Cathie Wooden’s agency, ARK Make investments, is thought for giant swings. Their newest Bitcoin name is a monster although – They see a path to $2.4 million by 2030!

This isn’t only a quantity pulled from skinny air. It’s constructed on a mannequin the place Bitcoin begins consuming into each main monetary asset on the planet. Nevertheless, with Wall Avenue now within the sport and regulators watching carefully, it’s important to surprise in the event that they’re seeing the long run or simply dreaming.

How did they get to that bonkers quantity?

ARK’s math is mainly a sport of market share. They take a look at enormous pots of cash—like institutional property and your complete gold market—guess how huge they’ll be in 2030, after which predict how a lot of a slice Bitcoin will carve out for itself.

Their most optimistic state of affairs, specified by stories like “Large Concepts,” imagines Bitcoin snatching 6.5% of the institutional funding pie and grabbing 60% of gold’s turf. In addition they bake in assumptions about its use in rising economies and by company treasuries.

They actually have a trick up their sleeve that despatched their already-high targets into orbit. By introducing a “liveliness” metric, they only ignore about 40% of all Bitcoin, calling it “dormant” and successfully shrinking the obtainable provide.

This single accounting transfer juices their bull case from an already wild $1.5 million to the brand new $2.4 million headline grabber.

What might energy the rocket ship?

There’s an actual case to be made that the rocket gas is already within the tank, and it strains up completely with ARK’s considering.

Wall Avenue lastly confirmed up! – The floodgates didn’t simply open in 2024 with the launch of U.S Spot Bitcoin ETFs; they had been blown off their hinges. These new, easy-to-buy merchandise noticed a staggering $12.8 billion pour in throughout July 2025 alone. BlackRock’s IBIT fund is now a titan with over $80 billion beneath its belt. All this new cash has satisfied regulators the market is rising up, main the SEC to greenlight extra advanced choices buying and selling.

It’s not simply Wall Avenue fits, both. Public corporations now sit on a hoard of over 774,000 BTC, following the lead of fanatics like MicroStrategy. Even sleepy pension funds, like Michigan’s state retirement system, are dipping a toe in, tripling their stake in a single Bitcoin ETF to over $10 million.

