Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

With US inflation middle stage and oil-market provide steering due, this can be a data-heavy week the place macro can resolve whether or not Bitcoin’s tight consolidation resolves into contemporary highs and the broader crypto market continues to blow up additional.

Crypto Market Braces For Main Week

The July Shopper Worth Index arrives Tuesday, August 12, at 14:30 CEST (08:30 ET). The median economist name leans towards a firmer core and a still-contained headline: Bloomberg’s survey factors to a 0.3% month-over-month improve in core CPI, whereas a number of desks anticipate headline CPI at 0.2% m/m and a pair of.8% y/y after 2.7% in June.

The Cleveland Fed’s real-time nowcast is in the identical ballpark on the year-over-year prints, exhibiting ~2.7% for headline and ~3.0% for core going into the discharge. The schedule is official; the nuance is {that a} 0.3% core m/m is per core holding close to 3% y/y, which markets would learn as sticky however not re-accelerating—till tariffs or power change the calculus.

Producer costs observe Thursday, August 14, additionally at 14:30 CEST (08:30 ET). Consensus pegs PPI last demand close to +0.2% m/m after a flat June; the Bureau of Labor Statistics has confirmed the timing and flagged methodology modifications that take impact with this launch. Taken with CPI, a 0.2% PPI would indicate solely modest pipeline strain—until companies margins shock.

Associated Studying

Retail’s read-through for demand lands Friday, August 15, at 14:30 CEST (08:30 ET). The road is searching for +0.5% m/m on headline retail gross sales, with many desks additionally watching the management group for a gradual goods-spending pulse after June’s 0.5%. One hour later, at 16:00 CEST (10:00 ET), the College of Michigan prints its preliminary August sentiment; July’s enchancment into the low-60s set the bottom. None of those are binary for crypto, however a scorching gross sales beat towards a 0.3% core CPI would harden “higher-for-longer” charge chatter; a cooler combine would do the alternative.

Power is the wild card. OPEC’s Month-to-month Oil Market Report publishes Tuesday, August 12, with July’s version having saved 2025 demand progress regular at ~1.3 mb/d; the cadence of OPEC+ provide steering and the IEA’s Oil Market Report on Wednesday, August 13, will feed instantly into headline-inflation expectations through the gasoline channel. The precise launch dates are mounted on OPEC’s calendar and the IEA information portal.

Associated Studying

On crypto-native flows, FTX’s property has set Friday, August 15 because the document date for its subsequent money distribution cycle, with disbursements anticipated to start on or about September 30, 2025. The step is funded by a court-authorized $1.9 billion discount of the disputed claims reserve (to $4.3B), and funds will route through BitGo, Kraken and Payoneer for eligible, totally onboarded claimants. Virtually, which means Aug. 15 determines who’s in line; the precise liquidity arrives at quarter-end.

Ethereum’s particular catalyst is corporate-treasury optics. SharpLink Gaming (Nasdaq: SBET)—which has been publishing weekly accumulation tallies—will maintain its Q2 2025 name on Friday, August 15, at 14:30 CEST (08:30 ET). The corporate disclosed 521,939 ETH on the stability sheet as of August 3, alongside ongoing capital raises to develop that treasury. Any change in tempo, staking technique or financing combine might transfer the “ETH as a balance-sheet asset” narrative.

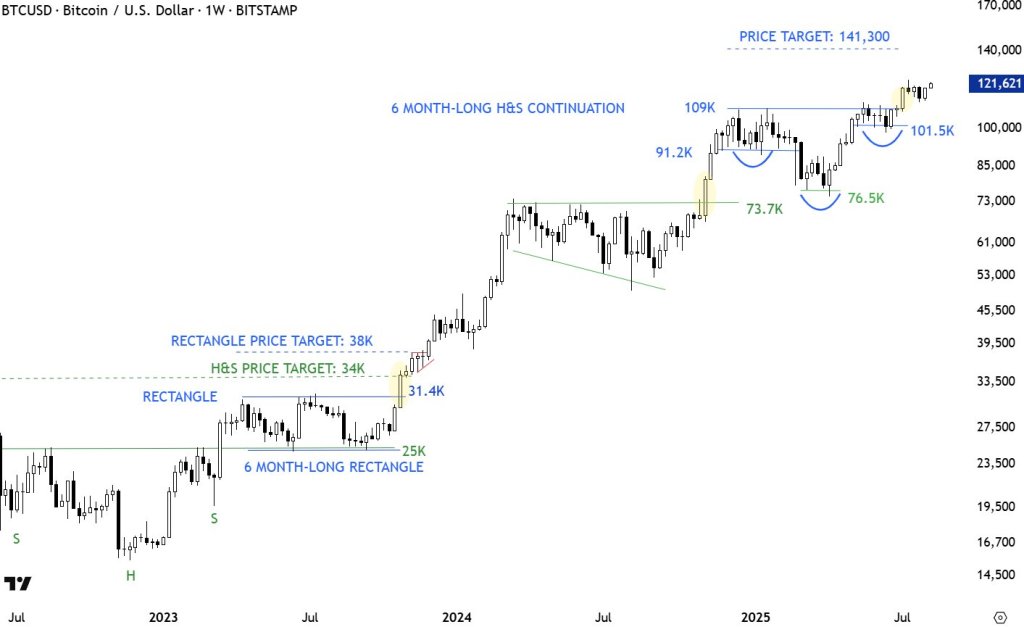

Technically, Bitcoin sits a stone’s throw from July’s document at $123,153. Aksel Kibar, CMT, characterised the previous week’s pause as “a text-book pullback to the neckline,” including that “monitoring the chart for acceleration this week. Breach of 123.2K (minor excessive) can resume uptrend.”

At press time, BTC traded at $121,699.

Featured picture created with DALL.E, chart from TradingView.com