- Technique’s 3,000% five-year achieve has outpaced Bitcoin’s 870%, powered nearly fully by BTC accumulation.

- It now holds almost 629K Bitcoins, far forward of opponents, however trades at excessive valuation multiples disconnected from fundamentals.

- The inventory is a high-risk, high-reward proxy for Bitcoin, greatest fitted to traders with robust conviction and tolerance for volatility.

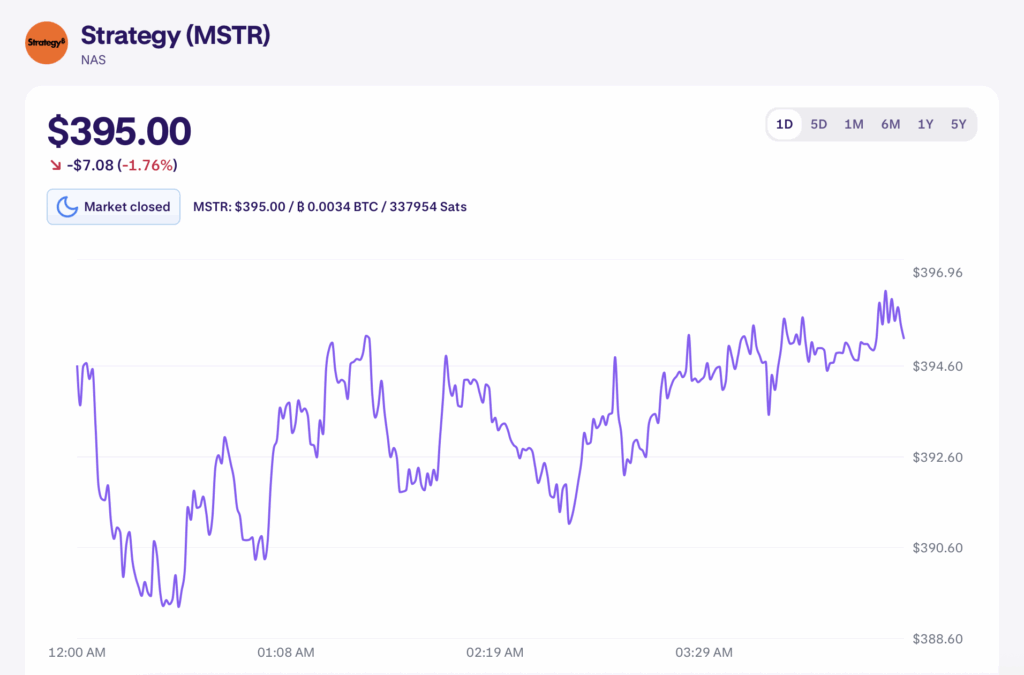

Over the previous 5 years, Bitcoin has delivered an 870% return — a jaw-dropping achieve in comparison with the S&P 500’s 91%. Spectacular as that’s, Technique (previously MicroStrategy) has crushed each, surging greater than 3,000% in the identical interval. The corporate hasn’t executed it by reinventing its enterprise or changing into a tech big in AI; as an alternative, it’s merely been shopping for Bitcoin and holding it. This singular focus has turned its inventory right into a magnet for retail traders, nevertheless it additionally raises the query: after such large positive aspects, is it nonetheless a sensible purchase or a ticking time bomb?

Extra Corporations Copy the Playbook

Technique’s method hasn’t gone unnoticed. Different companies are leaping in, utilizing Bitcoin holdings as a technique to appeal to market consideration. Trump Media and Know-how Group lately introduced a $2 billion Bitcoin buy, immediately changing into the fifth-largest company BTC holder. In the meantime, firms like Block and Tesla have additionally collected important stacks. But, Technique stays in a league of its personal — holding almost 629,000 Bitcoins as of Aug. 4, far forward of runner-up Mara Holdings with 50,000. Whereas this dominance fuels pleasure, the novelty might fade if different firms begin stacking at an identical scale.

Valuation Disconnect and Speculative Dangers

With a market cap round $110 billion, Technique now sits amongst Nasdaq 100 heavyweights. However its fundamentals inform a really totally different story. The inventory trades at over 200x income, and its ahead P/E exceeds 1,200 — metrics that scream speculative. In Q2, the corporate posted $10B in web revenue on simply $115M in income, pushed by unrealized Bitcoin positive aspects moderately than operational efficiency. Such excessive valuation tied to a risky asset makes for a dangerous experience, particularly if Bitcoin’s momentum stalls.

Ought to Buyers Nonetheless Chunk?

If Bitcoin retains climbing and Technique holds its place, extra upside is feasible. However with no stable enterprise fundamentals anchoring its worth, the inventory is basically a leveraged wager on BTC’s future. For die-hard crypto believers, that is perhaps superb. For many traders, although, it’s a high-volatility gamble that might swing wildly in both path. And not using a robust abdomen for sharp drawdowns, sitting this one out is perhaps the wiser transfer.