Welcome to Commerce Secrets and techniques — Bitcoin and Ether worth predictions from high analysts, together with choices knowledge, sentiment evaluation and prediction markets to find out what they will inform us concerning the months and years forward.

XRP to $7.50 if “momentum sustains”; ATH by the top of August?

XRP is gearing up for a large 160% surge by the top of 2025, predicts Shubh Varma, co-founder and CEO of Hyblock Capital.

Varma tells Journal that XRP might hit $7.50 by the top of 2025 if the “momentum sustains.” His forecast comes after XRP reached a year-to-date excessive of $3.66 on July 18 however fell in need of retesting its official all-time excessive of $3.84 from January 2018.

Over the subsequent couple of weeks, Varma says XRP may commerce inside the $3.25-$3.50 vary, which is roughly 12% increased than its present worth of $2.85 on the time of publication.

He says the token’s “cooling off” after the latest rally, however sturdy shopping for might set it as much as creep nearer to its all-time highs by the top of August.

In the meantime, crypto analyst Cryptoes says XRP wants to remain above the “make-or-break” $2.80-$2.95 help vary to maintain its bullish momentum.

Ether will “rip like 2021” as soon as it faucets $4,200: Crypto dealer

Ether is about to enter worth discovery if it breaks previous $4,200, says Merlijn The Dealer.

“Break $4,200 and ETH will rip like 2021,” the crypto dealer stated in a latest X put up, pointing to the transferring common convergence divergence (MACD) indicator “crossover,” which has beforehand led to important worth strikes.

“Ethereum is organising for a monster transfer,” he added.

In 2021, Ether soared over 230% between March and November, topping out on the all-time excessive of $4,878.

Ether briefly pushed above $4,000 in December 2024 throughout a post-election rally, however it hasn’t been close to $4,200 since 2021.

Quite a lot of merchants consider that’s about to alter. The Lord of Entry tells Journal that Ether will break its all-time excessive of $4,878 by the top of October and push previous $5,000 earlier than the 12 months’s up.

Crypto dealer MilkyBull Crypto stated in an X put up, “Ethereum is about for a macro breakout.”

“It’s going to activate an enormous altszn if it occurs. A really crucial second for Ethereum.”

Ether’s relative energy in opposition to Bitcoin continues to rise

Regardless of taking a dive over the weekend, Ether is buying and selling at $3,697 on the time of publication and stays up 44% over the previous 30 days, based on Nansen.

The asset’s relative energy in opposition to Bitcoin continues to climb, up 30% over the previous 30 days, based on TradingView’s ETH/BTC ratio.

Rising institutional curiosity in Ether is a serious catalyst behind the momentum. Commonplace Chartered stated in a latest analysis report that the ten largest company cryptocurrency treasury firms have now purchased up 1% of the whole ETH provide because the starting of June.

Over the identical interval, Ether-focused treasury firms have doubled the tempo of investments in comparison with their Bitcoin-focused counterparts.

Whereas Yellow’s government chairman, Alexis Sirkia, was hesitant to offer Journal an Ether worth prediction, he stated he stays tremendous bullish on Ethereum’s infrastructure.

“Ethereum is rising extra scalable and user-friendly day-after-day,” he tells Journal.

“The remainder of the market can chase short-term tendencies. I choose to focus on property which might be actually constructing the longer term,” he says.

Solana set to plunge 10% as Ether institutional curiosity mounts

Extra large establishments moving into Ether might significantly damage Solana’s worth within the brief time period, says Derive head researcher Sean Dawson.

“ETH’s latest resurgence seems to be draining each consideration and liquidity from competing L1s, notably Solana,” Dawson tells Journal.

Dawson identified that whereas Solana’s worth is up 10% this previous month, it has additionally dropped 25% in comparison with ETH, going from 0.06 ETH per SOL to 0.045.

The pattern coincides with rising curiosity in ETH from TradFi, as treasury firms resembling Bitmine and The Ether Machine proceed to stack their ETH luggage.

Dawson factors to Solana choices knowledge for the Aug. 29 expiry, which reveals a focus of put choices round as little as $145, suggesting merchants are bracing for a possible 10% drop in SOL throughout August.

“Crypto Banter” host and dealer Fefe Demeny tells Journal he’s anticipating some volatility this month however nonetheless sees Solana climbing about 50% from its present worth of $161.

“I’m anticipating a fast pullback someday in August. Underneath present market situations, it’s very tough to make correct worth predictions for the month, but when I needed to, I’d say Solana might attain the $240-$260 vary,” Demeny says.

Demeny expects Solana to interrupt its all-time excessive of $293 by October, however he has a a lot gloomier take for the way issues finish the 12 months.

“By December, I count on to see the start of a serious correction, probably a 30%-50% drawdown,” he says.

Learn additionally

Options

State of Play: India’s Cryptocurrency Business Prepares For A Billion Customers

Options

Unforgettable: How Blockchain Will Essentially Change the Human Expertise

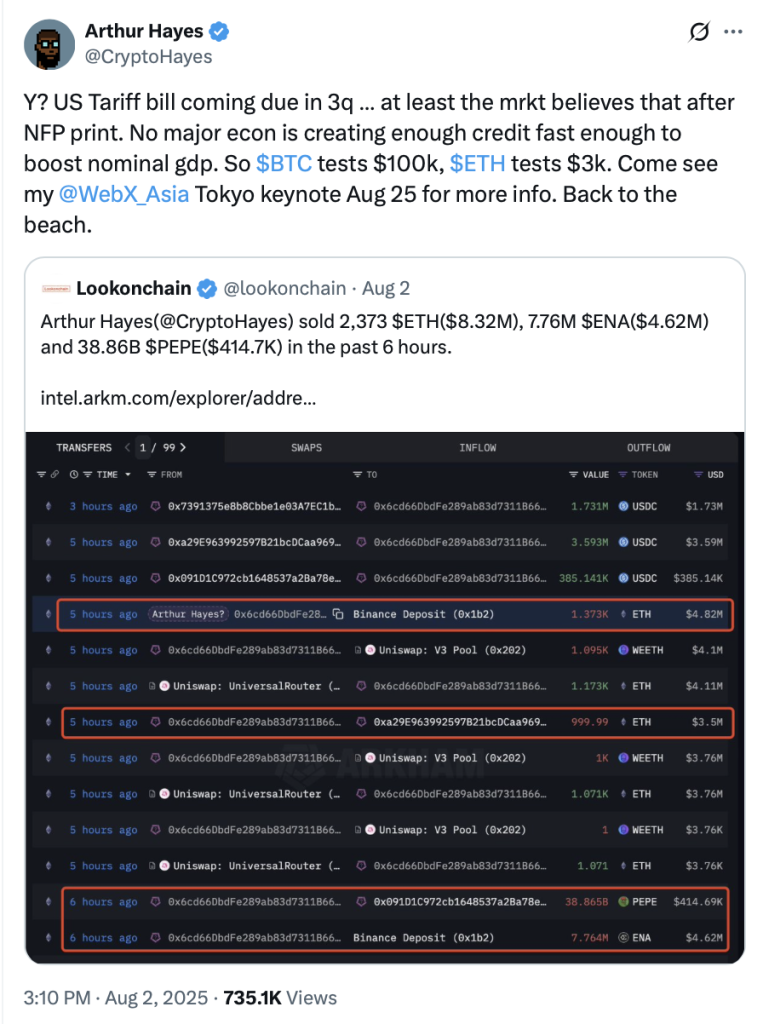

Arthur Hayes says Bitcoin might drop to $100,000

Bitcoin might as soon as once more fall to the psychological $100,000 worth stage because the impacts of tariffs turn into clearer, based on BitMEX co-founder Arthur Hayes.

“US Tariff Invoice coming due in 3Q,” Hayes stated on Aug. 2, pointing to the disappointing non-farm payroll report — simply 73,000 jobs added vs. the 100,000 estimate — as an indication the labor market is weakening, reinforcing market fears.

“No main econ is creating sufficient credit score quick sufficient to spice up nominal GDP,” Hayes stated.

Xapo Financial institution head of funding Gadi Chait stated Bitcoin’s consolidation after latest all-time highs comes as no shock. “But once more, inflationary fears have risen as tariffs and geopolitical uncertainty linger, spooking each crypto and conventional markets,” Chait stated.

“In latest occasions, Bitcoin has confirmed its capacity to climate turbulence inflicted by exterior components, an encouraging signal of its rising maturity. Our conviction in Bitcoin’s long-term potential nonetheless stands, undeterred by short-term worth fluctuations.”

Hayes’s and Chait’s feedback come as Bitcoin continues to drag again from its July 14 all-time excessive of $123,100, now 7% beneath at $114,349.

Nonetheless, different analysts see the drop as only a wholesome correction inside a much bigger uptrend.

Crypto analyst Mags stated that Bitcoin’s latest worth drop to $115,000 was a bullish retest of an inverse head-and-shoulders’ neckline earlier than BTC continues its uptrend.

“It’s only a matter of time earlier than Bitcoin worth goes vertical,” Mags stated in a Thursday put up on X.

In the meantime, crypto dealer Kyle du Plessis tells Journal that Bitcoin has far more upside and doesn’t suppose Bitcoin will high out with the standard four-year cycle this time.

As an alternative, he sees the late phases of the cycle enjoying out effectively into late 2025, perhaps even early 2026.

