In August 2025, Stellar (XLM), one of many blockchain business’s earliest platforms specializing in cross-border funds and monetary inclusion, set a number of data.

What are these data, and what do they imply for XLM worth? This text breaks them down intimately.

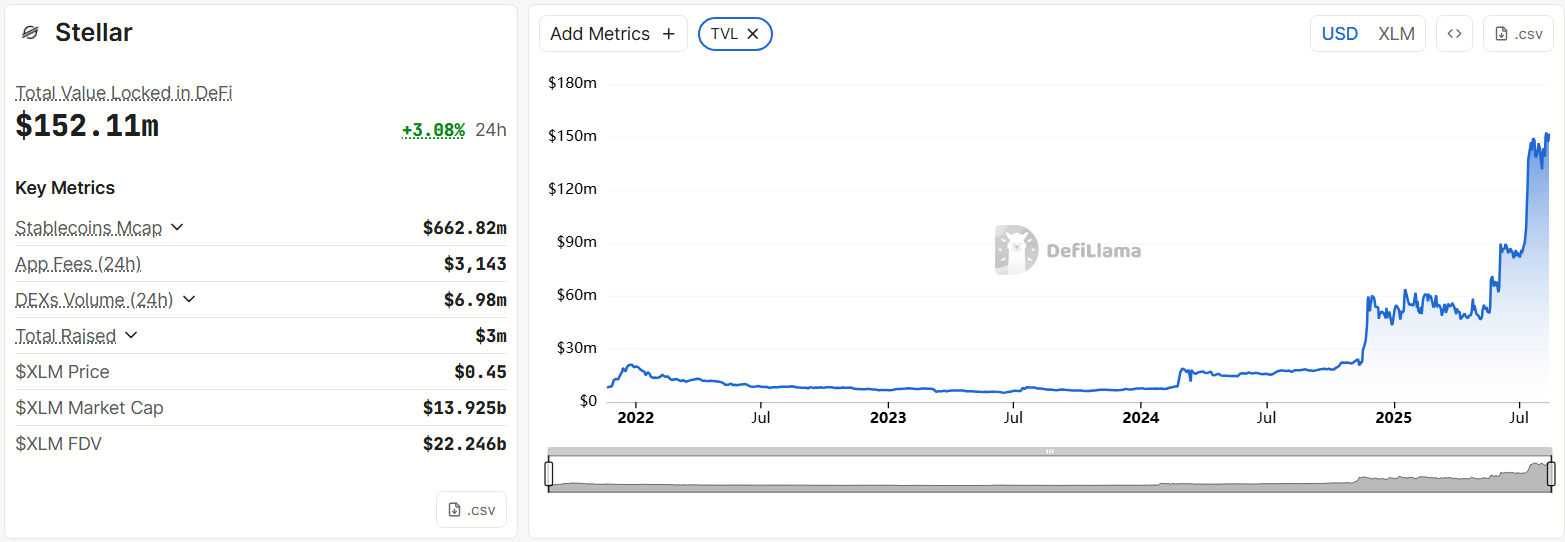

1. Stellar’s Whole Worth Locked Reached an All-Time Excessive

The primary document is Stellar’s Whole Worth Locked (TVL), which hit an all-time excessive (ATH) of $152.11 million.

Information from DeFiLlama reveals Stellar’s TVL surged from $84 million in July to over $150 million in August—a rise of over 80%.

Main contributors to this progress embrace protocols like Mix, Stellar DEX, and Aquarius Stellar. Mix is a modular liquidity protocol that enables anybody to create versatile lending markets. Stellar DEX and Aquarius Stellar are rising decentralized exchanges on the Stellar community, attracting contemporary capital inflows.

Whereas the quantity remains to be modest in comparison with DeFi protocols with billions in TVL, it represents a formidable rise. It displays rising curiosity in Stellar’s ecosystem inside the DeFi sector.

“Stellar TVL is skyrocketing. For those who’re concerned in Stellar DeFi earlier than it hits $1 billion in TVL, you’re a legend,” an XLM investor commented.

