- DOT fell 6% in 24 hours as a consequence of institutional promoting.

- Resistance sits at $4.15; fragile help at $3.90.

- Broader market gained, making DOT’s drop asset-specific moderately than market-wide.

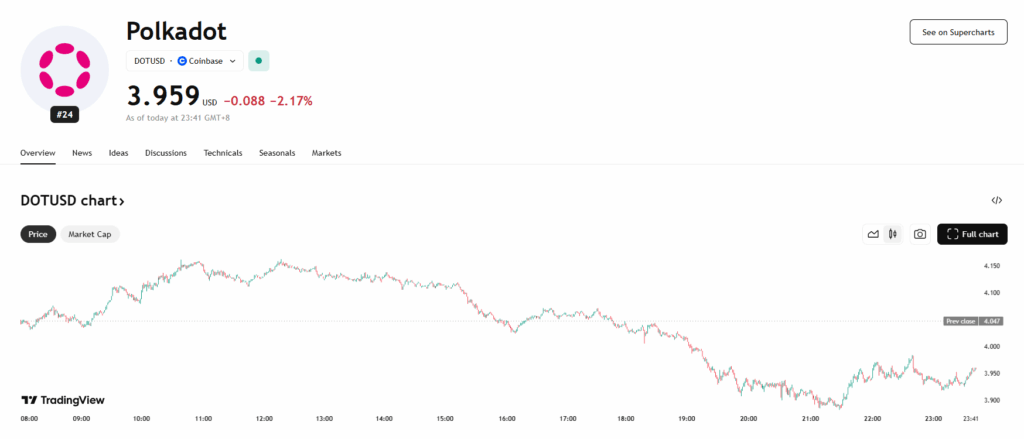

Polkadot’s DOT noticed a pointy reversal over the previous 24 hours, erasing earlier features and shutting in adverse territory. Between August 10 at 12:00 and August 11 at 11:00, the token fell from $4.15 to $3.91, marking a 6% decline on robust promoting quantity. CoinDesk Analysis’s technical mannequin factors to institutional liquidations as the first driver behind the transfer, with heavy order stream pushing costs via a number of help ranges.

Market Context and Divergence

Apparently, DOT’s decline got here whereas the broader crypto market was edging greater—the CoinDesk 20 Index was up 0.5% over the identical interval. This divergence highlights DOT’s distinctive promoting stress and means that the drop was much less about macro sentiment and extra about asset-specific positioning by giant holders.

Technical Breakdown

- Buying and selling vary: $0.24 unfold between $3.91 and $4.15, indicating 6% volatility.

- Quantity spike: Last-hour decline noticed 4.96M tokens traded, signaling institutional unloading.

- Resistance: Firmly set at $4.15 after an aborted rally try.

- Assist: Weak close to $3.90, with danger of breakdown if stress continues.

- Development: Formation of decrease highs confirms a deteriorating construction.

- Intraday promoting bursts: A number of 11:15–11:30 intervals logged over 300,000 in quantity, intensifying the downward push.

Outlook

With resistance now clearly established at $4.15 and help simply barely holding at $3.90, DOT could possibly be prone to additional draw back if promoting quantity persists. A decisive break beneath $3.90 would seemingly shift short-term sentiment extra firmly bearish, whereas any rebound would wish to retest and break $4.15 to sign restoration momentum.