Welcome to the US Crypto Information Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso, as monetary markets are flashing warning indicators eerily just like these seen earlier than a number of the largest crashes in fashionable historical past. This time, nevertheless, analysts and merchants are debating whether or not Bitcoin (BTC), buying and selling above $120,000, can escape the gravitational pull of a possible fairness market collapse.

Crypto Information of the Day: Inventory Market Crash Warnings Mount — Will Bitcoin and Ethereum Soar or Sink?

Robert Kiyosaki, who featured in a current US Crypto Information publication, warns that inventory market crash indicators warn of a large crash. In his view, this might be excellent news for gold, silver, and Bitcoin homeowners however a extreme blow for Child Boomers with heavy publicity to 401(okay) plans.

A few of these indicators are discovered within the bond market, with Financelot, a market commentator, highlighting a historic correlation between spikes within the US 3-month Treasury yield and main market meltdowns.

As we speak, the yield’s sample mirrors these pre-crash peaks, together with March 2002, September 2008, and February 2020. This has raised fears that historical past could repeat itself.

In the meantime, not everybody buys into the narrative that Bitcoin will rally if conventional markets falter. Commentator Beka challenged Kiyosaki’s optimism, arguing that Bitcoin has been absorbed into the standard monetary (TradFi) system and is unlikely to decouple throughout a inventory market crash.

Gold, usually a safe-haven asset, has additionally confronted headwinds. It tumbled essentially the most in three months on experiences that the US could make clear its tariff coverage on bullion.

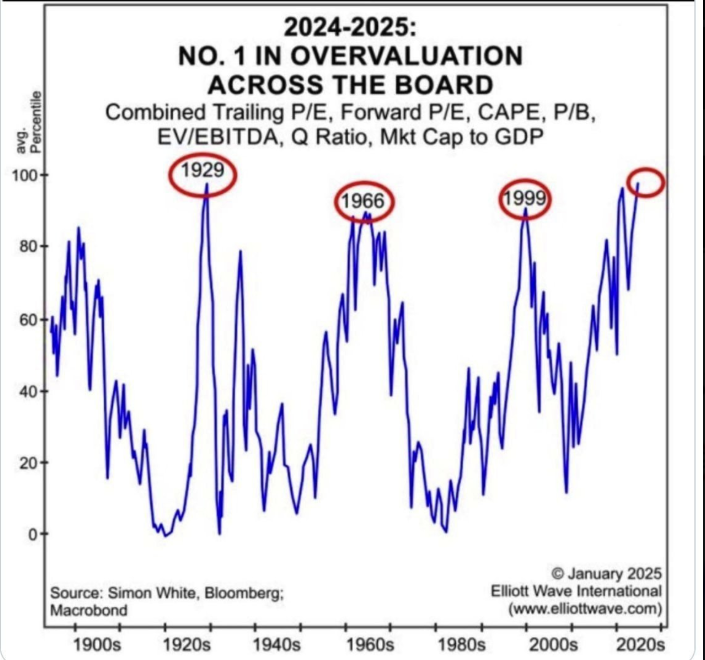

Towards that backdrop, US equities are at their most costly valuation for the reason that Nice Melancholy, including one other layer of danger.

Nonetheless, crypto merchants stay targeted on short-term catalysts, with Bitcoin reclaiming the $122,000 mark. Analyst Ted Pillows notes that altcoins had dominated final week, however a softer CPI studying due tomorrow may set off a Bitcoin surge to new all-time highs.

International Market Turmoil Checks Crypto’s Protected-Haven Standing

Ethereum, in the meantime, continues to draw institutional consideration. Funding agency BitMine has greater than doubled its ETH holdings in every week, now controlling 1.2 million ETH price $4.96 billion.

The agency’s inventory has climbed, and Wall Avenue’s liquidity rankings replicate robust investor curiosity within the second-largest cryptocurrency.

Globally, market instability will not be confined to the US. Iran’s inventory market has shed over 75% of its greenback worth since 2020, highlighting the fragility of rising markets.

The central query now’s whether or not Bitcoin will comply with the script of previous market downturns or lastly break away. Historical past means that even various belongings can get caught within the sell-off when worry grips Wall Avenue.

However with inflation knowledge, Fed coverage shifts, and deepening institutional crypto adoption in play, the stage is ready for a high-stakes take a look at of Bitcoin’s resilience.

Charts of the Day

This chart exhibits the US 3-month Treasury yield’s technical indicators earlier than the June 2002, September 2008, and February 2020 inventory market crashes. Present yield patterns intently resemble previous peaks, elevating fears of one other potential market downturn.

A protracted-term view of the U.S. 3-month yield reveals a recurring 40-year pattern, with spikes previous main market crashes. The most recent surge matches historic pre-crash ranges, hinting that the cycle could also be repeating once more within the present market.

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to comply with as we speak:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of August 8 | Pre-Market Overview |

| Technique (MSTR) | $395.13 | $406.00 (+2.75%) |

| Coinbase International (COIN) | $310.54 | $320.50 (+3.31%) |

| Galaxy Digital Holdings (GLXY) | $27.78 | $28.90 (+4.03%) |

| MARA Holdings (MARA) | $15.38 | $15.86 (+3.12%) |

| Riot Platforms (RIOT) | $11.08 | $11.46 (+3.43%) |

| Core Scientific (CORZ) | $14.41 | $14.23 (-1.25%) |

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.