Analysts are more and more calling for the beginning of altseason as Ethereum posts large features and a wave of altcoins surges throughout the market. Over the previous days, bullish momentum has pushed many digital property increased, with value constructions displaying clear indicators of power. For a lot of merchants, that is the second they’ve been ready for—the long-anticipated shift the place altcoins outperform Bitcoin and ship outsized returns.

Associated Studying

Ethereum’s latest breakout above key resistance ranges has added gasoline to the narrative, with large-cap and mid-cap altcoins following in its footsteps. The market’s renewed optimism has sparked hypothesis that the altseason cycle, the place capital rotates from Bitcoin into the broader altcoin market, could already be underway.

Nevertheless, not all consultants are satisfied. Some level to Bitcoin’s continued dominance and the truth that most altcoins stay nicely under their all-time highs as causes for warning. Historic altseasons have usually seen aggressive outperformance throughout the board, one thing the market has but to completely verify.

Altseason Nonetheless Ready For Its True Breakout

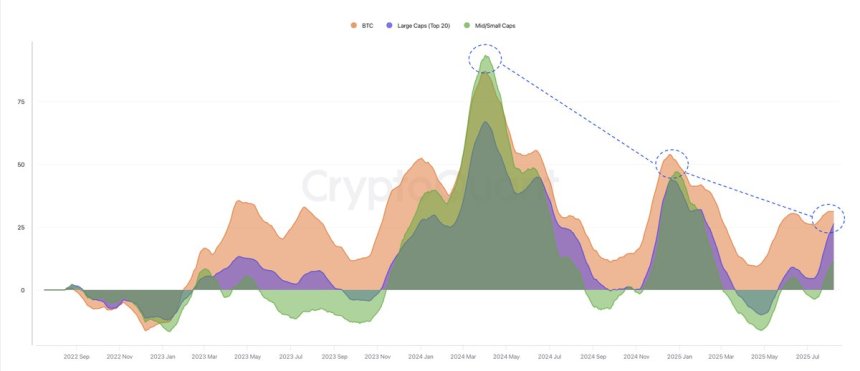

In response to high analyst Darkfost, the much-anticipated altseason hasn’t actually begun. By analyzing a comparative chart of Bitcoin, giant caps (high 20), and mid/small caps, Darkfost notes that the present cycle is displaying the weakest altcoin efficiency to date. Whereas altcoins have made notable strikes in latest weeks, their features nonetheless pale compared to Bitcoin’s dominant run.

The final occasion that resembled a real altseason occurred in early 2024, when altcoins—notably mid- and small-cap tasks—outpaced Bitcoin over a brief however intense interval. That surge marked a transparent capital rotation away from BTC into the broader market, delivering outsized returns for altcoin holders. Nevertheless, the current market circumstances counsel that type of broad-based outperformance has but to materialize.

Regardless that Ethereum has damaged above multi-year highs and several other altcoins are posting spectacular features, the rally seems selective somewhat than widespread. Massive caps are recovering steadily, however mid- and small-cap cash—usually the hallmark of an explosive altseason—are nonetheless lagging. This disparity means that institutional and retail capital stays concentrated in additional established property.

For a confirmed altseason, analysts can be expecting a sustained breakout in mid- and small-cap efficiency relative to BTC. Till that shift happens, the present market could also be higher described as a robust altcoin rally inside Bitcoin’s dominant section somewhat than the beginning of a full-scale altseason.

Associated Studying

Altcoin Market Nears Key Resistance

The Whole Crypto Market Cap excluding Bitcoin (TOTAL2) is displaying robust bullish momentum, at the moment sitting at $1.57 trillion after a pointy 13.21% weekly surge. This rally brings the market near retesting its 2025 highs across the $1.6 trillion degree, a important resistance zone that has capped altcoin features in earlier makes an attempt.

The chart reveals that the market has been in a sustained uptrend since early 2024, with value motion persistently holding above the 50-week shifting common (blue line) and sustaining bullish construction. Each the 100-week (inexperienced) and 200-week (crimson) shifting averages are trending increased, reinforcing long-term assist and signaling wholesome market circumstances.

Associated Studying

If the breakout happens, TOTAL2 might goal the earlier all-time excessive zone close to $1.75–$1.8 trillion, marking a possible acceleration in capital rotation from Bitcoin into altcoins. Conversely, failure to clear this resistance might result in a short-term pullback towards $1.4 trillion assist, which aligns with the 50-week MA. The approaching weeks can be essential for figuring out whether or not altseason actually ignites.

Featured picture from Dall-E, chart from TradingView