The cryptocurrency business has been about hitting new milestones in 2025, with the futures-based Solana and XRP ETFs (exchange-traded funds) among the many newest to achieve new achievements. In response to the newest market information, the SOL and XRP ETFs have reached $1 billion in whole capital inflows since their launch earlier. This feat comes on the again of rumors that the world’s largest asset supervisor, BlackRock, may look to launch a spot XRP-based exchange-traded fund.

SOL & XRP Futures ETFs Hit New Milestone

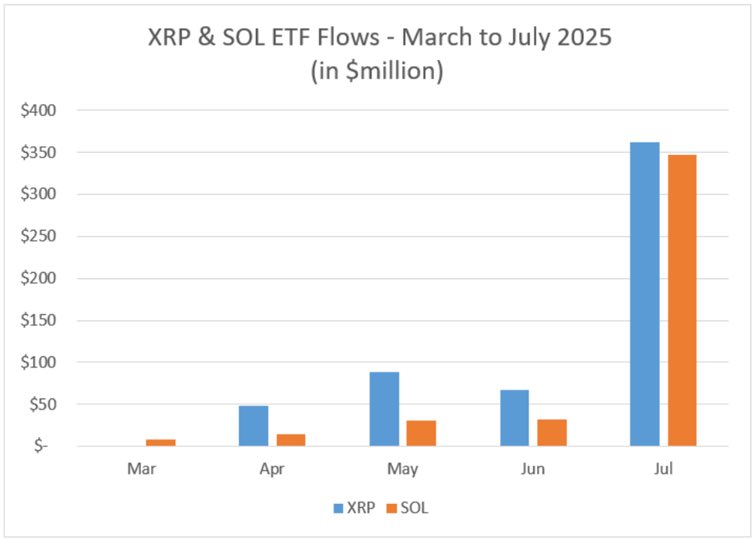

In an August 9 submit on the X platform, the president of The ETF Retailer, Nate Geraci, revealed that the futures-based Solana and XRP ETFs have attracted over $1 billion in capital since launch. These crypto-linked funding merchandise began buying and selling in the USA about 5 months in the past—round March (for SOL ETF) and April (for XRP).

For context, futures-based exchange-traded funds are a kind of funding product that holds the futures contracts of an asset. A futures contract is a monetary instrument that enables an investor to purchase an asset at a predetermined value on a predetermined date.

In March 2025, Volatility Shares launched the first-ever Solana exchange-traded funds in the USA. The agency rolled out two merchandise on the time: Volatility Shares’ Solana fund, which replicates the efficiency of Solana futures, and the 2x SOL ETF that gives double-leveraged publicity.

Whereas Teucrium launched the primary US-based XRP ETF (a 2x leveraged fund) in April, Volatility Shares supplied the primary non-leveraged futures-based XRP exchange-traded fund in Could. As proven within the chart under, each the SOL and XRP ETFs had posted solely modest month-to-month performances up till July—the place they every posted roughly $350 million in capital inflows.

Supply: @NateGeraci on X

Geraci famous that these figures embody REX-Osprey’s Solana staking exchange-traded fund, which boasts as much as $150 million in belongings underneath administration. In response to the ETF knowledgeable, this efficiency proves that there can be demand for spot SOL and XRP ETFs.

Skilled Doubles Down On BlackRock’s Utility For SOL And XRP ETFs

It’s price mentioning {that a} slew of purposes from varied asset managers are awaiting approval from the USA Securities and Alternate Fee (SEC) to launch Solana and XRP ETFs. As reported by Bitcoinist, BlackRock has indicated that it presently has no plans to affix the race for spot Solana and XRP ETFs.

In a second submit on X, Geraci reiterated his perception that BlackRock could be trying to develop its crypto ETF portfolio. “And I’m being instructed BlackRock doesn’t desire a piece of this?” the ETF knowledgeable stated, referring to the eye being loved by the future-based model of the XRP exchange-traded fund.

The value of XRP on the day by day timeframe | Supply: XRPUSDT chart on TradingView

Featured picture from Pexels, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.