Supply: BitcoinTreasuries

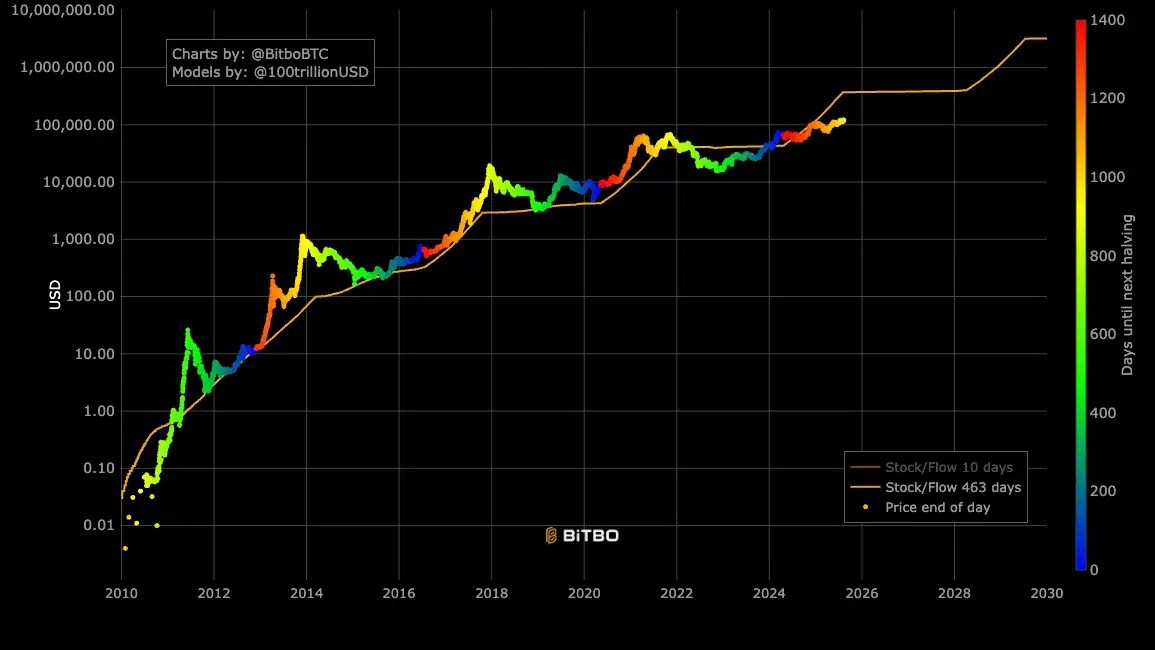

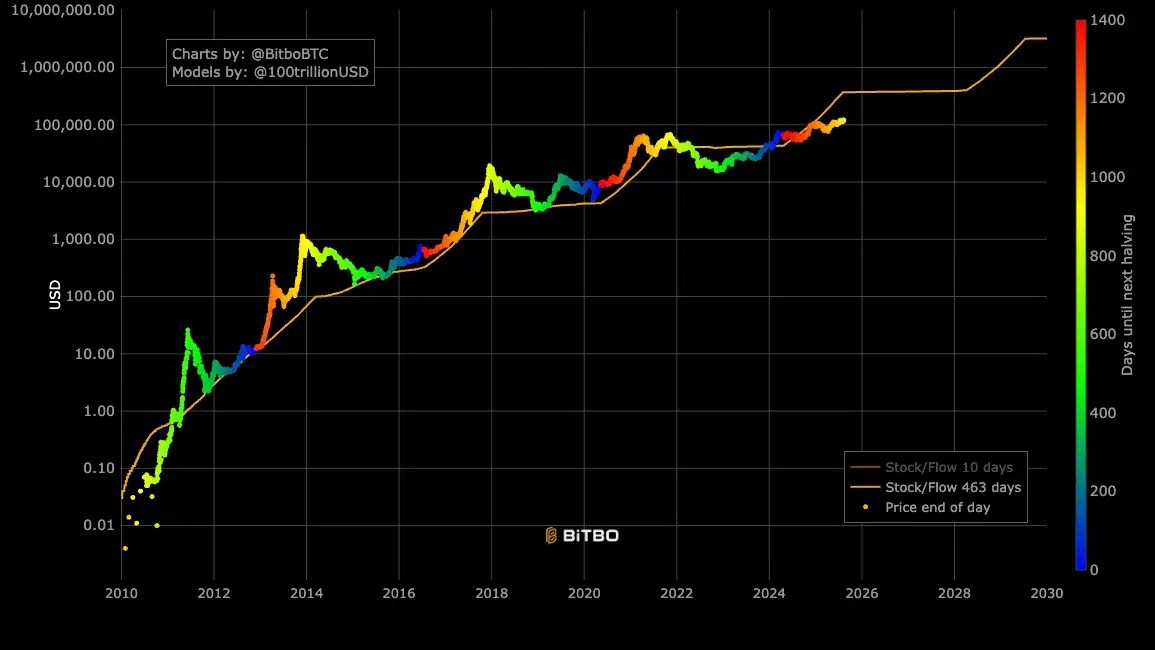

Constructed-in shortage engine – Bitcoin’s core attraction is its inflexible, unchangeable shortage. An occasion referred to as the “halving,” which occurs each 4 years, routinely slashes the creation of recent cash in half. It’s a manufactured provide disaster that has traditionally kicked off large worth rallies. After the April 2024 halving, Bitcoin’s inflation charge dropped beneath 1%, making it look extremely strong subsequent to government-printed cash.

This programmed shortage is why some fashions, just like the controversial Inventory-to-Movement, have lengthy predicted a million-dollar price ticket.

Supply: S2F Mannequin, Bitbo Charts

Golden throne usurper – An enormous a part of this guess is that Bitcoin will ultimately steal gold’s crown because the world’s go-to asset for preserving wealth. The argument is easy: Bitcoin is simpler to divide, simpler to maneuver, and its shortage is mathematically sure. As big-money gamers and perhaps even central banks begin to purchase that argument, transferring even a fraction of gold’s large market worth into Bitcoin might have an explosive impact. In a shaky world financial system, individuals are already utilizing it as an escape hatch from crashing native currencies.

What might cease the ascent?

Each bull run faces a wall of fear, and Bitcoin’s is a giant one.

The regulatory hammer? – The most important monster beneath the mattress is regulation. Washington’s current friendlier tone could possibly be a feint earlier than a knockout punch. On a worldwide scale, watchdogs just like the Monetary Stability Board are busy constructing a regulatory cage designed to cease crypto from getting too wild.

Their guidelines, set to be reviewed in late 2025, might wrap the business in a lot pink tape that it chokes out the very innovation that makes it thrilling.

Not the one sport on the town – For the primary time, Bitcoin has actual rivals. Its singular deal with being “digital gold” makes it look one-dimensional subsequent to rivals. Ethereum has constructed a sprawling digital metropolis of decentralized finance and NFTs on its platform. Different networks, like Solana, are nipping at its heels with sooner and cheaper transactions. However the greatest long-term menace may simply be governments beating crypto at its personal sport.

As nations like China push their very own Central Financial institution Digital Currencies (CBDCs), the typical particular person may simply choose a state-guaranteed digital greenback or yuan, leaving Bitcoin as a wierd collectible for a small group of believers.

Soiled power debate – And, then there’s the unending struggle over Bitcoin’s power invoice. Critics slam its large carbon footprint, which retains some huge traders away. The business is preventing again, claiming miners can truly assist the setting by utilizing stranded renewable power or gasoline that may in any other case be flared.

Is it an environmental menace or a grid-stabilizing answer? This messy PR warfare isn’t going away and can proceed to form how politicians and the general public see Bitcoin.

A collision course forward?

A single Bitcoin value seven figures isn’t only a worth; it will imply a complete market worth that rivals your complete U.S. cash provide. That type of shift doesn’t occur and not using a struggle. That is what the battle is about – Wall Avenue’s newfound starvation versus the specter of a worldwide regulatory crackdown.

It’s the magnificence of digital shortage versus the messy politics of power and technological competitors. ARK has positioned its guess on a monetary revolution. The subsequent few years will present if it was a genius name or the most costly “what if” in historical past.