Bitcoin’s worth has steadily risen, climbing roughly 4% over the previous seven days. This development displays enhancing market sentiment and rising optimism amongst buyers.

As momentum builds, key on-chain indicators sign the opportunity of a sustained rally within the coming buying and selling periods.

Bitcoin Miners Maintain Tight

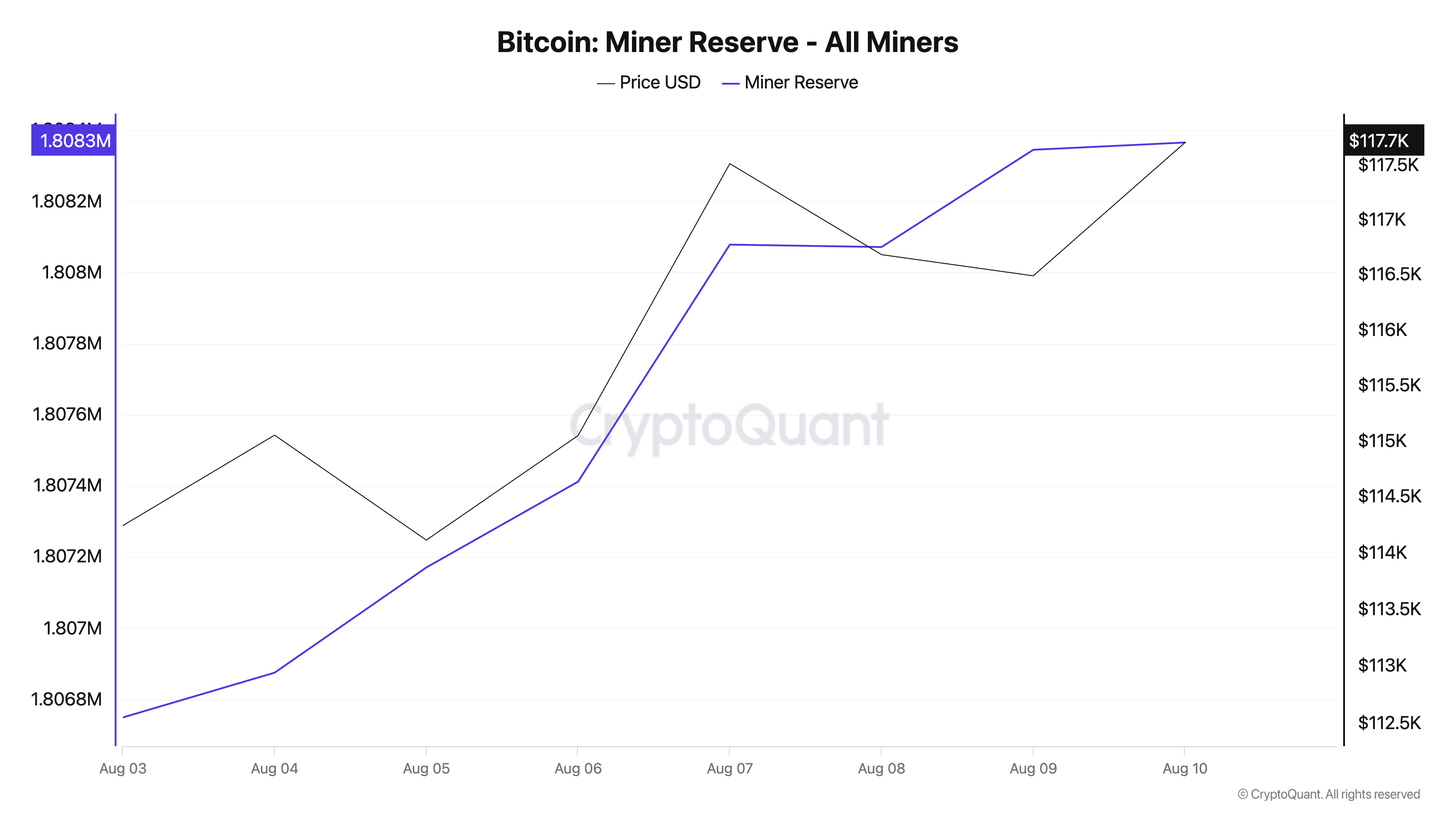

Bitcoin miners have resumed accumulation, with the coin’s miner reserve reaching a weekly excessive of 1.8 million BTC.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

The Bitcoin miner reserve tracks the variety of cash held in miners’ wallets. It represents the coin reserves miners have but to promote. When it declines, miners are shifting cash out of their wallets, often to promote, confirming rising bearish sentiment towards BTC.