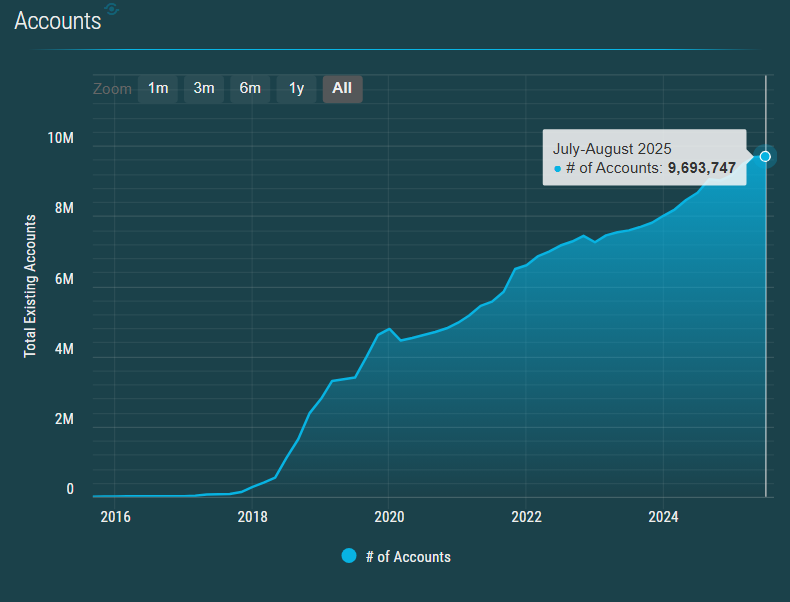

2. XLM Accounts Hit an All-Time Excessive

The second document is the variety of XLM accounts reaching a brand new peak of over 9.69 million.

Information from Stellar Professional signifies the community has expanded considerably. Regardless of main market ups and downs since 2016, Stellar continues demonstrating vast adoption.

Further knowledge from Artemis reveals that round 5,000–6,000 new addresses are created day by day, including to the rising account base.

A latest BeInCrypto report notes that XLM has a robust correlation with XRP. The investor base of those two altcoins overlaps significantly. In consequence, XRP’s increase in 2025 has additionally helped entice new customers to XLM.

This document is essential to Stellar’s mission. It reveals the platform is on observe towards democratizing finance, with thousands and thousands of latest customers becoming a member of to switch cash, retailer worth, or take part in DeFi.

Nonetheless, the speedy enhance in accounts challenges the community to enhance scalability to keep away from congestion — particularly if transaction quantity spikes.

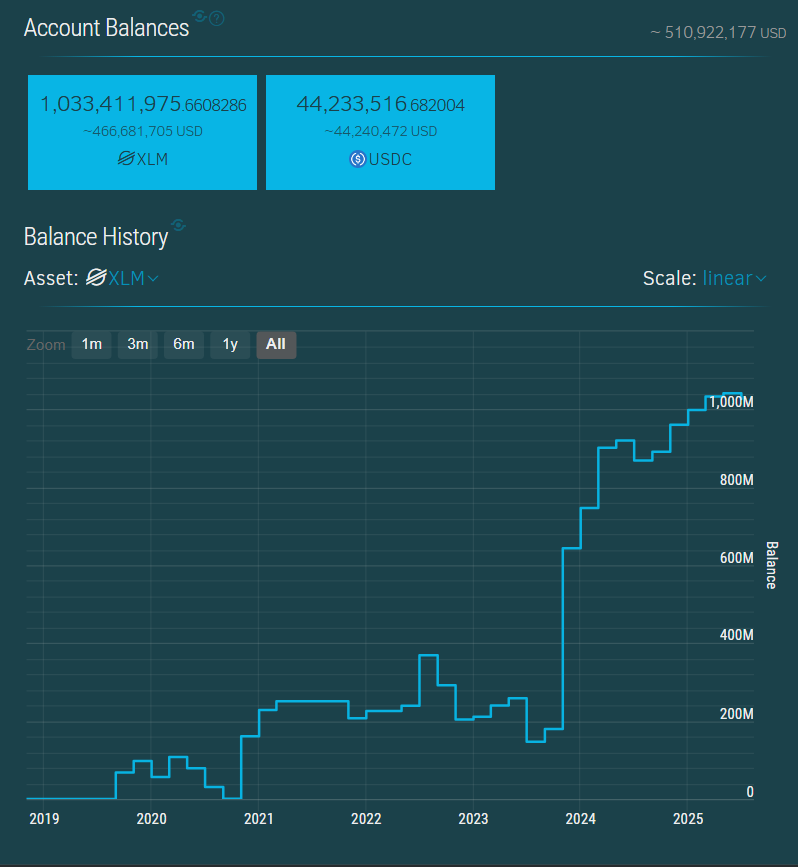

3. XLM on Exchanges Hit a File Excessive in August

Not all data are constructive. The third document is the quantity of XLM on exchanges reaching an all-time excessive, with over 1.03 billion XLM prepared on the market.

Binance’s Proof of Reserves report publicly disclosed its XLM pockets deal with as “GBAI…GPA.” In response to Stellar Professional, the stability of this deal with spiked from 2024 to 2025, peaking at 1,033,411,975 XLM in July–August 2025.

“XLM provide on exchanges at all-time excessive — 1.03 billion able to promote. Ought to we be frightened?” Steph Is Crypto commented on X.

This document serves as a warning. A big provide of XLM on exchanges might set off sell-offs, particularly if the market faces turbulence or damaging information.

On this context, Stellar’s Protocol 23 improve performs a vital position. In response to an announcement on X, the schedule features a testnet reset on August 14 and a mainnet improve vote on September 3.

Protocol 23 is anticipated to ship vital efficiency enhancements, decrease prices, and develop the capabilities of the Stellar blockchain.

The put up Stellar Units New Data in August—Is Now the Time to Watch XLM Worth? appeared first on BeInCrypto.