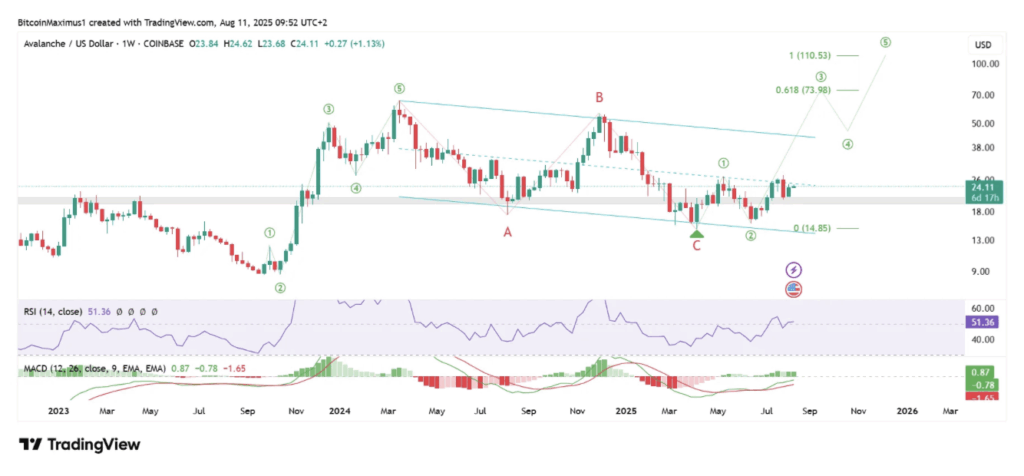

- AVAX is testing the $26 resistance, with a breakout doubtlessly opening targets at $74 and $110.

- Weekly chart exhibits an A-B-C correction could also be full, whereas each day chart reveals a bullish 1-2/1-2 wave construction.

- A confirmed shut above $26 may kick off a fast August rally, mirroring current surges in PENDLE and LINK.

Avalanche (AVAX) is inching towards a make-or-break level at $26 — a degree that would unlock a surge towards $74 and even $110 if bulls get their manner. The setup isn’t simply random; the wave depend mirrors current explosive strikes seen in PENDLE and LINK, hinting that one thing large may very well be brewing right here.

Weekly Chart Indicators a Shift

Trying on the weekly chart, AVAX has been caught inside a descending parallel channel since its March 2024 cycle excessive. A powerful bounce in April pushed it again above $20, flipping that zone into doubtless help. The catch? Value remains to be hovering slightly below the channel’s midline. The bullish wave depend suggests an extended A-B-C correction may be over, which means an upward leg may very well be subsequent. However it all hinges on a detailed above $26 — that’s the technical inexperienced gentle. Momentum is near tipping too, with RSI sitting at 50 and MACD barely shy of turning constructive.

Day by day Chart Appears Even Extra Bullish

On the each day timeframe, the construction is screaming power. AVAX seems to be in a uncommon 1-2/1-2 wave formation, a setup that tends to precede quick, aggressive strikes. If this learn is right, we’re getting into sub-wave three — usually the steepest a part of the rally. In contrast to the weekly chart, each day momentum is already bullish, with RSI above 50 and a recent MACD bullish cross.

August May Be AVAX’s Launchpad

If bulls can safe a stable shut above $26, the trail may very well be open for a parabolic climb, with $74 and $110 as reasonable targets for this cycle’s high. With each each day and weekly charts aligned and momentum constructing, AVAX would possibly simply be on the sting of a breakout that merchants can be speaking about for months.