Be part of Our Telegram channel to remain updated on breaking information protection

US banks are urging Congress to shut a stablecoin yield “loophole” that they warn may drain as much as $6.6 trillion in deposits from the standard banking system, doubtlessly destabilizing credit score flows to American companies and households.

The Financial institution Coverage Institute (BPI), in addition to the American Bankers Affiliation, Shopper Bankers Affiliation, the Monetary Companies Discussion board, and the Impartial Neighborhood Banks of America all voiced their considerations in a letter to Congress yesterday.

They expressed considerations concerning the present wording within the Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act. Signed into regulation on July 18, 2025, the Act establishes guidelines and rules for stablecoin issuers to comply with.

The GENIUS Act is among the many most transformative legal guidelines in a long time.@Jerallaire, with @RichardQuest on @CNN, explains what this implies for stablecoins. pic.twitter.com/BMLiwJix3Q

— Circle (@circle) July 23, 2025

Amongst these guidelines is the prohibition on stablecoin issuers that stops them from providing curiosity or yield on to holders. In accordance with the BIP, nonetheless, the Act doesn’t explicitly prolong the ban to crypto exchanges or affiliated companies.

Within the letter, the BIP warned that ”with out an specific prohibition making use of to exchanges, which act as a distribution channel for stablecoin issuers or enterprise associates, the necessities within the GENIUS Act might be simply evaded and undermined by permitting fee of curiosity not directly to holders of stablecoins.”

“The consequence will probably be higher deposit flight danger, particularly in occasions of stress,” which the BIP says can have a damaging influence on credit score creation “all through the financial system” and set off $6.6 trillion in deposit outflows from the standard banking system.

The implications of that taking place will probably be “larger rates of interest, fewer loans, and elevated prices for Major Avenue companies and households,” the banking group stated.

Stablecoins Are Essentially Completely different From Conventional Yield-Bearing Merchandise

The banking group stated that stablecoins are essentially completely different from financial institution deposits and cash market funds as a result of they don’t fund loans or put money into securities to present holders yields.

As an alternative, stablecoin issuers akin to Tether (issuer of USDT) and Circle (issuer of USDC) generate and move on returns in a number of methods to holders by way of third social gathering platforms.

Each of these firms maintain the identical quantity of reserves in fiat, of their case the US greenback, as the quantity of their tokens which are in circulation to make sure their blockchain-based tokens keep a 1:1 peg to the dollar.

These reserves are largely in short-term, curiosity bearing belongings akin to US Treasuries, which the issuers then pay the curiosity from to holders.

Nevertheless, due to the GENIUS Act’s prohibition, issuers usually are not allowed to straight distribute the curiosity to holders. To get round this, issuers like Tether and Circle enter into revenue-sharing agreements with third events or flip to lending and custodial platforms like BlockFi and Gemini.

For instance, Coinbase at present presents a 4.1% yield to anybody who holds USDC on its platform.

There are additionally yield-bearing stablecoins akin to OUSD and sDAI that mechanically embed returns from DeFi lending, real-world asset yields or implement different methods straight into the token. Nevertheless, these stablecoins have a tendency to come back with larger ranges of danger when in comparison with USDT and USDC, primarily sensible contract, market and liquidity dangers.

These distinctions, stated the BIP, “are why fee stablecoins shouldn’t pay curiosity the way in which extremely regulated and supervised banks do on deposits or supply yield as cash market funds do.”

Stablecoin Market A Small Proportion Of US Cash Provide

The GENIUS Act’s signing final month was celebrated as a significant milestone and watershed second for the crypto area. Many noticed its passing and subsequent signing as step one in direction of US regulators providing the business some long-awaited authorized readability.

Its signing additionally comes as US President Donald Trump and federal companies push to make the US the crypto capital of the world.

Inside the first week of the GENIUS Act being signed, the market capitalization for stablecoins jumped $4 billion to $264 billion, in accordance to information from DefiLlama.

Stablecoin market cap (Supply: DefiLlama)

Prior to now week, the mixed valuation of stablecoins in circulation has risen greater than 1%, round $2.76 billion to face at about $271.37 billion as of 6:23 a.m. EST.

That progress is predicted to proceed within the coming years. In an April 30 report, the US Treasury predicted that the stablecoin market may attain round $2 trillion by 2028.

On Aug. 8, the S&P International Scores made historical past and assigned a “B” credit standing to stablecoin protocol, Sky Protocol. The platform operates the DAI and USDS stablecoins.

Regardless of the rising capitalization and recognition of stablecoins, the sector nonetheless makes up a fraction of the US cash provide. As of the tip of June, the US Federal Reserve (Fed) reported that the US cash provide stood at $22 trillion.

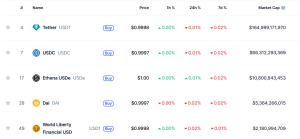

Tether’s USDT stays the most important stablecoin by market cap by a snug margin. CoinMarketCap information places its valuation at $164.99 billion.

High stablecoins by market cap (Supply: CoinMarketCap)

USDC, which is backed by the New York Inventory Trade (NYSE)-listed agency Circle, is the second largest stablecoin available in the market with its capitalization standing at over $66.31 billion.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection