Ethereum reached multi-year highs, breaking decisively above the $4,300 stage after a number of days of robust bullish momentum. This breakout marks Ethereum’s highest stage since late 2021, fueled by rising institutional demand, ETF inflows, and increasing on-chain exercise. Nonetheless, recent market information from CryptoQuant means that warning could also be warranted within the brief time period.

Associated Studying

The all-exchange Estimated Leverage Ratio (ELR) has climbed to 0.68, approaching historic highs and signaling extreme market-wide leverage. Whereas Binance’s ELR sits decrease at 0.52, indicating extra measured positioning on the world’s largest trade, larger relative leverage on different platforms factors to elevated speculative exercise elsewhere.

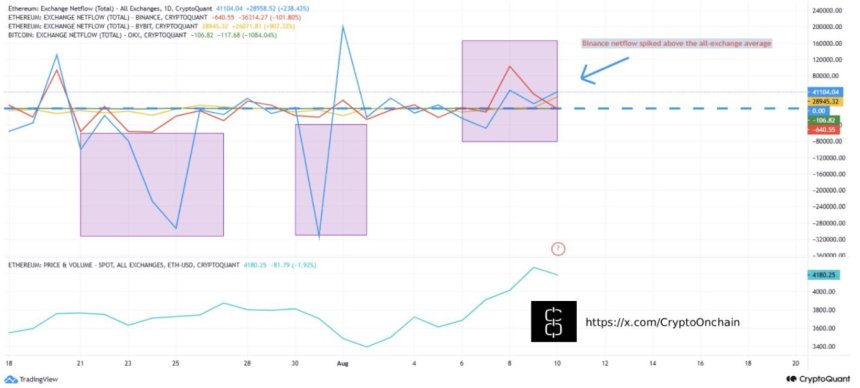

Ethereum’s worth is at the moment testing a important resistance zone between $4,020 and $4,060—a traditionally pivotal space that has usually decided whether or not a rally accelerates or faces a pointy pullback. Including to the short-term threat profile, Binance netflows have spiked considerably above the all-exchange common, suggesting concentrated inflows which will result in localized promote stress, probably linked to liquidations or arbitrage-driven trades.

Ethereum Mid-Time period Outlook: Institutional Flows and Community Power

In keeping with Crypto Onchain, a CryptoQuant analyst, Ethereum’s mid-term fundamentals stay strongly bullish regardless of short-term warning indicators. Institutional demand is surging, with US Spot Ethereum ETFs recording a document $726.6 million in day by day internet inflows, pushed by giants like BlackRock and Constancy. This has pushed whole ETF holdings above 5 million ETH (valued at roughly $20.3 billion), a milestone that underscores Ethereum’s rising position in institutional portfolios.

Past ETFs, main gamers are growing direct publicity. Ark Make investments bought 30,755 ETH value $108.57 million, whereas Basic World allotted $200 million to ETH as a part of its treasury technique. This wave of accumulation displays deepening confidence in Ethereum’s long-term utility and worth proposition.

On-chain metrics additionally paint a bullish image. Transaction volumes are hitting new highs, and staking participation continues to increase, locking up extra ETH and lowering circulating provide. Regulatory readability—such because the SEC closing investigations into liquid staking—has additional strengthened structural demand for ETH. Upcoming community upgrades, together with Pectra and Fusaka, are set to spice up scalability and decrease prices. This may improve Ethereum’s attraction to each builders and enterprises.

Within the brief time period, excessive leverage, key resistance ranges, and concentrated trade inflows pose a threat of sharp volatility. Nonetheless, the mid-term outlook stays intact, supported by sustained institutional inflows, strong community progress, and technological developments. Even when near-term corrections happen, these elements ought to assist cap draw back stress and keep Ethereum’s broader bullish trajectory.

Associated Studying

Value Motion Particulars: Setting Recent highs

Ethereum’s 4-hour chart exhibits a robust breakout above the important thing resistance at $3,860, which had capped worth motion in late July. Following this decisive transfer, ETH surged previous the $4,300 stage, marking its highest level since November 2021. This rally was supported by robust bullish momentum, as seen within the steep incline of the 50-period SMA (blue) and the value holding nicely above the 100-period (inexperienced) and 200-period (pink) SMAs.

At the moment, ETH is consolidating slightly below its current peak, round $4,240, signaling a possible pause earlier than the following transfer. This consolidation at elevated ranges, quite than a pointy retracement, means that bulls stay in management. The $3,860–$3,900 zone now acts as a important assist, and a retest may present a wholesome setup for continuation.

Associated Studying

Quantity spikes through the breakout point out robust shopping for curiosity, however the lowered quantity within the newest candles suggests the market is ready for recent catalysts. A sustained transfer above $4,300 may open the door towards the $4,450–$4,500 zone, whereas a breakdown beneath $3,860 would weaken the bullish construction.

Featured picture from Dall-E, chart from TradingView