Be a part of Our Telegram channel to remain updated on breaking information protection

The cryptocurrency market is roaring again to life, with OKB main the cost after hovering greater than 136% up to now 24 hours.

Solana, Ethereum, and Dogecoin additionally posted spectacular positive aspects as bullish momentum envelopes the sector.

OKB surged from $44.50 to $107.86 in simply 24 hours after a significant token burn slashed its circulating provide by 52%.

Solana (SOL) jumped 13.6% to $201.8 on sturdy DeFi development and rising institutional demand, whereas Ethereum (ETH) climbed 6.9% to $4,703.91, nearing its all-time excessive on bullish momentum.

Dogecoin (DOGE) additionally gained 9.1% to $0.2459, fueled by a “golden cross” chart sample typically seen as a sign for additional worth positive aspects.

Bitcoin Nears $122K As XRP Rallies

Bitcoin (BTC) additionally rallied, reclaiming the $122,190 mark briefly right this moment, earlier than falling again to $121,053 to commerce up 1.3% within the final day.

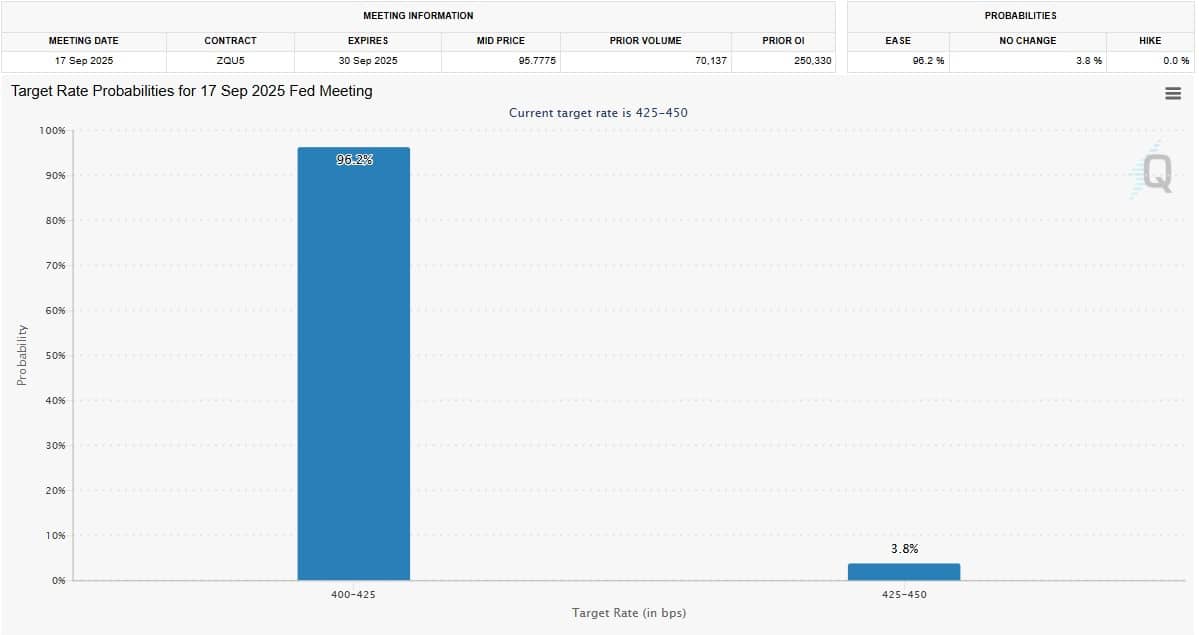

The push increased comes after lower-than-expected July CPI within the US boosted the chance of an rate of interest reduce to 93.9% subsequent month, in line with the CME FedWatch Instrument.

Treasury Secretary Scott Bessent known as for a 50 foundation level reduce subsequent month, additional boosting market sentiment.

XRP rose 4.2% to $3.29 and Shiba Inu (SHIB) went on a tear, leaping 11.8% to $0.000028.

DeFi And NFTs Surge As Macro Tailwinds Gas Crypto Frenzy

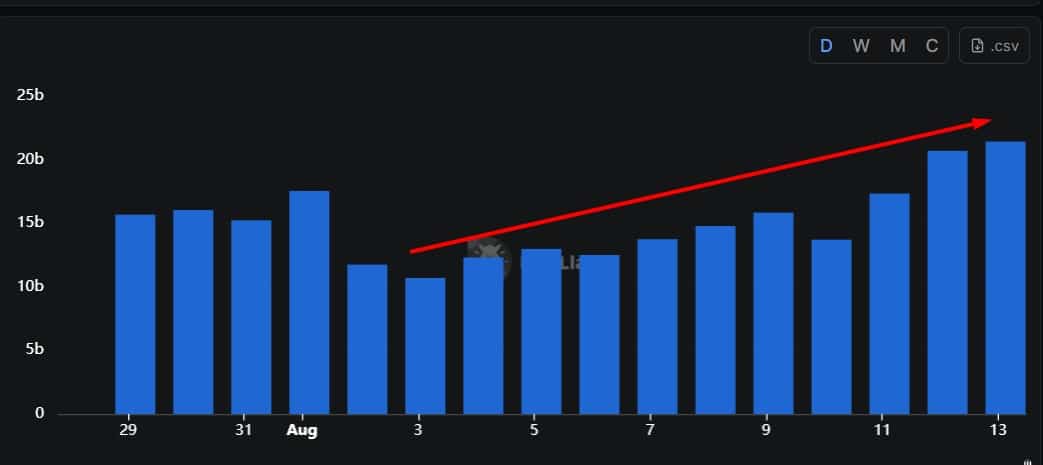

DeFi tokens are additionally surging because the Uniswap worth jumped 10% to $12.11, because of exploding buying and selling volumes on decentralized exchanges (DEXs). Information from DefiLlama exhibits DEX quantity throughout all chains greater than doubled from $10.17 billion on August 3 to $20.723 billion on August 12.

Chainlink (LINK) surged 7.8% to $23.86 as extra initiatives use its information feeds for real-world integrations.

On the NFT and gaming aspect, Axie Infinity (AXS) rose 8% to $2.6, driving a wave of play-to-earn hype amid broader market euphoria. Even layer-2 options like POL (ex-MATIC) are in on the motion, up 4.7% to $0.25, as scalability turns into the secret with Ethereum’s upgrades.

Surging ETH ETF Inflows And Bullish IPO

Crypto ETF inflows are additionally surging. Spot Ethereum ETFs hit $523.92 million yesterday, led by BlackRock’s monster $318.67 million haul, marking 14 straight weeks of inexperienced, in line with information from Soso Worth.

That pushed cumulative ETH ETF inflows previous $20.6 billion.

In the meantime, digital asset trade Bullish (NYSE: BLSH), the dad or mum of CoinDesk, simply priced its NYSE debut at $37 a share, above the anticipated vary, elevating over $1.1 billion and valuing the corporate at $5.41 billion.

The Operating of The Bullish 🤘 Watch this house as @Bullish, the digital asset trade, goes public on NYSE$BLSH | @CoinDesk | @ThomasFarley pic.twitter.com/NZINQYPLh5

— NYSE 🏛 (@NYSE) August 13, 2025

Regardless of a Q1 loss, the platform dealt with $250 billion in trades final yr, up from $115 billion in 2023.

All this comes as the full crypto market cap blasts previous $4.19 trillion to a brand new all-time excessive, overtaking Apple’s valuation within the course of.

The prospect of price cuts is injecting rocket gas into the crypto market because the prospect of cheaper borrowing boosts investor sentiment.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection