Welcome to the Asia Pacific Morning Transient—your important digest of in a single day crypto developments shaping regional markets and international sentiment. Monday’s version is final week’s wrap-up and this week’s forecast, dropped at you by Paul Kim. Seize a inexperienced tea and watch this house.

With the US employment state of affairs deteriorating dramatically, the battle between the Trump administration and the Fed over rate of interest cuts is intensifying. The outlook for rates of interest over the following three months is fluctuating every day with the inflation and employment indicators’ releases. The market is displaying indicators of utmost sensitivity.

US Stagflation Fears Triggered

Final week’s volatility within the cryptocurrency market started with the discharge of the ISM Providers PMI on Tuesday. The index signaled a slowdown within the US providers sector. Moreover, it reported that costs within the providers sector have risen and employment has declined since April, when Trump’s “tariff struggle” started.

The state of affairs the place costs are rising whereas employment is declining is stagflation, probably the most troublesome financial crises to cope with, as a result of it prevents central banks from both reducing or elevating rates of interest. Considerations are rising out there that the Trump administration’s tariff coverage is pushing the US into stagflation.

On the similar time, the chance of three rate of interest cuts this yr has been diminished to 2. Final week, costs of most threat property delicate to market liquidity, together with cryptocurrencies, fluctuated in step with the ever-changing rate of interest outlook. When the chance of a fee reduce was two occasions throughout the yr, costs fell, and when it modified to a few occasions, costs rose repeatedly.

The information that marked the top of the week was that Stephen Miran, chair of the White Home Council of Financial Advisers, was appointed to fill the vacant place of Fed Governor Adriana Kugler. Miran is considered one of President Trump’s closest financial advisors. The market interpreted this appointment as an indication that President Trump strongly pushes to decrease rates of interest. The US inventory market closed with the expectation of three rate of interest cuts this yr.

Ethereum Recovers From BlackRock Outflow

Over the weekend, Fed Vice Chair Michelle Bowman’s sudden remarks fueled Ethereum’s shock rise. In a speech to the Kansas Bankers Affiliation, Bowman bluntly said that “three fee cuts are mandatory.” She emphasised that latest employment knowledge present that proactive measures are wanted to stop additional weakening of financial exercise and employment situations. Then, the value of Ethereum quickly exceeded $4,300.

Quite the opposite, BlackRock made a transfer that was largely sudden out there. The key participant within the US spot exchange-traded fund (ETF) trade withdrew important funds from each its Bitcoin spot ETF (IBIT) and Ethereum spot ETF (ETHA) on Monday, injecting uncertainty into the market.

Web outflow of $292.21 million occurred in IBIT that day, marking the biggest single-day outflow since Might 30, over two months in the past. Market analysts started speculating that Bitcoin costs might drop again right down to the $111,000 degree.

The Ethereum spot ETF, ETHA, noticed a web outflow of $375 million. This represents a 3% lower in BlackRock’s Ethereum holdings in a single day. The large outflow from BlackRock’s ETF halted the 21-day consecutive web influx file for Ethereum spot ETFs.

Tom Lee: “Shopping for Ethereum the Most Vital Commerce in Subsequent 10 Years.”

Thankfully, the online outflow of ETF funds stopped after two days. Among the many two main cryptocurrencies, Ethereum confirmed a quicker restoration. The strategic purchases of ETH by U.S.-listed corporations acted as a catalyst for Ethereum’s worth restoration. Bitmain additionally up to date its file because the world’s largest Ethereum-holding listed firm, holding over 830,000 ETH.

Tom Lee, a famend Wall Avenue funding guru, emphasised that purchasing Ethereum can be crucial commerce he makes within the subsequent 10 years. Geoff Kendrick, head of digital asset analysis at Normal Chartered Financial institution, defined that shares of corporations shopping for Ethereum may very well be a extra enticing funding goal than Ethereum spot ETFs.

It was per week when President Trump signed new government orders to stop debanking for lawful crypto companies and to open the retirement fund market. Ethereum noticed a 25.01% enhance in its weekly worth, whereas Bitcoin rose by solely 5.44%, regardless of that it regained $119,000 over the weekend. Solana (SOL), which has a decrease market capitalization than ETH, noticed a 15.04% enhance. It was per week during which Ethereum confirmed its clear presence.

