Bitcoin treasury agency Metaplanet has simply delivered its strongest quarter ever, with income rising by 41% in comparison with the earlier quarter.

Metaplanet Has Seen A Sharp Flip In Web Revenue

In a brand new submit on X, Metaplanet has shared the numbers associated to its Q2 2024 efficiency, revealing important quarter-over-quarter progress in a number of key metrics. The Japanese firm recorded a income of ¥1.239 billion ($8.4 million) and gross revenue of ¥816 million ($5.5 million), up 41% and 38% in comparison with the final quarter, respectively. The larger story, nevertheless, is the dramatic turnaround in extraordinary revenue and web earnings.

The previous stood at a lack of ¥6.9 billion in Q1, however flipped to a revenue of ¥17.4 billion ($117.8 million) in Q2. Equally, the latter went from -¥5.0 million to +¥11.1 billion ($75.1 million). The agency’s web belongings additionally surged to ¥201.0 billion ($1.36 billion), equivalent to a quarter-over-quarter enhance of a whopping 299%. “That is the strongest quarter in Metaplanet’s historical past,” commented Simon Gerovich, the corporate’s president.

Metaplanet, which transitioned to a Bitcoin treasury mannequin final 12 months, says its technique is easy: “to prudently and quickly accumulate as a lot Bitcoin as potential on behalf of our shareholders.” This strategy is just like the one adopted by Michael Saylor’s Technique (previously Microstrategy).

Previously quarter, the technique has seemingly labored out for Metaplanet, with its record-breaking quarter being backed by the appreciation of its BTC reserves and continued accumulation efforts.

On Tuesday, Gerovich introduced a brand new acquisition for the corporate involving 518 BTC. These tokens had been purchased at a mean value of $118,519, that means the whole stack price the agency $61.4 million.

Following this buy, Metaplanet’s Bitcoin reserve has grown to 18,113 BTC, with a value foundation of $1.85 billion. On the present change fee, these holdings are value $2.18 billion, placing the agency right into a revenue of 17.8%.

Whereas treasuries like Technique and Metaplanet are busy shopping for, some veteran gamers out there have been utilizing the bull run costs to promote, as revealed by institutional DeFi options supplier Sentora (beforehand IntoTheBlock) in an X submit.

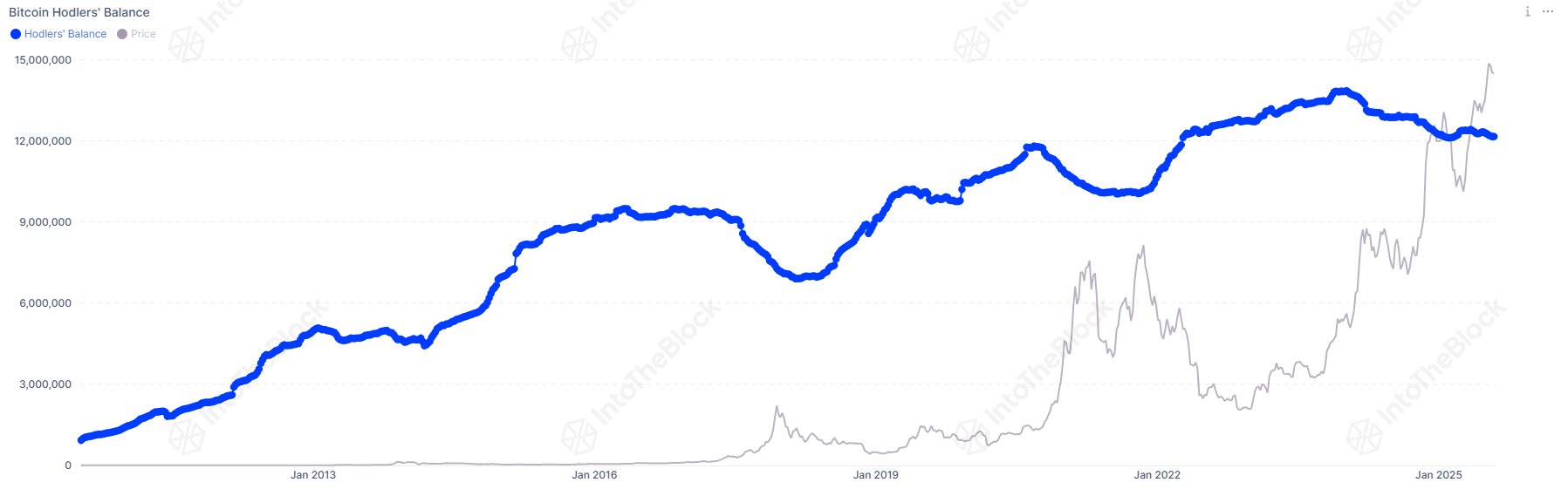

The development within the holdings of the BTC HODLers over the cryptocurrency's historical past | Supply: Sentora on X

From the above chart, it’s seen that Bitcoin long-term holders have been shedding their holdings lately. This isn’t something uncommon, because the diamond palms of the sector have traditionally moved to take their hard-earned earnings throughout main bull rallies.

What’s completely different this time, nevertheless, is the truth that the selloff has been extra gradual than earlier cycles. Solely time will, although, whether or not this is a sign that the present cycle goes to be completely different or if this truth could have no impact on its size.

Bitcoin Value

On the time of writing, Bitcoin is floating round $120,200, up greater than 5% over the past seven days.

Appears to be like like the worth of the coin has been climbing again to the all-time excessive | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.