Converesly, when it climbs, miners are holding onto extra of their mined cash, which often displays confidence in future worth appreciation and a bullish outlook.

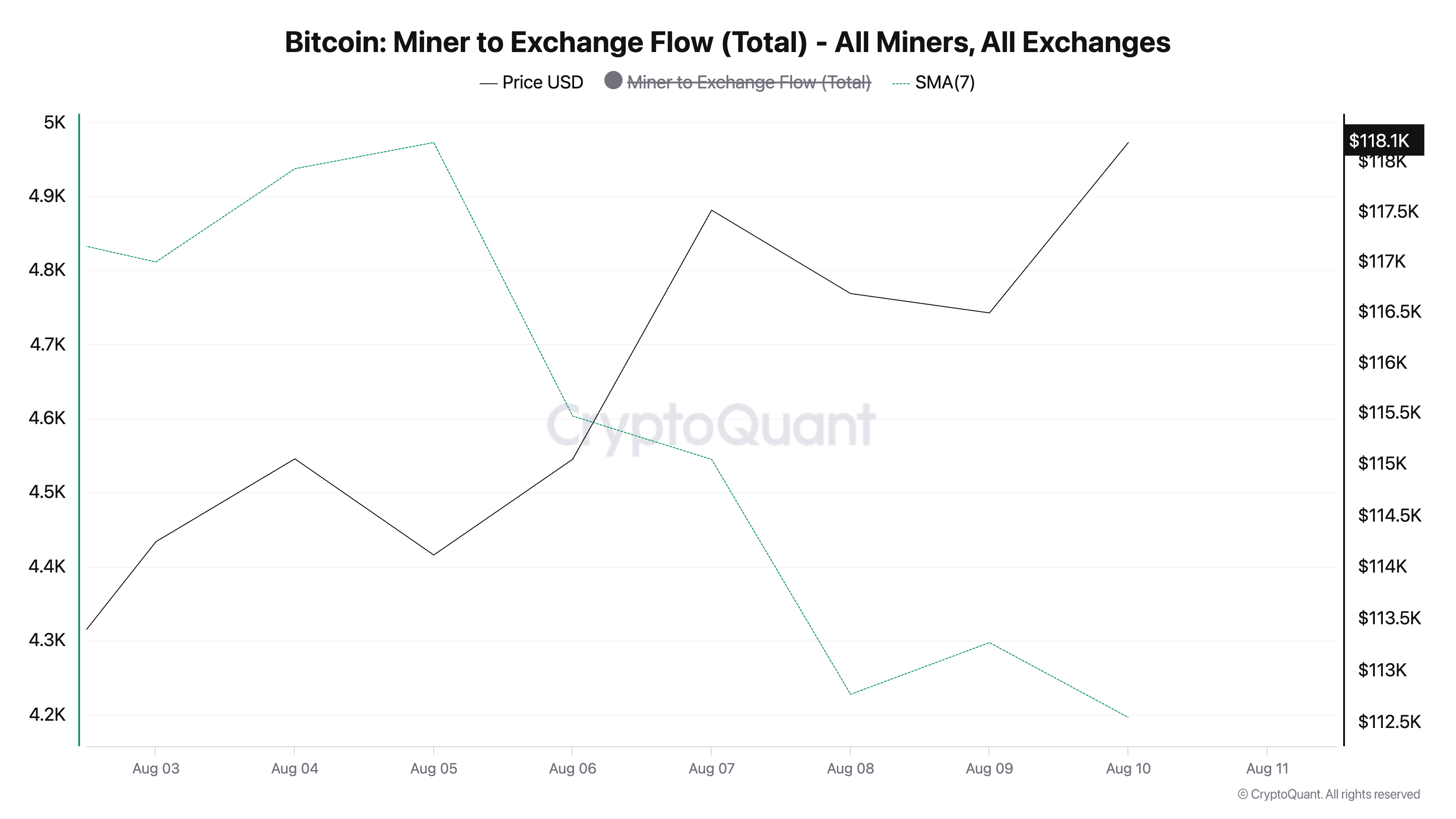

Moreover, the decline in BTC’s Miner-to-Alternate Circulation highlights the buildup development amongst miners on the community over the previous seven days.

