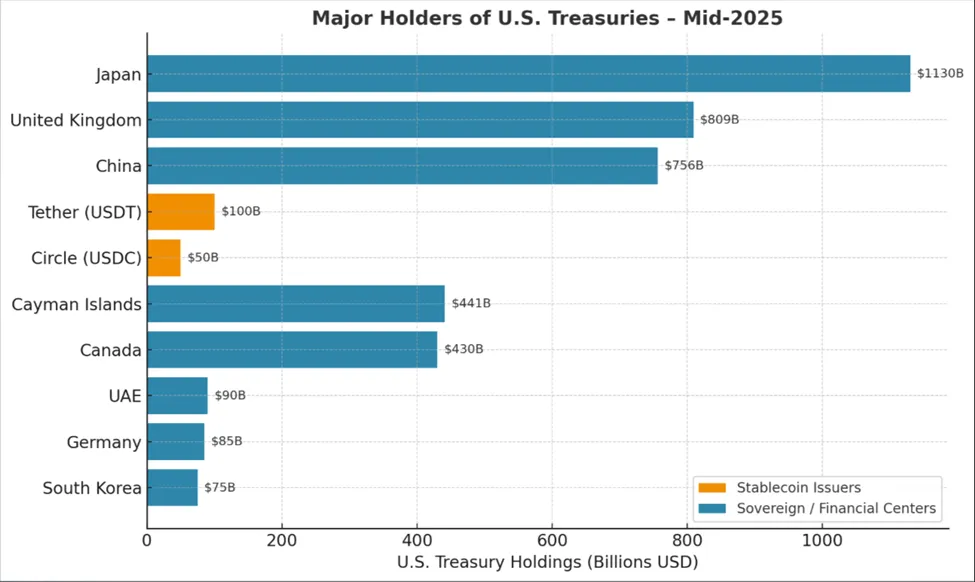

As soon as a distinct segment instrument for crypto merchants, stablecoins have developed into heavyweight gamers in world finance – now holding extra U.S. Treasury debt than international locations like Germany, South Korea, and the UAE.

Information reveals that Tether (USDT) and Circle (USDC) collectively handle over $150 billion in Treasury payments, with Tether alone rating because the world’s 18th-largest holder. This surge follows the GENIUS Act, which granted regulatory readability to dollar-backed stablecoins and unlocked institutional adoption for funds and settlements.

Their attraction lies in velocity and price. Pegged 1:1 to the U.S. greenback, stablecoins allow immediate, low-fee transfers throughout borders, rivaling – and in some circumstances surpassing – the throughput of conventional networks like Visa. USDC’s market cap has soared almost 90% previously yr to $65 billion, reflecting surging demand.

The shift comes as main U.S. debt consumers like China and Japan scale back holdings, leaving room for brand spanking new, unconventional consumers. Advocates see stablecoin issuers as dependable, long-term purchasers that may bolster the greenback’s world dominance. Skeptics, nevertheless, warning that such reliance on a still-young sector may amplify market dangers if confidence falters.

From buying and selling flooring to company treasuries, what started as a crypto comfort is now influencing U.S. bond market dynamics – an indication that stablecoins’ function in mainstream finance is not a query, however an inevitability.

Supply