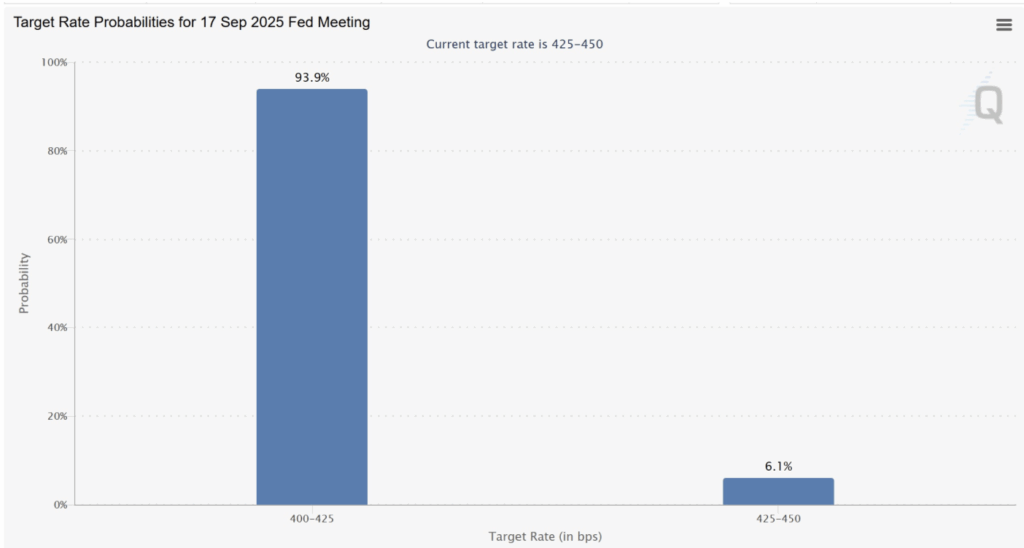

- July CPI knowledge exhibits cooling inflation at 2.7%, boosting September Fed price lower odds to 93.9%.

- Bitcoin eyes $120K breakout, with analysts focusing on $130K–$137K if momentum sustains.

- Key help sits at $117,650–$115,650, with danger of deeper pullback towards $100K if bulls fail to reclaim $120K.

Bitcoin’s value motion this week has been dancing round a essential psychological mark, with contemporary macro knowledge including gasoline to the rally narrative. The July US Shopper Value Index (CPI) got here in at 2.7% year-over-year — unchanged from June and beneath the two.8% forecast. Core CPI, stripping out meals and power, ticked up 3.1% in keeping with expectations. On a month-to-month foundation, total CPI slowed to 0.2%, down from June’s 0.3%, whereas core CPI rose 0.3%, barely greater than the earlier 0.2%.

Macro Tailwinds Constructing

The softer inflation print reinforces the case for financial easing, a backdrop traditionally pleasant to risk-on belongings like Bitcoin. Decrease charges cut back the chance value of holding BTC, probably attracting extra institutional and retail inflows. After the CPI launch, CME FedWatch knowledge confirmed September price lower odds hovering to 93.9%, as merchants leaned closely into dovish expectations. That stated, the regular core CPI hints that the Fed may nonetheless watch for additional proof earlier than performing. Eyes at the moment are on subsequent week’s Producer Value Index (PPI) — a cooler-than-expected studying might strengthen the bullish setup.

Technical Image Factors Increased

BTC’s value briefly touched $122,190 earlier this week earlier than slipping 3% to $118,500. Submit-CPI, it rebounded to $119,500, however merchants are expecting a decisive each day shut above $120,000 — a milestone that’s by no means been reached earlier than. On the charts, a bullish flag not too long ago broke upward, and present value motion seems to be like a retest earlier than continuation. Analysts like Titan of Crypto see potential for $130,000, even $137,000, if momentum holds.

Dangers Nonetheless on the Desk

Failure to reclaim $120,000 might invite short-term promoting, with instant help sitting between $117,650 and $115,650 — an space overlapping with a CME hole from the weekend. A deeper correction might even retest $100,000, and in a worst-case slide, $95,000. Nonetheless, with macro winds shifting and technicals leaning bullish, the stage is ready for Bitcoin’s subsequent large transfer — the one query is whether or not bulls can seize the second.