an hour.

Notably, this whale secured important earnings by executing a high-conviction commerce forward of Trump’s Bitcoin Strategic Reserve government order. In keeping with Lookonchain, the exact timing has led many to suspect the dealer could also be a political insider, making their strikes particularly price watching during times of political uncertainty.

In addition to Lookonchain, Arkham Intelligence’s web site and X account are additionally wonderful sources of buying and selling alpha for retailers seeking to copy commerce prime whales.

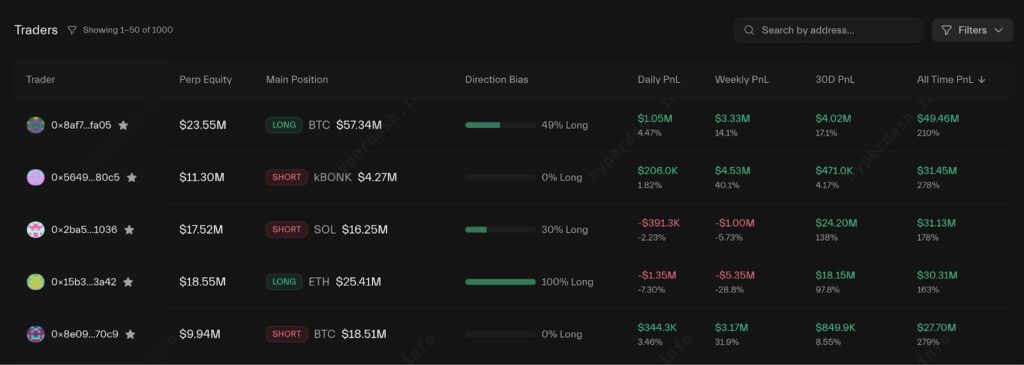

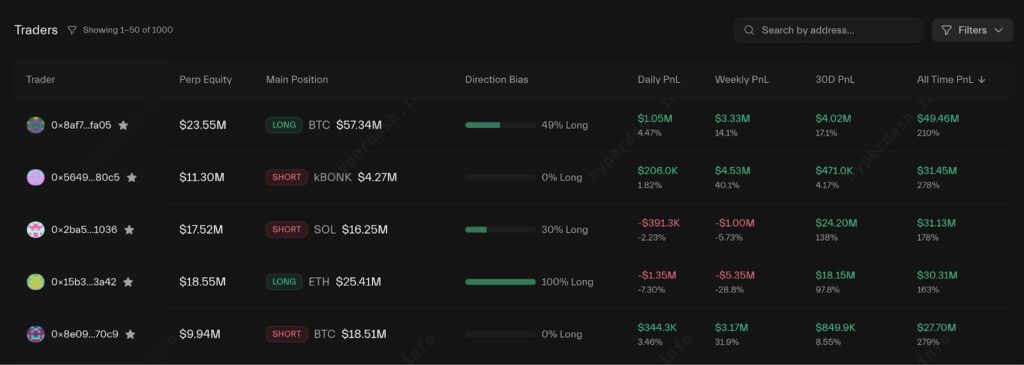

The viral new crypto alternate Hyperliquid has made its orderbook absolutely on-chain, which suggests it’s attainable to trace its prime merchants by way of platforms like HypurrScan and HyperDash.

As an illustration, HyperDash’s prime merchants part ranks accounts with the best all-time PnL and permits customers to verify their present trades. For a newbie the interface can seem difficult nevertheless.

How To Make 100x Leverage Crypto Trades On CoinFutures

CoinFutures has quickly turn into one of many prime decisions for crypto leverage merchants searching for high-conviction performs, particularly these which are new to it.

With as much as 1000x leverage crypto merchants can doubtlessly make outsized returns, and there’s alo no KYC requirement, prompt funding choices, and a easy “Up” or “Down” commerce interface. It strips away the complexity that deters many retail traders from exploring perpetual futures crypto trades.

In contrast to conventional exchanges that demand funding charges, have complicated order books, or prohibit merchants to 10x leverage, CoinFutures lets even small-bankroll merchants amplify positions with minimal complexity.

The platform additionally gives real-time bust value calculation, letting merchants clearly see the place a place could be liquidated. Add to this built-in stop-loss and take-profit settings, and CoinFutures delivers the type of threat administration instruments usually solely out there to institutional gamers, in a mobile-first, beginner-friendly format.

Right here’s tips on how to place a 100x leverage crypto commerce on CoinFutures and even larger:

Step 1: Monitor Good Cash

Begin by sourcing alpha from platforms like Lookonchain, Arkham Intelligence, or HyperDash. These monitor on-chain whale exercise, providing clues on when and the place giant gamers are getting into trades.

Step 2: Obtain the CoinPoker App

CoinFutures is hosted contained in the CoinPoker app, out there on Android and Home windows. Create an account utilizing simply an electronic mail and username; no paperwork or KYC wanted.

Step 3: Fund Your Pockets

Prime up utilizing crypto (BTC, ETH, USDT, SOL, and many others.) or fiat choices like Visa, Mastercard, Apple Pay, or PIX.

Step 4: Place the Commerce

Choose your asset. Then choose “Up” or “Down”, the path you consider the worth will transfer. Select 100x leverage, which means a $100 commerce controls a $5,000 place. CoinFutures calculates the bust value (liquidation degree) robotically, serving to handle threat.

Step 5: Set Take-Revenue and Cease-Loss

Earlier than confirming, enter a Take-Revenue degree (the place the commerce will auto-close with good points) and a Cease-Loss degree (to cap draw back). That is essential in fast-moving markets.

CoinFutures additionally tracks ROI in real-time, so customers can modify or exit positions primarily based on efficiency.