In an fascinating flip of occasions, Federal Reserve Governor and distinguished stablecoins advocate Chris Waller has emerged because the frontrunner to turn into the following Fed Chairman. This growth comes amid a financial coverage battle between US President Donald Trump and present Fed Chairman Jerome Powell.

Trump’s Fed Chair Candidate?

Over the previous few months, Trump has publicly criticized Powell over the Fed Chair’s choice to take care of the market rate of interest within the vary of 4.25% – 4.50%. Notably, the pinnacle of the US apex financial institution has constantly rejected calls to decrease this charge, fearing sporadic inflation, regardless of potential advantages resembling stimulating financial development because of decrease borrowing charges.

This coverage stalemate between the White Home and the Federal Reserve has resulted in statements by Trump through which the Republican has both pressured Fed Chair Powell to step down or hinted at firing the previous funding banker. Nevertheless, amid the sturdy chance of Jerome Powell seeing out his tenure, which ends in Could 2026, there have been speculations on the following Fed chief.

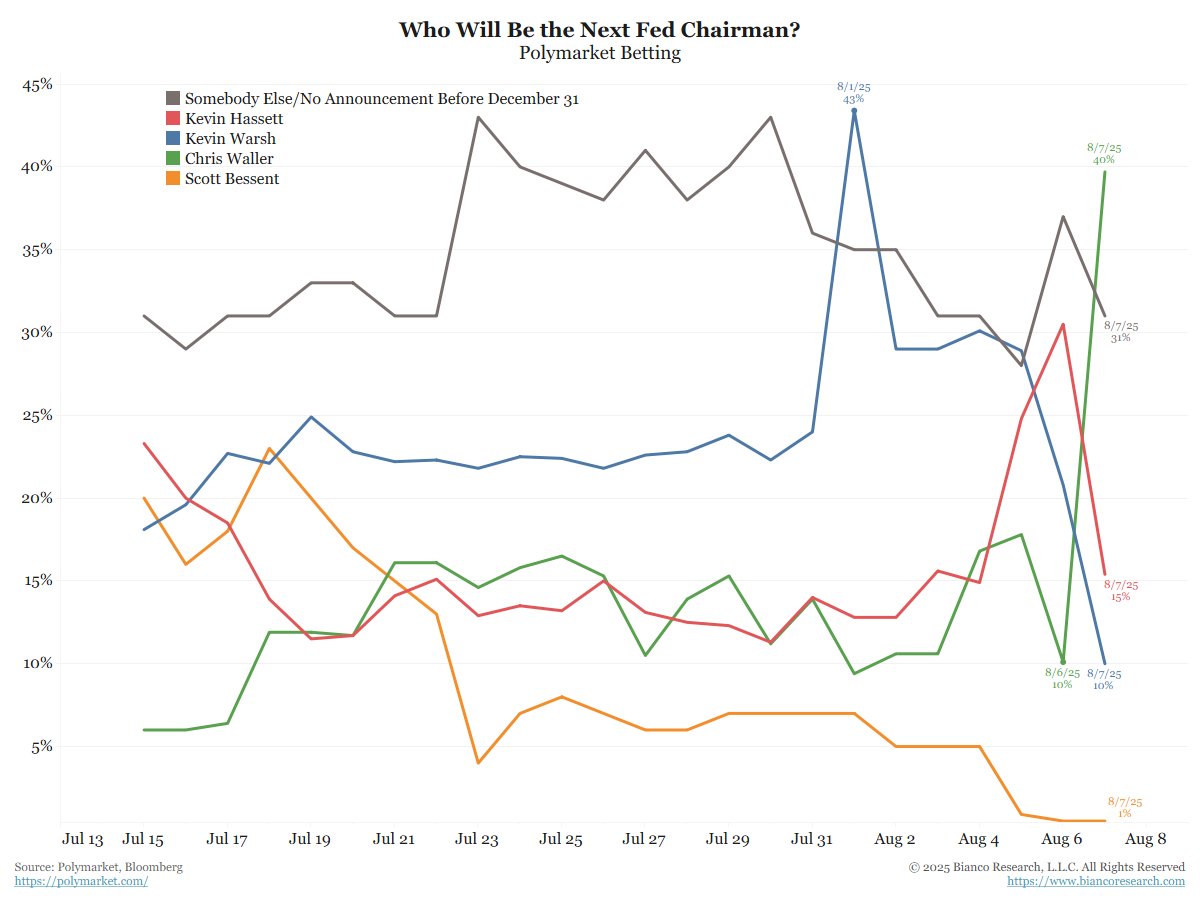

In a latest publish on X, in style analyst Jim Bianco highlighted Polymarket knowledge exhibiting rising market backing for Chris Waller to turn into the following Fed Chairman. Waller, who was nominated to the Federal Reserve Board of Governors in 2020, is reportedly the favorite amongst Trump’s group to take cost of the apex financial institution after Powell’s tenure expires.

In keeping with Bloomberg, Waller voted for an rate of interest lower within the final Federal Open Market Committee (FOMC) assembly alongside Fed Vice Chair Michelle Bowman, albeit leading to a 9-2 defeat in opposition to opposing votes by Powell and different board governors. Due to this fact, Waller might affect the FOMC as Fed Chairman in assist of Trump’s name for a charge lower if “promoted” in Could 2026.

Notably, Waller has additionally beforehand voiced assist for stablecoins, lauding the potential advantages of those dollar-pegged cryptocurrencies to the US monetary system. In July, He acknowledged that stablecoins might stimulate competitors within the funds business whereas boosting the demand for the US greenback typically.

Crypto Market Overview

On the time of writing, the entire crypto market cap is valued at $3.87 trillion following a 1.27% achieve up to now 24 hours. In the meantime, normal market buying and selling quantity is now valued at $174.14 billion.

Notably, an rate of interest lower could be extremely helpful to the digital asset market, because it frees up capital for funding in riskier property. If this materializes, mixed with different pro-crypto initiatives from the Trump administration, it might sign promising occasions forward.

Featured picture from Pexels, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.