Learn additionally

Options

Who takes gold within the crypto and blockchain Olympics?

Columns

Socios boss’ purpose? To knock crypto out of the park

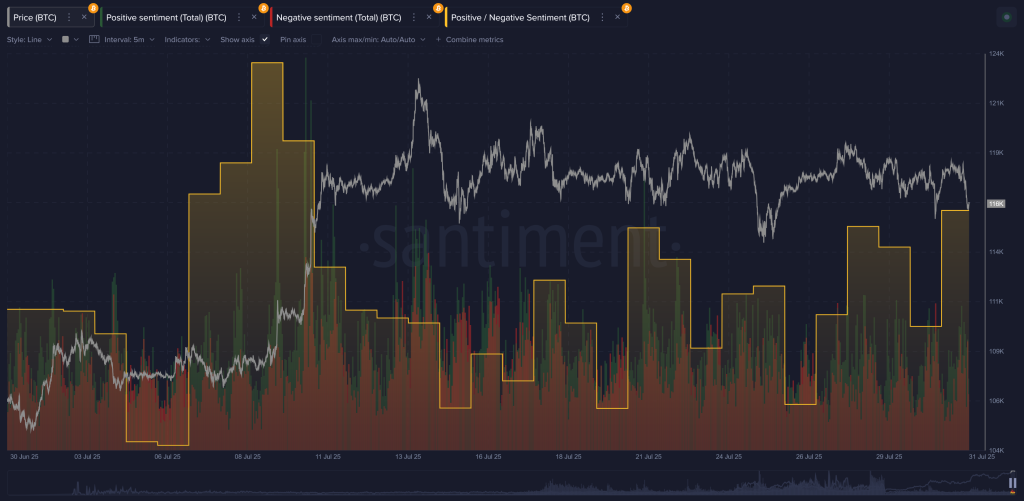

Crypto merchants are exhibiting “cautious optimism”: Santiment

Crypto merchants are staying cautiously bullish as Bitcoin trades additional beneath the all-time excessive it reached on July 14, based on sentiment knowledge platform Santiment.

“Total, merchants are primarily exhibiting cautious optimism after retracing from the $123,000 all-time excessive two and a half weeks in the past,” Santiment analyst Brian Q tells Journal.

The dip didn’t come as a shock to Santiment analysts. Q famous that social media chatter had gotten a bit too bullish, typically a warning signal {that a} reversal is perhaps close to.

Q shared the chart beneath to indicate the sample of Bitcoin pulling again when social media sentiment expects it to rise, and it typically rebounds when sentiment is bearish.

“Sentiment has steadily crept up as July has come to an in depth, and although not fairly as excessive as we noticed again on June 10, there may be positively a lean towards bullishness throughout social media,” Q says.

Whereas Q says the social media sentiment alerts there’s a “delicate cooldown interval” forward for Bitcoin, it’s not going to be drastic:

“These anticipating a large, sudden crash might not have as easy of a dip purchase alternative as they’re hoping for.”

Based on Q, wallets holding between 10 and 10,000 BTC — which management 68.4% of the whole provide — have dumped 21,114 BTC since July 15, after stacking onerous from mid-March to mid-July.

“This isn’t a giant drop by any means. However traditionally, after they take a pause on accumulating, costs are inclined to lose steam rapidly,” Q explains.

What the derivatives markets are saying about Bitcoin and Ether

Onchain choices protocol Derive founder Nick Forster tells Journal that futures merchants are getting barely extra bearish.

Future merchants are pricing in a 36% likelihood of Bitcoin falling beneath $100,000 earlier than September 26, up 6% from final week.

As for Ether, future merchants are pricing in a 22% likelihood that Ether retests $2,500 earlier than September 26, up sharply 14% from final week.

Forster says the information alerts that merchants are pricing within the threat of a sudden, sharp market reversal.

“It’s a transparent signal the market expects a tough begin to August as commerce tariff tensions warmth up,” Forster says.

What the prediction markets are saying about Bitcoin and Ether

Prediction markets have turn into extra bullish over the previous 30 days after Bitcoin’s July all-time highs kicked off a broader market rally.

Bitcoin reached new highs of $123,100 on July 14 and has a 59% likelihood of breaking that stage by September 30, based on crypto prediction platform Polymarket.

Because the July Commerce Secrets and techniques column, Polymarket’s odds of different main cryptocurrencies hitting new all-time highs by year-end have elevated.

Solana now has a 26% likelihood of surpassing its earlier peak of $293 by the top of 2025, up 4% from its odds final month as its worth spiked 10% over the identical interval.

Ethereum has 48% odds of breaking its all-time excessive of $4,878 this 12 months, up 26% from its odds final month, as its worth spiked 40% over the identical interval.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Challenge.