- TRX’s multi-year higher-low sample retains the $1 goal in play.

- Clearing $0.42–$0.45 resistance may spark a quick September–October rally.

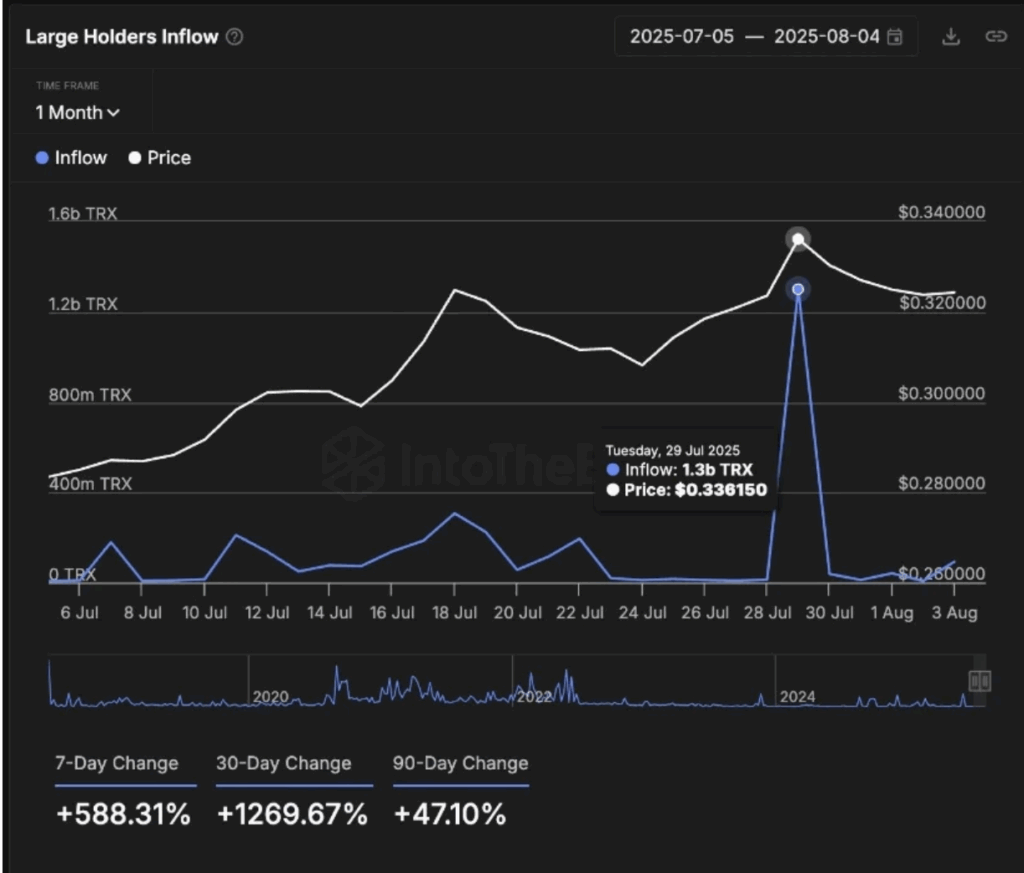

- Whale inflows up 1,269% sign good cash’s already positioning for the following leg.

TRON’s holding regular close to $0.346, not precisely fireworks—however the type of quiet climb that always hides larger strikes forward. From a base round $0.33, consumers have been stepping in at every increased low, refusing to let the multi-year uptrend crack. And with whale wallets loading up at a tempo not seen in months, the market’s beginning to marvel if TRX’s subsequent leap may lastly clear the massive psychological markers.

The $1 Ambition Isn’t Simply Hype

Taking a look at TRON’s long-term chart, it’s principally a staircase—every dip discovering a ground, every consolidation ultimately giving technique to a push increased. Analysts monitoring the ascending trendline say this sample’s performed out earlier than, and if it holds once more, $1 sits proper within the path of the following breakout leg. The true check? Smashing by means of the $0.42–$0.45 resistance zone with out hesitation. Do this, and the September–October window may flip from “perhaps” to “momentum.”

