- Solana surged 18% in underneath every week, reclaiming $180, however buying and selling quantity dipped 10% as some merchants locked in income.

- On-chain knowledge reveals $15.18M in change inflows and robust bullish dominance, with $184 because the vital resistance to interrupt.

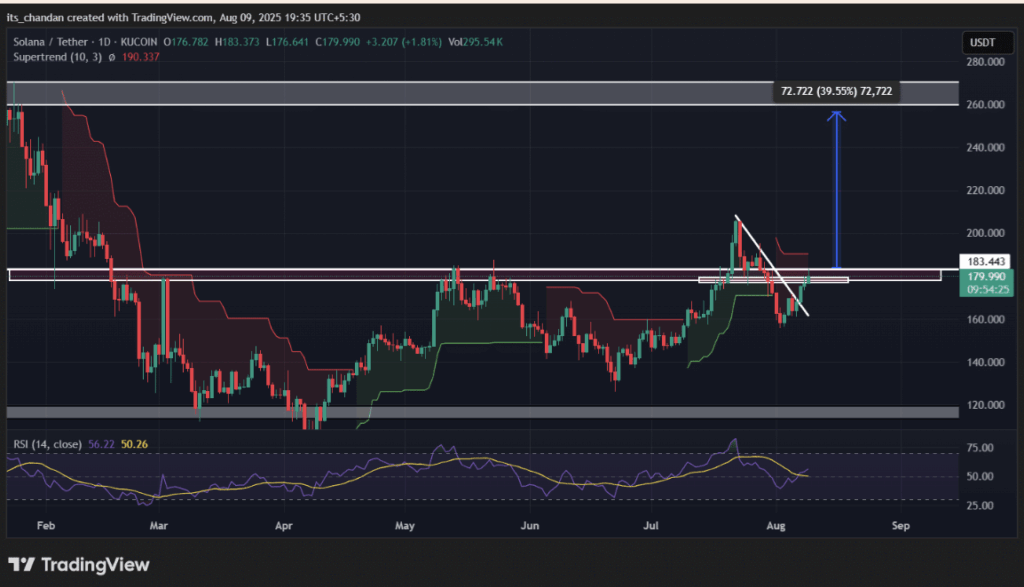

- A every day shut above $185 might open the trail towards $256, although sellers stay lively with the Supertrend nonetheless signaling a downtrend.

Solana’s had fairly the week—leaping 18% in underneath seven days and reclaiming that $180 territory merchants had been eyeing for some time. On August ninth, it ticked up one other 3% in simply 24 hours, hitting round $181, marking three straight days of inexperienced. Naturally, the transfer has fueled discuss of extra upside, but in addition triggered some profit-taking from those that don’t wish to push their luck.

Apparently although, buying and selling quantity didn’t comply with the identical trajectory. CoinMarketCap knowledge reveals a ten% drop in 24-hour quantity regardless of the value rally. That dip hints that some merchants are sitting out till the following clear transfer—probably cautious after previous volatility, or simply cashing in on short-term features earlier than the following take a look at.

Combined On-Chain Alerts Counsel a Tug of Warfare

CoinGlass knowledge recorded $15.18 million flowing into exchanges on August ninth. That form of influx, particularly throughout a rally, generally is a warning signal that holders are on the brink of promote into power. On the flip aspect, liquidation maps present a $174 assist stage holding sturdy and a transparent resistance ceiling sitting just below $184.

Lengthy positions closely outweigh shorts proper now—$436.74 million versus simply $23.79 million—indicating bullish dominance. Nonetheless, that $184 mark is rising as the true make-or-break level for whether or not this run retains climbing or stalls out.

The Technical Image: Key Ranges in Sight

From a chart perspective, Solana’s breakout above its descending trendline is what actually kicked this rally into gear, and it’s been driving broader market optimism ever since. The RSI is sitting round 57, comfortably beneath overbought territory, so there’s nonetheless room to run. However right here’s the catch—closing above $185 is important for any real looking shot at that $256 goal (a couple of 40% upside from right here).

The Supertrend line at $190.33 continues to be in a downtrend mode, which implies sellers haven’t left the constructing simply but. If momentum fades earlier than breaking by way of $185, we might see a pullback or sideways drift earlier than one other actual try.