Be a part of Our Telegram channel to remain updated on breaking information protection

Metaplanet is rolling out a Bitcoin-backed yield curve and a most well-liked share program geared toward making BTC a reputable type of collateral in Japan’s capital markets, a transfer geared toward difficult the dominance of conventional mounted earnings merchandise.

The Bitcoin-backed yield curve would create a pricing framework for Bitcoin-collateralized credit score, opening the door for institutional traders to faucet into BTC whereas locking in predictable yields.

The “Metaplanet Prefs” program will additional weaponize the agency’s rising Bitcoin treasury by issuing BTC-backed devices throughout a number of credit score profiles and maturities.

Head of Bitcoin technique Dylan LeClair mentioned in an X submit immediately that the initiatives mark the following step in Metaplanet’s mission to “digitally remodel Japan’s capital markets” and put together for “hyperbitcoinization.”

By embedding Bitcoin into the nation’s mounted earnings construction, the corporate is betting it could legitimize BTC as institutional-grade collateral.

The bulletins land on the heels of Metaplanet’s greatest quarter but, with income up 41% quarter-on-quarter 1.239 billion yen ($8.4 million) and internet earnings swinging to a 11.1 billion yen ($75.1 million) revenue from a 5 billion yen loss.

Metaplanet Posts Robust Quarterly Outcomes

Metaplanet’s new initiatives got here because it introduced a strong-second quarter efficiency.

The corporate’s income climbed 41% quarter-over-quarter (QoQ) to 1.239 billion yen, which is round $8.4 million. Internet earnings additionally rebounded to a 11.1 billion yen ($75.1 million) revenue from a 5 billion yen loss final 12 months.

Metaplanet Q2 Earnings Outcomes:

– Income ¥1.239B ($8.4M) +41% QoQ

– Gross Revenue ¥816M ($5.5M) +38% QoQ

– Atypical Revenue ¥17.4B ($117.8M) vs. -¥6.9B

– Internet Earnings ¥11.1B ($75.1M) vs. -¥5.0B

– Belongings ¥238.2B ($1.61B) +333% QoQ

– Internet Belongings ¥201.0B ($1.36B) +299% QoQ— Metaplanet Inc. (@Metaplanet_JP) August 13, 2025

The corporate’s year-to-date (YTD) efficiency dwarfed the 7.2% common acquire posted by the Tokyo Inventory Value Index (TOPIX) Core 30, which is a benchmark that tracks giants together with Toyota, Sony and Mitsubishi Heavy Industries.

Metaplanet additionally outperformed Nintendo and SoftBank Group, which each posted double-digit good points throughout the identical interval however lagged behind the Bitcoin treasury agency by a large margin.

CEO Simon Gerovich mentioned in an X submit earlier immediately that this newest quarter efficiency marks the corporate’s strongest ever.

With the stellar quarter outcomes and the launch of two new initiatives, Metaplanet is completely positioned to proceed its Bitcoin accumulation technique.

Only a day earlier than the earnings launch, the corporate introduced that it purchased one other 518 BTC for about $61.4 million. Gerovich disclosed that the common buy value for this most up-to-date acquisition was round $118,519 per BTC, with the holdings producing a yield of 468.1% for the agency YTD.

Metaplanet has acquired 518 BTC for ~$61.4 million at ~$118,519 per bitcoin and has achieved BTC Yield of 468.1% YTD 2025. As of 8/12/2025, we maintain 18,113 $BTC acquired for ~$1.85 billion at ~$101,911 per bitcoin. $MTPLF pic.twitter.com/Gm2bYBgYF0

— Simon Gerovich (@gerovich) August 12, 2025

Following the most recent Bitcoin purchase, the Japanese agency now holds 18,113 BTC, which was acquired for about $1.85 billion at $101,911 per BTC.

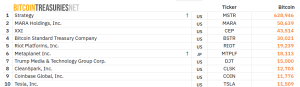

Metaplanet is now simply over 1,000 BTC away from overtaking Riot Platforms because the fifth largest company Bitcoin holder globally. Riot at present holds 19,239 BTC, knowledge from Bitcoin Treasuries exhibits

Buyers are additionally more and more inserting bets that Metaplanet’s BTC technique will repay. In line with the earnings report, the variety of Metaplanet shareholders has soared 350% for the reason that agency began shopping for BTC in This autumn 2024.

Technique, the corporate that pioneered debt-funded Bitcoin buys, nonetheless maintains a cushty lead within the BTC treasury race. The Michael Saylor-led software program large holds 628,946 BTC.

Largest company Bitcoin holders (Supply: Bitcoin Treasuries)

Metaplanet does, nonetheless, have plans to accumulate 210,000 Bitcoin by the tip of 2027. Assuming the highest 5 company BTC holders, excluding Technique, don’t purchase extra of the crypto, Metaplanet may turn out to be the second largest Bitcoin holder as early as subsequent 12 months.

At first of the month, the corporate already introduced that it goals to boost $3.73 billion via a inventory providing to assist its Bitcoin accumulation.

*Q&A Concerning Amendments to the Articles of Incorporation and the Shelf Registration for Issuance of As much as 555 Billion JPY of Perpetual Most popular Inventory*https://t.co/sCYW9ajDxN pic.twitter.com/V7tpS0oe1z

— Metaplanet Inc. (@Metaplanet_JP) August 1, 2025

US Leads In Quantity Of Company Bitcoin Treasuries Underneath Professional-Crypto Trump

Over the previous 30 days, one other 15 firms have added Bitcoin to their stability sheets, pushing the full quantity of those corporations worldwide to 292.

Bitcoin treasury statistics (Supply: Bitcoin Treasuries)

The US has probably the most Bitcoin treasury firms, with 99 such corporations. In second place is Canada with 43 firms that maintain BTC.

A potential motive for the upper variety of Bitcoin treasuries within the US may very well be linked to the pro-crypto administration beneath US President Donald Trump, which is pushing to make the US the crypto capital of the world.

Trump has already began delivering on his pro-crypto marketing campaign guarantees since coming into the White Home for a second time period, and has signed the GENIUS stablecoin Act into regulation, amongst different crypto coverage adjustments.

Underneath the brand new administration, the US Securities and Change Fee (SEC) has additionally dropped a number of excessive profile circumstances in opposition to US crypto corporations, whereas its Chair, Paul Atkins, seems to ease crypto licensing necessities along with his recently-unveiled “Challenge Crypto” initiative.

Following the SEC’s lead, the US Commodity Futures Buying and selling Fee (CFTC) additionally kicked off its “Crypto Dash” initiative earlier this month, asserting that it has began exploring spot crypto buying and selling on futures exchanges.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection