- A $58.6M XRP whale switch and 29.38M in trade outflows pushed the worth above $3.07, signaling robust accumulation.

- With $75M in brief positions stacked close to $3.10–$3.30, XRP is primed for a possible quick squeeze if resistance breaks.

- Holding above $3.00 is essential—falling under may flip the setup bearish, concentrating on help close to $2.72.

XRP’s again within the highlight. On August 5, a large 20M XRP switch—value about $58.6 million—was noticed shifting from Upbit to a mysterious pockets. The value instantly popped previous $3.07. Nothing confirmed but, however yeah… the market observed. Trade outflows additionally surged to 29.38M XRP in a single day, which often means one factor: of us are taking tokens off platforms, possible planning to carry. Long run vibes.

All of this, mixed with a stack of quick positions between $3.10 and $3.13, has merchants buzzing. We’re speaking $75.65M in shorts sitting proper round that vary—if value breaks cleanly, it may squeeze. Exhausting.

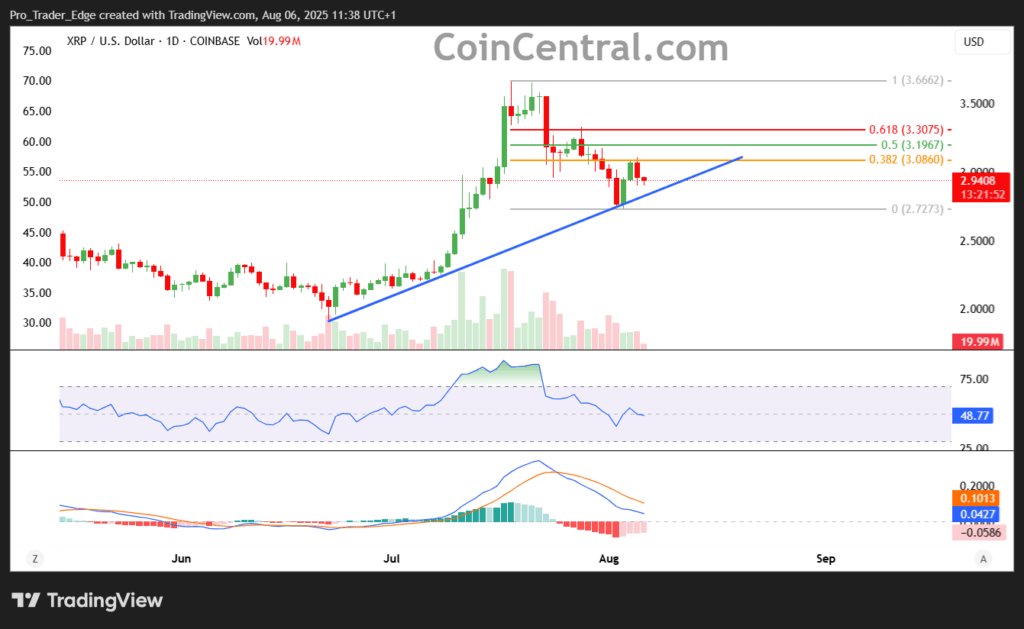

Technicals Flash Bullish—However $3.30 Nonetheless the Key

Chart watchers say XRP simply busted out of a falling wedge sample—a setup that usually flips bullish as soon as damaged. And positive sufficient, a 4H Supertrend indicator confirmed that transfer. Worth pulled again barely however stayed above the wedge breakout zone close to $3.00. If it holds there, we may see a ten% rip towards $3.30.

That $3.30 goal traces up with Fib retracement ranges and, curiously, matches the quick liquidation wall. Which implies? If XRP climbs into that zone, there’s a good likelihood of shorts getting worn out, creating much more upside strain.

Whale Conduct Is Getting… Quieter?

One thing’s shifted these days. In previous rallies, whales dumped aggressively as XRP neared resistance. However this time? Not a lot. On July 30 and August 3, there have been spikes in whale inflows when value dipped. However by August 4, these inflows dropped—though XRP stayed above $3.00. That’s a touch some massive gamers could be easing off the promote button.

Based on Bitget’s liquidation heatmap, the imbalance is apparent: $1.6B in shorts vs simply $784M in longs. That’s a lopsided setup, and if momentum flips bullish once more, we may see a squeeze that nukes a piece of these quick positions quick.

Holding $3.00 Is Every little thing Proper Now

On the time of writing, XRP is buying and selling round $3.06—up simply 0.79% in 24 hours. Quantity’s flat, which reveals indecision. However zoom out a bit and also you’ll see XRP’s nonetheless up 35% this month, regardless of taking a 5.3% hit over the previous week. We’re at a crossroads.

August tends to be a unstable month for XRP traditionally. Trade inflows are ticking up once more, similar to they did again on July 11—proper earlier than costs surged previous $3.60 (then dumped later). It’s attainable we’re in for a repeat. A clear break previous $3.45 would wipe out most remaining shorts and make sure the bullish thesis. But when $3.00 fails? All bets are off—we may revisit $2.72 help