In a surprising transfer, Tom Lee’s Ethereum treasury agency BitMine is providing as much as $20 billion in frequent inventory to gasoline its aggressive ETH shopping for and staking technique,

The legendary Wall Avenue investor and Fundstrat CEO seems decided to accumulate 5% of Ethereum’s complete provide, and isn’t losing any time to get there.

BitMine has now elevated the dimensions of its at-the-market (ATM) providing to $24.5 billion, which it’s anticipated to solely use to extend its ETH holdings.

The Ethereum worth has climbed as much as $4400 on the information for the primary time since December 2021, additionally buoyed by a comfortable headline CPI print.

It’s trying more and more possible that sidelined traders nonetheless have time to affix the Ethereum rally, with some consultants predicting a brand new all-time excessive as early as August.

ETH’s bullish energy has supplied the best backdrop for ERC-20 cash to rally as nicely, with Uniswap, Lido DAO and Arbitrum among the many high crypto gainers. Small-cap cash like Bitcoin Hyper are additionally in excessive demand as traders hunt for outsized returns.

BitMine Raises $20B In Frequent Inventory Providing

Underneath the chairmanship of Fundstrat CEO Tom Lee, BitMine is already the most important company holder of Ethereum, presently holding 1.2 million ETH price almost $5 billion.

At present, it launched a supplementary prospectus, rising the quantity of frequent inventory that may be bought beneath its Gross sales Settlement to $24.5 billion. This can be a 5x enhance in issuance capability, virtually solely for use for rising the corporate’s Ethereum treasury.

In the meantime, Joseph Lubin’s Sharplink Gaming has introduced a $400 million registered direct providing, alongside $200 million in present ATM proceeds able to deploy, which may push its Ethereum holdings previous $3 billion.

Collectively, the 2 ETH treasury companies are exerting vital shopping for strain on Ethereum. Lubin just lately informed CNBC he believes ETH may overtake Bitcoin’s market valuation inside the subsequent yr.

Ethereum Value Hits $4400 For The First Time Since 2021

The Ethereum worth surged previous the $4400 mark for the primary time since December 2021.

Outstanding analysts like Jacob Bury imagine {that a} main ETH breakout is imminent as the most important altcoin seems to be breaking out of a parallel triangle.

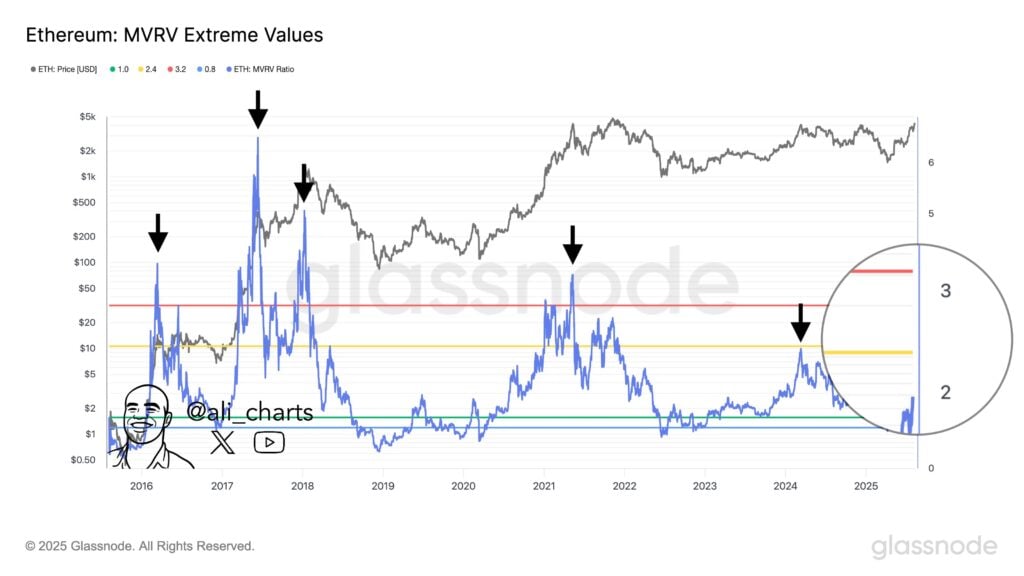

With Ethereum’s MVRV ratio presently close to 2, removed from the three.2 to 4 vary marked at earlier cycle tops, on-chain information factors to vital upside potential. It seems possible that ETH will hit a brand new all-time excessive in August and probably, $10,000 this yr.

Finest ERC-20 Cash To Purchase

ERC-20 cash present a powerful correlation with the Ethereum worth. Due to this fact, tokens like Lido DAO, Arbitrum and Uniswap are among the many high crypto gainers over the previous a number of days.

Sidelined traders ought to hold a watch out for Pepe and Floki as nicely. Sensible cash traders proceed to view Ethereum meme cash as wonderful beta bets on ETH.

Quite the opposite, Bitcoin Hyper (HYPER) is a superb funding for these trying to find low-cap gems and outsized returns.

The HYPER presale goes viral and has raised almost $9 million briefly order. Whales and seasoned merchants are among the many early consumers, as they’ve been fast to recognise the potential of this BTC layer-2 coin.

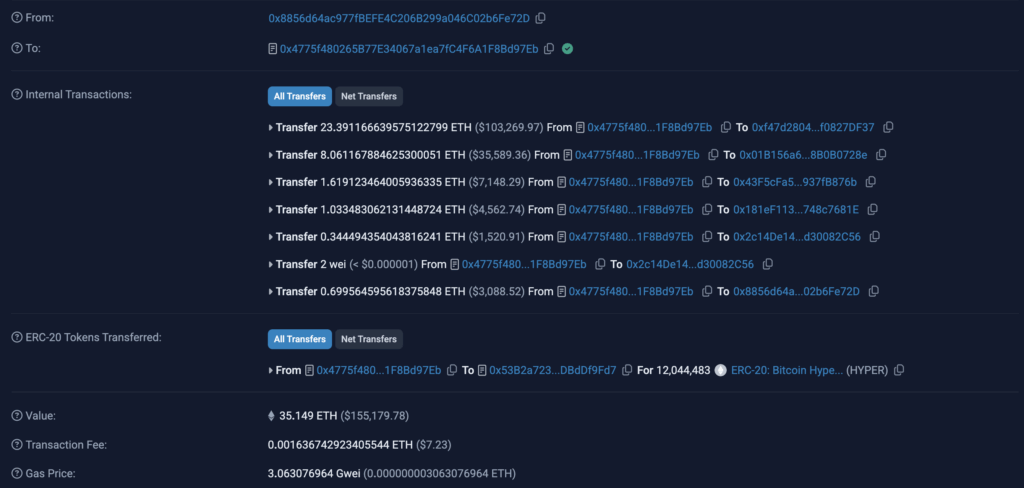

One whale simply swapped 35 ETH to buy almost $150k price of HYPER.

Powered by the Solana Digital Machine and cutting-edge zero-knowledge structure, Bitcoin Hyper guarantees to draw cost options, DeFi merchandise and even meme cash to the BTC ecosystem.

Such high layer-2 cash have a tendency to succeed in multibillion-dollar valuations. Even Bitcoin’s Stacks has a peak market cap of over $5 billion.

Unsurprisingly, consultants are viewing HYPER as probably the greatest ERC-20 tokens to purchase with as much as 100x upside potential.

Go to Bitcoin Hyper Presale

This text has been supplied by certainly one of our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions might use affiliate applications to generate revenues by the hyperlinks on this text.