XLM’s value efficiency has remained muted over the previous 5 buying and selling periods, shifting inside a decent vary.

This sideways motion comes as Stellar prepares for a key milestone: the reset and secure launch of its Protocol 23 Testnet, scheduled for August 14.

Stellar’s Protocol 23 Gears Up for Testnet Reset

Stellar’s much-anticipated Protocol 23 improve, first deployed to the Testnet on July 17, is anticipated to go reside on the mainnet in September.

In line with a June 10 weblog put up, Protocol 23 introduces eight Core Development Proposals to spice up Stellar’s efficiency, good contract capabilities, and developer instruments.

Key upgrades embody quicker and cheaper Soroban good contracts via in-memory storage and parallel execution, unified occasion streams for simpler monitoring, new host capabilities for higher information dealing with, and configurable consensus settings to scale back ledger latency.

A testnet reset and secure launch are scheduled for August 14.

XLM’s Newest Acquire Dangers Fading

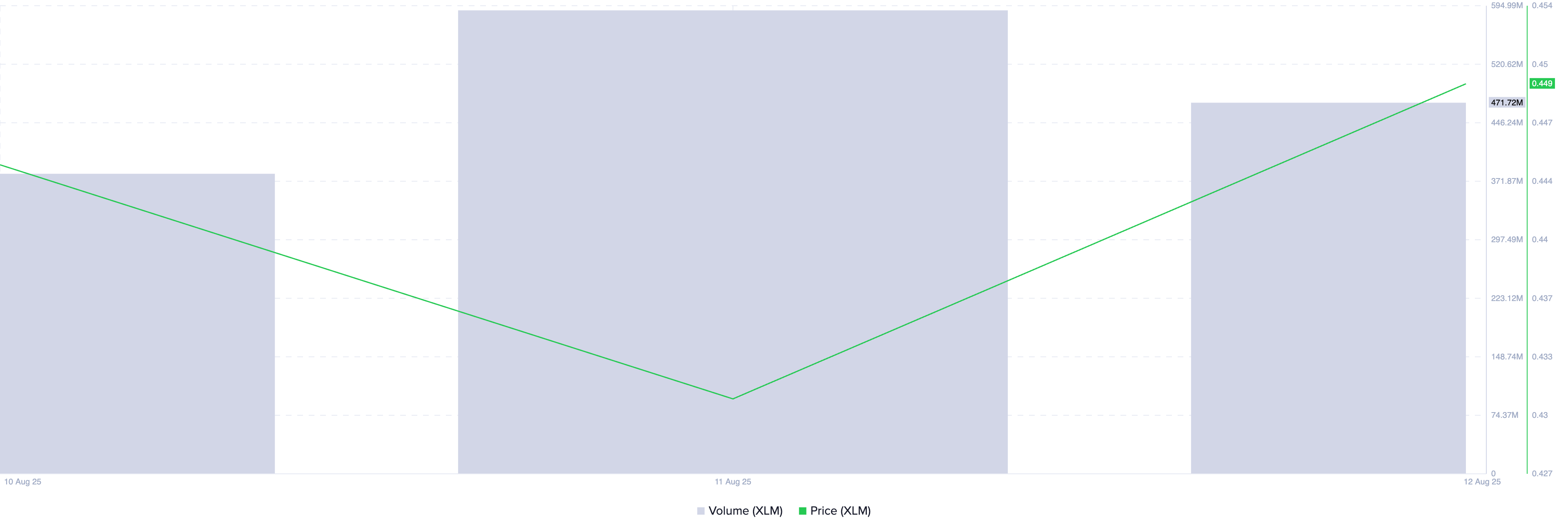

Forward of this reset, XLM’s value efficiency has remained lackluster. Though its value has risen by 4% over the previous day, this transfer comes alongside declining buying and selling quantity. This unfavourable divergence suggests the rally shouldn’t be being fueled by real demand for the altcoin.

When an asset’s value climbs whereas buying and selling quantity falls, this means an absence of sturdy market participation. Such strikes are usually much less sustainable, as they depend on skinny liquidity and should reverse shortly if promoting stress returns. This places XLM prone to shedding its most up-to-date positive factors.

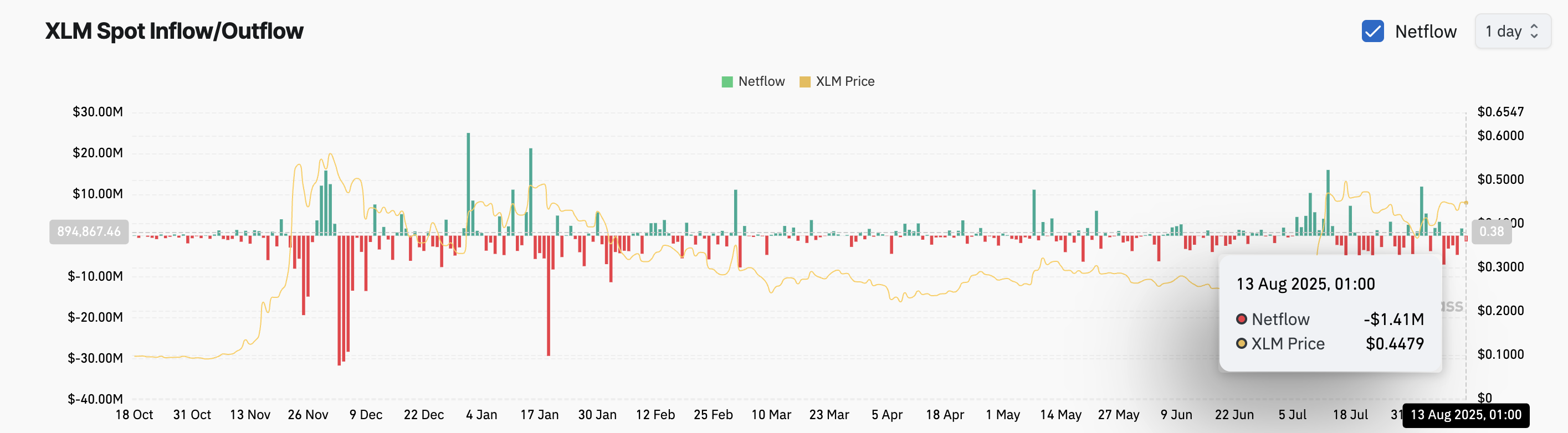

Moreover, the decline in capital inflow into the XLM spot markets confirms the waning demand for the altcoin. In line with Coinglass, the altcoin has recorded a web outflow of $1.41 million at the moment, highlighting the shortage of assist behind XLM’s 4% achieve.

This reveals the weakening demand for the token and elevated promoting stress, which may decrease its value.

Can XLM Bulls Maintain the Line?

Rising sell-side stress threatens to push XLM beneath the crucial $0.42 assist degree. On this case, the token’s worth might drop towards $0.39 if profit-taking continues.

Conversely, if bullish momentum strengthens, the token might break via resistance at $0.4689. This opens the door for a rally towards $0.5206.

The put up XLM Worth Flatlines Forward of Stellar’s Protocol 23 Testnet Reset appeared first on BeInCrypto.