In line with CryptoQuant, this metric, which measures the overall quantity of cash despatched from miner wallets to exchanges, has plunged by 10% throughout that interval.

When BTC’s Miner-to-Alternate Circulation falls, miners maintain again from promoting and preserve their cash off exchanges. This lowered promoting stress alerts rising confidence in BTC’s worth and may help strengthen its rally.

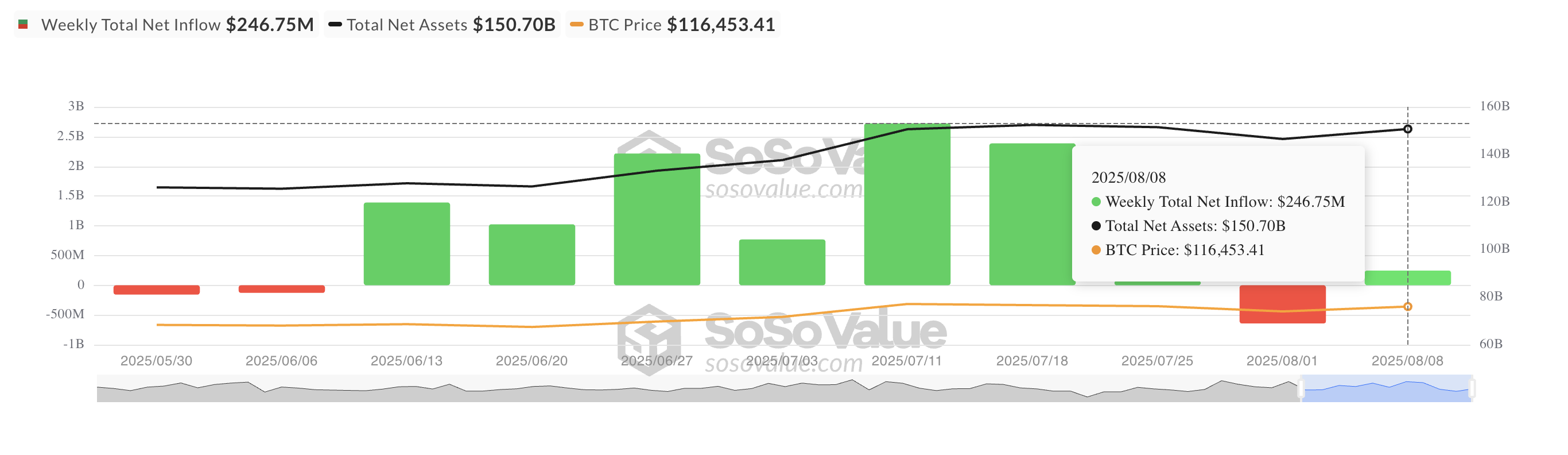

Furthermore, final week, weekly inflows into spot Bitcoin ETFs turned constructive, reversing the detrimental outflows recorded within the earlier week. Per SosoValue, between August 4 and eight, capital influx into these funds totaled $247 million.

This shift alerts renewed institutional shopping for curiosity and a change in market bias towards BTC. Institutional buyers stay assured that the coin will lengthen its good points and are rising their direct publicity by ETFs.

Can BTC Push Previous $118,851 to $120,000?

This mix of renewed institutional demand and miner confidence strengthens the case for BTC’s near-term return to above $120,000. Nevertheless, for this to occur, the king coin should first break above the resistance at $118,851.

However, if accumulation stalls, the coin might resume its decline and fall towards $115,892.

The put up How Bitcoin Miners May Drive a New All-Time Excessive For BTC appeared first on BeInCrypto.