Bulls Have Their Eyes on $0.45 First

Brief time period, TRX is up 2% in 24 hours and buying and selling comfortably above its primary assist at $0.332. On the 4-hour chart, value has reclaimed shifting averages, with the 50 MA appearing like a security internet. The subsequent checkpoint sits at $0.351—clear that, and also you’re taking a look at a runway towards $0.38, $0.40, and ultimately a retest of $0.45. What makes this stretch attention-grabbing is that TRON’s been one of many steadier large-cap performers this cycle, a slow-burn pattern that doesn’t depend on hype alone.

On-Chain Power + Whale Exercise = Gasoline for the Transfer

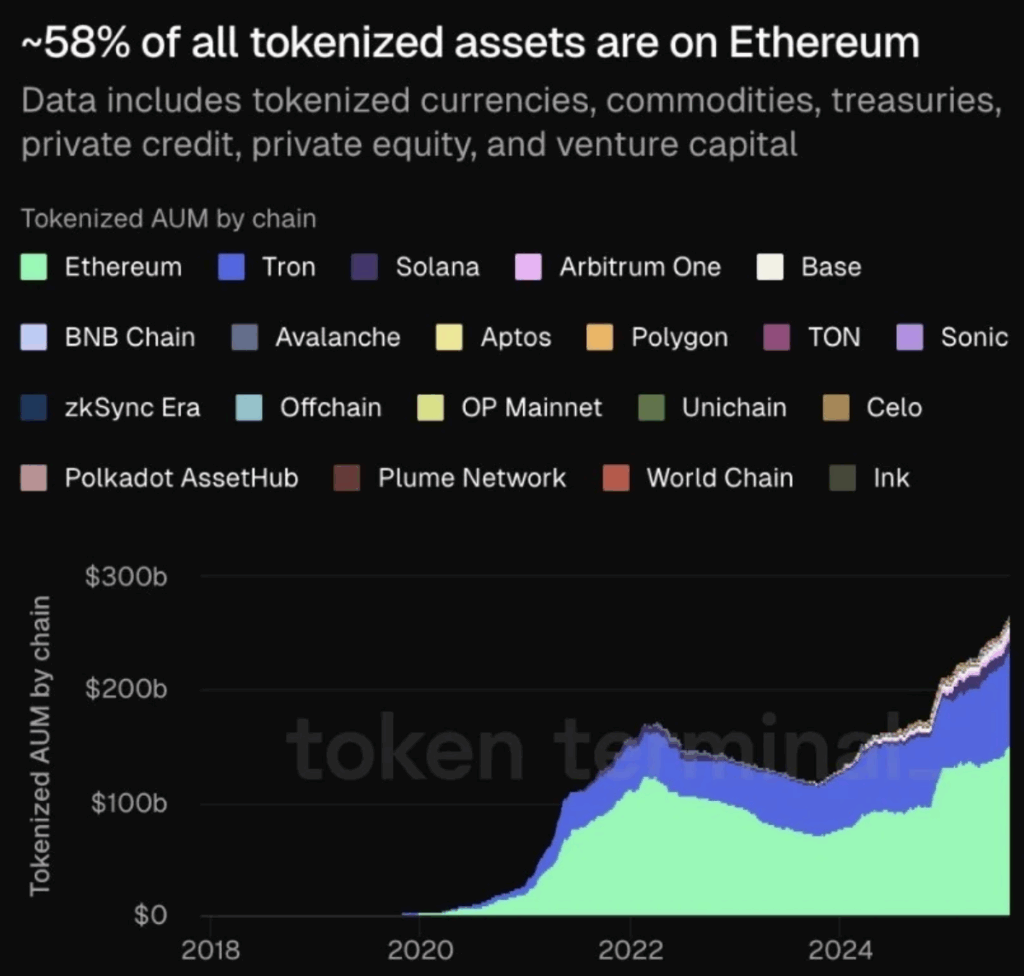

Whereas Ethereum nonetheless dominates tokenized asset flows, TRON’s been quietly grabbing a much bigger slice of the pie, particularly with stablecoins and different real-world asset transfers. This regular community utility backs the worth chart’s bullish construction. Add in the truth that giant holder inflows spiked 1,269% in 30 days—hitting 1.3B TRX on July 29—and also you’ve obtained a powerful case for accumulation-driven upside. Traditionally, these whale shopping for waves haven’t been only for present—they’ve typically come proper earlier than the true breakout.