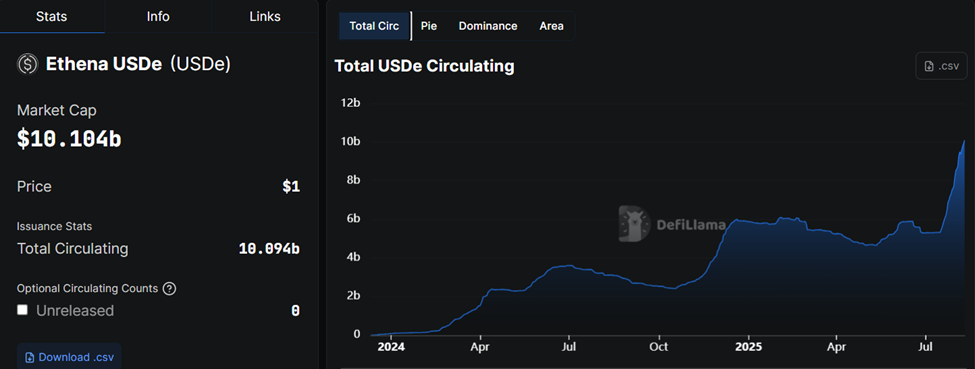

Ethena’s artificial greenback, USDe, has hit a $10 billion market cap in simply 500 days. The transfer cements its place as one of many fastest-growing stablecoins in crypto historical past.

Nonetheless, there stays skepticism about USDe, with some analysts suggesting it could be the UST of this cycle.

Ethena and USDe Stablecoin’s $10 Billion Milestone Units Stage for Subsequent Development Part

Ethena broke $10 billion in TVL (Whole Worth Locked) on Sunday, practically doubling in lower than a month. The previous week marked certainly one of Ethena’s highest fee-generating weeks up to now, and the protocol has generated over $475 million in charges.

The provision has doubled prior to now month alone, a trajectory that has buyers eyeing a probably explosive subsequent part.

Based on analyst Crypto Stream, ENA, Ethena’s governance and protocol token, could also be on the verge of unlocking a strong new income engine. 4 of 5 governance-mandated circumstances for activating Ethena’s price change have already been met.

Ethena’s governance framework outlines strict thresholds for price distribution activation:

- USDe provide above $8 billion — met.

- Protocol income above $25 million — met, now over $43 million.

- Reserve Fund no less than 1% of provide — met.

- sUSDe APY unfold inside the 5.0-7.5% vary — met, at the moment round 10%.

- USDe integration on three of the highest 5 derivatives exchanges — not but met.

The analyst says this paves the best way for protocol income to be distributed to ENA holders. The ultimate hurdle is a list on both the Binance or the OKX change.

“Price change turned on: Ethena is a income monster. In some unspecified time in the future, income will probably be funneled into ENA,” Crypto Stream posted, calling ENA their largest spot place.

OKX and the Binance change stay the lacking integrations. Regulatory points below the EU’s MiCA (Markets in Crypto Property) framework initially blocked Binance from itemizing USDe.

Nonetheless, off-boarding EU customers earlier this month could clear the trail for a worldwide USDe itemizing on widespread exchanges.

Converge Might Rework Ethena Right into a Yield Powerhouse

Whereas the price change would mark a serious milestone, some see a good larger prize forward. Analyst Jacob Canfield pointed to Ethena’s long-term plan to launch its blockchain, Converge, with ENA because the protocol token.

On this mannequin, ENA holders might stake tokens to validators and earn a proportion of transaction worth. This might flip ENA right into a yield-bearing asset tied to the community’s financial exercise.

In the meantime, Ethena’s roadmap goes past crypto-native development. Crypto Stream highlighted the deliberate Nasdaq itemizing of StablecoinX (TCO) in This fall, probably giving institutional buyers direct publicity to Ethena’s ecosystem.

Circle’s previous success with USDC demonstrates important demand for regulated stablecoin autos from conventional finance (TradFi).

In the meantime, Arthur Cheong, founding father of DeFiance Capital, believes that giant funds have underestimated Ethena as a result of its token unlock schedule.

“You guys merely don’t know what number of funds… casually dismissed $ENA with one easy purpose of ‘too many unlocks’ and ignored the potential development forward and the tier S execution of the staff,” Cheong stated.

Nonetheless, regardless of all that, Ethena’s meteoric rise has drawn comparisons to Terra’s ill-fated UST, which collapsed in 2022.

It follows USDe turning into the third-largest stablecoin following the passage of the GENIUS Act. Critics warn that artificial stablecoins face inherent fragility, particularly in confused market circumstances.

Nonetheless, Ethena’s founder, Man Younger, has countered by pointing to built-in threat controls and diversified DeFi collateral designed to mitigate de-pegging dangers.

If Binance or OKX integration of USDe stablecoin happens and the price change prompts, Ethena might see protocol income redirected to ENA holders simply as macro tailwinds align.

In such a state of affairs, decrease Federal Reserve (Fed) charges, traditionally inversely correlated with crypto funding prices, might enhance Ethena’s profitability.

The items could fall into place amid rising USDe adoption, a rising reserve, and the looming Converge chain.

As of this writing, Ethena was buying and selling for $0.7759, up by over 3% within the final 24 hours.

The submit Why Analysts are Calling Ethena (ENA) the Greatest Altcoin Wager This Cycle appeared first on BeInCrypto.