CPI Ought to Be Low for a Stronger Market

This week is anticipated to comply with an analogous sample to final week. The market’s consideration is targeted on whether or not the Fed will implement three rate of interest cuts this yr and whether or not a particular rate of interest reduce can be introduced on the September Federal Open Market Committee (FOMC) assembly.

desk.event-table {

border-collapse: collapse;

width: 100%;

max-width: 700px;

margin: 20px auto;

font-family: Arial, sans-serif;

font-size: 15px;

border: 1px strong #ddd;

}

desk.event-table thead {

background-color: #f4f4f4;

}

desk.event-table th, desk.event-table td {

border: 1px strong #ddd;

padding: 10px 12px;

text-align: left;

}

desk.event-table th {

background-color: #f4f4f4;

font-weight: daring;

}

desk.event-table tr:nth-child(even) {

background-color: #fafafa;

}

desk.event-table tr:hover {

background-color: #f1f1f1;

}

| Date | Day | Occasion |

|---|---|---|

| Aug 13 | Tuesday | US July Shopper Value Index (CPI) launch |

| Aug 14 | Wednesday | Chicago Fed President Austan Goolsbee speaks at Springfield Chamber financial coverage luncheon |

| Aug 15 | Thursday | US Producer Value Index (PPI) launch |

| Aug 16 | Friday | US July Industrial Manufacturing knowledge launch |

| Aug 16 | Friday | US July Retail Gross sales knowledge launch |

On this context, the July US Shopper Value Index (CPI) knowledge to be launched on Tuesday is essential. If the precise CPI determine considerably exceeds market expectations, the outlook for rate of interest cuts within the second half of the yr will seemingly change into unsure once more. If that occurs, cryptocurrency costs will face adjustment once more.

The Producer Value Index (PPI) on Thursday night time and the US July industrial manufacturing and retail gross sales figures on Friday are additionally value watching. It is because they may present proof of whether or not the US financial system is contracting.

Feedback from Fed officers, who’ve a big affect on the September FOMC rate of interest choice, are additionally vital. On Wednesday, Chicago Federal Reserve Financial institution President Austan Goolsbee will attend a financial coverage luncheon hosted by the Springfield Chamber of Commerce. Any feedback on the present financial outlook or future rate of interest instructions might impression the market.

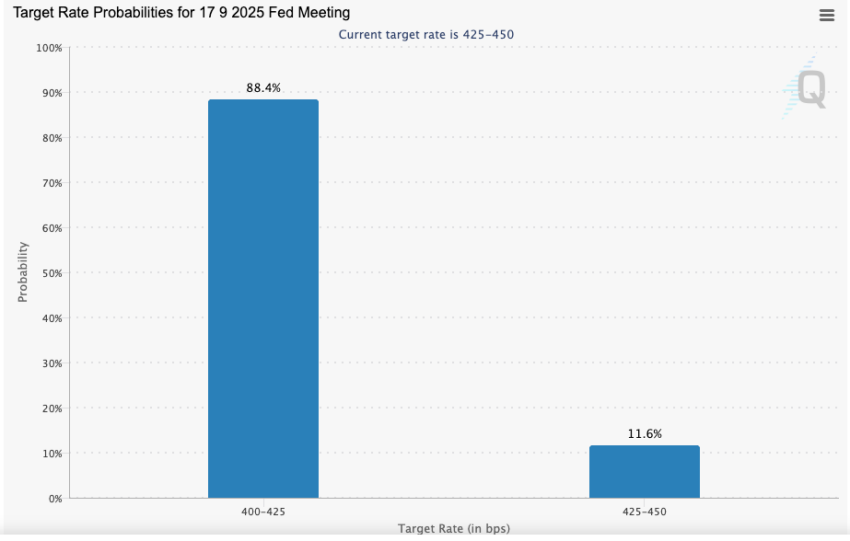

In response to FedWatch knowledge, as of the time of publication on Monday morning, the chance of a 0.25% rate of interest reduce on the September FOMC assembly stands at 88.4%. This chance would possibly rise barely as soon as the benchmark rate of interest futures market reopens after Vice Chair Bowman’s remarks over the weekend. Nonetheless, it’s troublesome to verify whether or not the chance of a fee reduce will stay at this degree by the top of the week.

I want all our readers profitable investments this week as nicely.

The submit Ethereum Surges Previous $4,300 as Markets Await Pivotal CPI Information appeared first on BeInCrypto.